Table of Contents

An early retirement plan might sound like a dream when you’re in your 30s, buried in student loans, rent, or raising kids. Still, more people are asking the big question: Can you actually retire decades earlier than the norm?

The idea is both tempting and intimidating, but the truth is, it depends on your approach, priorities, and willingness to stick to a clear plan.

Let’s unpack what it really takes and whether early retirement is something you can realistically reach.

What Early Retirement Really Means In Your 30s

When people talk about an early retirement plan, especially in your 30s, they don’t always mean sipping cocktails on a beach while never working again.

Retirement has shifted — it’s less about never earning another dollar and more about reaching the point where work becomes optional.

Defining Retirement Beyond Just Leaving Work

The old definition of retirement — quitting your job at 65 and drawing a pension — doesn’t fit anymore. Today, retirement can mean:

- Having enough invested to cover your living expenses without a paycheck.

- Choosing work you want to do, not work you’re forced to do.

- Building flexibility to step back during stressful life phases, like raising kids or caring for aging parents.

I like to think of early retirement as “financial freedom with choices.” You might keep freelancing, start a passion project, or consult part-time. The point is: You’re no longer tied to a 9-to-5 for survival.

Why Early Retirement Differs From Financial Independence

Financial independence (often shortened to FI) is the stepping stone, while retirement is the destination.

- FI means your investments or assets generate enough income to cover expenses.

- Retirement means you decide to stop working (or dramatically scale back).

Some people achieve FI but keep working because they love it. Others retire as soon as their FI number is hit. The two overlap, but they’re not identical.

In your 30s, focusing on FI first gives you a roadmap, and retirement becomes an optional chapter rather than a cliff you fall off.

Common Myths That Stop People From Planning Early

A lot of people dismiss early retirement because of outdated or flat-out wrong assumptions. Let me tackle three I hear the most:

- “You need millions to retire early.” Not true. Your retirement number depends on your expenses, not someone else’s. If you live on $40k a year, your number is very different from someone spending $120k.

- “Early retirement means never working again.” False. Many early retirees still earn income through hobbies, side hustles, or passion projects. That income actually makes retirement more secure.

- “I can’t start saving until I make six figures.” Nope. Even a modest salary can be powerful if you cut unnecessary spending and invest aggressively. I know people who started with average incomes but still retired before 40 because they saved 50% of what they earned.

Breaking these myths early makes the whole concept less intimidating. Retirement in your 30s isn’t about being ultra-rich — it’s about designing a life where you’re free from financial pressure.

How Much Money You Need To Retire Early

This is the question that keeps people awake at night: how much is enough? The truth is, the number isn’t fixed. It depends on your lifestyle, location, and risk tolerance.

The good news is, there are proven ways to calculate your retirement goal.

Calculating Annual Expenses You’ll Need To Cover

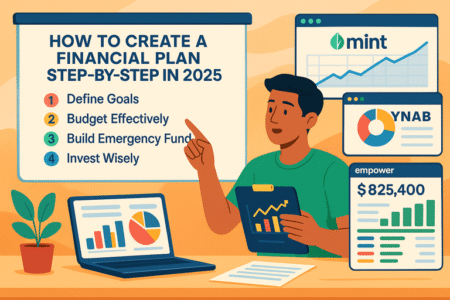

The foundation of any early retirement plan is understanding your expenses. Here’s how to figure it out:

- Track every dollar you spend for at least three months. Include housing, food, healthcare, transportation, debt payments, and entertainment.

- Multiply that monthly average by 12 to find your annual expenses.

- Ask yourself: Is this the lifestyle you want in retirement, or will it change? Some people downsize, others spend more on travel. Adjust accordingly.

For example, if you spend $3,500 per month today, that’s $42,000 per year. That becomes your baseline retirement budget.

Understanding The 25x Rule And Safe Withdrawal Rate

Once you know your expenses, the next step is figuring out the nest egg you’ll need. The 25x rule is a shortcut: multiply your annual expenses by 25.

- If your expenses are $42,000 per year, your target retirement savings is about $1,050,000.

This is tied to the 4% safe withdrawal rate, which suggests you can withdraw 4% of your investments each year without running out of money. It’s not perfect (markets change, inflation bites), but it’s a widely used starting point.

I suggest being a little conservative if you’re retiring in your 30s. A 3.5% withdrawal rate might be safer since your retirement horizon could stretch over 50 years.

That means saving closer to 28–30x your annual expenses.

Factoring In Healthcare, Inflation, And Emergencies

It’s easy to underestimate costs that aren’t as visible when you’re young. Here are three areas people overlook:

- Healthcare: If you leave work in your 30s, employer health insurance goes with it. Depending on your country, you may need to buy private insurance, budget for out-of-pocket costs, or move somewhere with affordable care.

- Inflation: A $42,000 lifestyle today may cost $80,000 in 20–30 years. Long-term retirees need to plan for compounding inflation. This is where growth investments (stocks, real estate) matter.

- Emergencies: Roof leaks, car repairs, family crises — they don’t vanish in retirement. A healthy cash buffer (at least 1–2 years of expenses) helps you avoid dipping into investments during market downturns.

When you combine the 25x rule with these extra layers, you get a clearer, more realistic picture. Early retirement isn’t about chasing an abstract “millionaire” label — it’s about tailoring the numbers to your life.

Proven Savings Strategies To Fast-Track Retirement

If you’re serious about building an early retirement plan in your 30s, saving aggressively is the engine that drives everything else.

Earning money is one thing, but holding onto it — and putting it to work — is where the magic happens.

Setting Aggressive Yet Realistic Savings Goals

Saving half your income might sound extreme, but many people chasing early retirement aim for 40–60%. The trick is making it sustainable.

Here’s how I like to break it down:

- Start with your retirement number. Let’s say you want $1 million.

- Work backward. If you save $40k per year and invest it at a 7% return, you’ll hit that goal in roughly 15 years.

- Stretch but don’t break. Saving 60% of your income may look impressive on paper, but if it makes you miserable, you won’t stick with it.

A chart comparing savings rates can be eye-opening. For example:

| Savings Rate | Years To Retirement (at 7% return) |

| 20% | ~37 years |

| 40% | ~22 years |

| 60% | ~12 years |

The takeaway: the more you save, the faster you buy your freedom, but it has to be a number you can live with long term.

Automating Your Savings And Living Below Your Means

I recommend setting up your finances so saving happens before you even see the money. That means:

- Direct a set percentage of your paycheck straight into investment accounts.

- Use apps that round up transactions and stash the difference into savings.

- Treat savings like a fixed bill, not something you do if “there’s money left.”

For example, you might set up an automatic transfer where 30% of your income goes into a brokerage account right after payday. This way, you don’t rely on willpower — the system does the work.

Living below your means doesn’t mean deprivation. It could be as simple as:

- Driving a reliable used car instead of leasing a new one.

- Cooking at home during the week and treating yourself on weekends.

- Renting a smaller place in a good location rather than stretching for a “dream house.”

When I made these shifts, I noticed I didn’t feel deprived at all — I felt lighter. That’s the kind of mindset shift that keeps momentum going.

Avoiding Lifestyle Creep That Delays Retirement Plans

Lifestyle creep is sneaky. You get a raise, and suddenly you’re “rewarding” yourself with a bigger apartment, a new car, or subscription services you barely use.

Over time, these little upgrades balloon into a bigger cost of living, which pushes retirement further away.

Here’s how to fight it:

- Every time you get a raise, save or invest at least 70–80% of the increase.

- Pause before upgrading anything. Ask: “Does this purchase move me closer to freedom, or further away?”

- Compare joy-to-cost ratios. For example, upgrading your phone every year might bring a short thrill, but it adds thousands over a decade. That same money invested could shave years off your retirement timeline.

Lifestyle creep is the enemy of an early retirement plan. The key is to stay conscious of your choices and keep reminding yourself: freedom feels better than fancy.

Smart Investment Options To Grow Your Wealth Faster

Saving aggressively is step one, but you can’t save your way to financial freedom. Investments multiply your money and help you outpace inflation.

If you want your early retirement plan to work in your 30s, you need growth, not just a pile of cash.

Leveraging Low-Cost Index Funds For Long-Term Growth

Index funds are often the backbone of an early retirement portfolio. They’re simple, cheap, and historically deliver solid returns. Instead of trying to pick winning stocks, you buy the whole market in one shot.

Why they work so well:

- Low fees: Many index funds charge as little as 0.03% annually. High fees eat into returns, and over decades, that’s massive.

- Diversification: One fund can give you exposure to thousands of companies.

- Proven history: The S&P 500 has averaged around 10% annual returns over the long term.

In practice, you might choose something like a “Total Stock Market Index Fund” (ticker VTSAX or equivalent in your brokerage).

I personally suggest setting up automatic monthly contributions, so you’re dollar-cost averaging — buying shares at different price points without having to time the market.

Think of index funds as your “set it and grow it” option. They won’t make you rich overnight, but they’re a proven wealth builder.

Using Real Estate To Build Passive Income Streams

Real estate can be a powerful second pillar. Unlike index funds, which mainly build wealth, real estate can also create steady cash flow.

Common strategies include:

- Rental properties: Buy a home or apartment, rent it out, and let tenants cover your mortgage while you build equity.

- House hacking: Live in one unit of a multi-family property and rent out the others. This can cover your housing costs completely.

- REITs (Real Estate Investment Trusts): If being a landlord sounds like a headache, REITs let you invest in real estate through the stock market.

For example, someone who buys a duplex, lives in one half, and rents the other could reduce their housing cost to nearly zero. That’s thousands freed up each month for investments.

Real estate does require more hands-on work than index funds, but the leverage (using a mortgage to buy an asset that pays for itself) can accelerate retirement by years.

Considering Side Businesses As Investment Vehicles

Side businesses can be an underrated investment. They don’t just generate income — some can become assets you eventually sell.

Ideas worth exploring:

- Freelancing or consulting: Use your professional skills to take on clients outside of your 9-to-5.

- Digital assets: Blogs, YouTube channels, or e-commerce stores can grow into revenue streams that keep paying even if you step away.

- Local services: A small landscaping, cleaning, or delivery business can scale if you hire help.

One friend of mine started a niche website while working full-time. After three years, the site was earning enough ad revenue to cover their monthly expenses. That’s essentially an investment that paid back freedom in the form of cash flow.

The beauty of side businesses is that they combine creativity with income diversification. If the stock market dips, your side hustle keeps money flowing.

If your rental property has a vacant month, your freelance work fills the gap. It’s about spreading out your risk while building more options.

How To Balance Debt Payoff With Retirement Planning

Debt doesn’t have to kill your early retirement plan, but you need a clear strategy. The key is knowing which debt slows you down the most and how to pay it off while still building wealth.

Prioritizing High-Interest Debt Before Heavy Investing

High-interest debt, like credit cards or payday loans, is a wealth killer. If you’re paying 18% interest, there’s no investment in the stock market that can reliably beat that. I always recommend tackling these first.

Here’s the order I’d use:

- Pay off high-interest debt (anything over 8–10%).

- Keep contributing to retirement accounts at least up to the employer match. That match is free money, and you don’t want to miss it.

- Once toxic debt is gone, funnel the freed-up cash into investments.

Think of it like patching a leaking bucket. Investing while drowning in high-interest debt is like pouring water in while there’s still a big hole at the bottom. Plug the leak first.

Using Debt Snowball And Avalanche Methods Effectively

There are two classic methods to pay down debt:

- Debt Snowball: Pay off the smallest balance first, then roll that payment into the next debt. It builds momentum and keeps motivation high.

- Debt Avalanche: Pay off the debt with the highest interest rate first, regardless of balance. It saves you more money in the long run.

If you’re someone who needs quick wins to stay motivated, I’d suggest the snowball method. If you’re more numbers-driven and patient, avalanche is more efficient.

Either way, the goal is the same: free yourself from interest so your money can start working for you instead of against you.

A little example: If you owe $2,000 at 19% interest and $5,000 at 6%, avalanche says tackle the $2,000 first. Snowball might tell you to start with a smaller $500 debt if that exists, just to taste progress. Both work — the right choice is whichever one keeps you consistent.

Building Wealth While Managing Mortgages Or Student Loans

Not all debt is bad debt. Mortgages and student loans often come with much lower rates, and sometimes they can even work in your favor.

- If your mortgage is at 3%, there’s no rush to pay it off aggressively when your investments could be growing at 7–10%.

- Federal student loans sometimes have protections or forgiveness options, so it may make sense to stick with minimum payments while investing elsewhere.

What I recommend: Keep paying your lower-interest debts on schedule, but don’t let them stop you from investing. A balanced approach — where you’re paying loans responsibly and also contributing to index funds or retirement accounts — will build long-term wealth without locking you into a debt-first trap.

Lifestyle Choices That Make Early Retirement Possible

Money isn’t just about math — it’s about behavior. The lifestyle you choose will make or break your early retirement plan.

Big sacrifices aren’t always necessary, but intentional choices add up in powerful ways.

Downsizing Your Housing And Living More Simply

Housing is usually the biggest expense in a budget. If you can reduce this one category, you’ll accelerate retirement by years.

Options include:

- Renting a smaller apartment or moving further out if it lowers costs significantly.

- House hacking (living in part of a property and renting the rest).

- Selling a large home and buying something more modest.

I’ve seen people cut $1,000–$1,500 per month just by downsizing their home. Multiply that savings over a decade, invested at a 7% return, and you’re talking about hundreds of thousands of dollars.

Living simply isn’t about deprivation — it’s about removing the clutter that doesn’t add happiness. You’ll find that the “status” purchases lose their shine quickly, while the freedom of low expenses never stops paying off.

Choosing Experiences Over Material Possessions

One of the best mindset shifts you can make is trading “stuff” for experiences. The new car smell fades, the thrill of a designer bag wears off, but the memory of a trip with friends or time spent learning a skill sticks around.

Psychologists back this up — experiences bring longer-lasting happiness than material goods. On top of that, they often cost less.

Instead of upgrading to the latest gadget every year, you could:

- Take a road trip.

- Try cooking classes.

- Spend a weekend hiking or camping.

These choices not only keep expenses in check but also align with the lifestyle many people want in early retirement: freedom, connection, and memorable experiences.

Relocating To Lower-Cost Cities Or Countries

Geography is a hidden lever in early retirement planning. Where you live has a massive impact on how much you need.

For example:

- Living in San Francisco with $100k annual expenses might require $2.5 million saved.

- Moving to a smaller city or even abroad could cut expenses to $40k, lowering your retirement number to around $1 million.

Places like Portugal, Mexico, or parts of Southeast Asia offer high quality of life at much lower costs. Even moving from a big U.S. city to a smaller one can have the same effect.

This doesn’t mean uprooting your life tomorrow, but considering geography as part of your plan could shave a decade off your timeline.

Building Multiple Income Streams For Security

Relying on one paycheck is risky — and the same goes for relying on one source of retirement income. Building multiple streams keeps your plan resilient, especially over decades.

Turning Skills Into Freelance Or Consulting Work

Your professional skills can become a side hustle. Whether it’s design, writing, coding, or marketing, freelancing platforms and networking make it easier than ever.

In practice, it might look like:

- Setting up a profile on Upwork or Fiverr.

- Reaching out to former colleagues for consulting projects.

- Packaging your expertise into workshops or online courses.

Even $500–$1,000 a month in freelance income can drastically reduce how much you need to pull from investments during retirement. It’s a safety net and an accelerator.

Creating Digital Assets That Generate Passive Income

Digital assets take time to build but can become powerful income machines. Examples include:

- A blog that earns ad revenue or affiliate commissions.

- A YouTube channel that pays through ads and sponsorships.

- An online course that sells automatically once created.

I’ve seen people spend a year building a niche website, and within three years it was generating enough to cover basic living costs. That’s the kind of compounding effect that makes early retirement much safer.

Diversifying To Avoid Dependence On One Source

Diversification isn’t just an investing term — it applies to income, too. If all your money comes from rental properties and the housing market dips, you’re exposed.

If it’s all from the stock market and there’s a crash, the same problem arises.

A balanced mix could look like:

- 60% from investments (index funds).

- 20% from real estate rental income.

- 20% from freelance or digital side hustles.

This way, if one stream dries up, the others keep you afloat. Think of it like a tripod: three legs keep it steady, even if one wobbles.

Common Pitfalls That Derail An Early Retirement Plan

Even the best early retirement plan can get thrown off track if you’re not careful. The good news is, most pitfalls are avoidable if you spot them early and plan ahead.

Underestimating Future Expenses Or Rising Inflation

It’s easy to underestimate what life will cost 20 or 30 years from now. Inflation slowly eats away at your purchasing power. For example, $40,000 today could feel more like $25,000 in a couple of decades.

To avoid this trap:

- Build a buffer into your plan. If you think you’ll need $40k a year, plan for $50k.

- Use a conservative safe withdrawal rate (3–3.5% instead of 4%).

- Keep part of your portfolio in growth investments like index funds to outpace inflation.

Don’t forget healthcare. A surprise medical bill can wipe out months of savings. I suggest setting aside a “health fund” specifically for premiums, out-of-pocket costs, or even long-term care.

Over-Reliance On A Single Investment Strategy

Relying on one path — whether it’s only index funds, only real estate, or only a side hustle — leaves you vulnerable. Markets shift, tenants stop paying, businesses slow down.

Think of your income like a stool: one leg might be strong, but it can’t hold you up alone. Three or four legs — investments, real estate, digital income, freelance work — make the stool stable, even if one weakens.

In my experience, the people who last longest in early retirement are those with multiple streams. They aren’t panicked when the market dips because they have rental income or a side hustle to smooth it out.

Failing To Adapt Plans As Life Circumstances Change

Life rarely goes exactly how you expect. You might have kids, move to a new city, care for parents, or simply change your mind about what retirement looks like.

The danger is clinging to a rigid plan that doesn’t fit anymore. Instead:

- Revisit your numbers yearly. Adjust savings, expenses, or goals as needed.

- Stay open to shifting your strategy — maybe you lean more on real estate one year and scale back later.

- Remember, early retirement doesn’t have to be an all-or-nothing leap. You can semi-retire, take a sabbatical, or test it in phases.

Flexibility keeps you from snapping under pressure. Think of your early retirement plan as a living document, not a carved-in-stone rulebook.

How To Stay Motivated And Stick To The Long Game

Saving aggressively and investing for early retirement in your 30s is exciting at first, but staying motivated over years takes real effort. Here’s how to keep your fire alive without burning out.

Tracking Your Net Worth And Celebrating Milestones

Progress feels invisible unless you measure it. That’s where tracking net worth comes in. Net worth is simply your assets minus liabilities — a snapshot of your financial health.

I suggest creating a simple spreadsheet or using a finance app to update your numbers monthly or quarterly. Seeing your debt shrink and your investments grow is addictive in the best way.

Set milestones and celebrate them. When you hit your first $100k invested, mark the moment. When you pay off your last high-interest debt, treat yourself (within reason). Small celebrations keep momentum strong.

Surrounding Yourself With A Like-Minded Community

It’s tough to stay the course when everyone around you is upgrading cars, buying bigger homes, or taking luxury vacations. You start to feel like the odd one out.

That’s why finding a community matters. Online forums, local meetups, or even a couple of friends who share the same goals can make a huge difference.

I believe community is like jet fuel for this journey. When you see others making sacrifices and succeeding, it reinforces that you’re not crazy — you’re just playing a different game.

Keeping Flexibility To Adjust Without Losing Sight

The danger of being hyper-focused on early retirement is burning out. If you cut every joy out of your life, you might resent the process and give up.

Instead:

- Build small luxuries into your budget (coffee shop mornings, occasional trips).

- Allow flexibility — if you have a rough year, it’s okay to pause big savings goals.

- Keep reminding yourself why you started. Write it down: “I want freedom to travel / spend time with family / pursue passion projects.”

Staying motivated is less about discipline and more about designing a system that rewards you along the way.

Is Early Retirement In Your 30s Truly Achievable?

So, can you really retire in your 30s? The answer is yes — but it’s not for everyone, and that’s perfectly okay.

Who Early Retirement Works Best For

In my view, early retirement works best for people who:

- Have a relatively high savings rate (40% or more).

- Can embrace simple living without feeling deprived.

- Value freedom and flexibility more than luxury lifestyles.

It’s less about income level and more about the gap between what you earn and what you spend. A teacher who lives simply might retire earlier than a doctor who inflates their lifestyle with every raise.

Why Flexibility Beats Perfection In Planning

The people who succeed at early retirement aren’t the ones with flawless spreadsheets. They’re the ones who adapt when life changes.

Maybe you don’t retire fully at 38, but you reach a point where you can quit your job, consult part-time, and travel the world. Maybe you take mini-retirements every few years instead of one permanent break.

Flexibility is what makes early retirement sustainable — it’s not about a perfect plan, but about building freedom into your life.

Expert Tip To Start Today Even If You’re Behind

If you’re reading this and thinking, “I’m already in my 30s, I’m behind,” here’s my advice: start with one thing today.

- Increase your savings rate by 5%.

- Open a retirement account if you don’t have one.

- Pay an extra $100 toward your highest-interest debt.

It doesn’t matter where you start — what matters is momentum. Over time, those small moves snowball into serious progress.

An early retirement plan in your 30s isn’t about perfection. It’s about building freedom brick by brick, so one day, work becomes a choice, not a necessity.