Table of Contents

When you set out to create a financial plan, the steps you take in 2025 look very different from what worked five or ten years ago. Between new tech tools, changing economic realities, and smarter strategies, it can feel overwhelming to know where to start.

How do you turn your goals into a realistic roadmap that keeps you financially secure this year and beyond? That’s the exact question this guide will answer as we walk through each step in detail.

Define Your Current Financial Situation

Before you can create a financial plan that actually works, you need a clear picture of where you stand right now.

Think of it like checking your GPS before starting a trip — you can’t plan the route if you don’t know your starting point.

Track Every Source of Income Clearly

A lot of people underestimate how many different income streams they actually have. Beyond your paycheck, you might have side gigs, freelance work, rental income, or even dividends from investments.

I suggest making a full list and writing down the net amount (what actually lands in your bank account).

Here’s a quick way to organize it:

- Open your bank app and export your last three months of transactions.

- Categorize every incoming dollar — salary, bonuses, freelance payments, child support, interest, dividends.

- Average irregular income, like freelance gigs, so you’re not counting on an inflated number.

Pro tip: If you use digital tools like Mint, or YNAB, they’ll automatically track income flows across accounts, which saves hours of manual sorting.

When you see the exact inflow of money, it becomes easier to spot gaps or opportunities. For example, you might realize that side gig bringing in $300/month could cover your car insurance entirely.

Assess Fixed and Variable Monthly Expenses

Expenses are where most financial plans crumble because people underestimate them. Start by splitting them into two buckets:

- Fixed expenses: Rent, mortgage, utilities, insurance, subscriptions. These don’t change much month to month.

- Variable expenses: Groceries, dining out, travel, clothing, entertainment. These fluctuate and are harder to control.

Here’s how I handle it: export bank and credit card statements, then sort line items into fixed or variable. Highlight any recurring subscription you haven’t used in months — these are “silent budget killers.”

I believe one of the best habits is to assign each dollar a job. For instance, if groceries average $450/month, lock that amount into your budget. Don’t “hope” it’ll be less; plan for the reality.

This breakdown will also reveal where cuts can be made without hurting your lifestyle. Canceling two unused subscriptions and dialing back weekly takeout could save you hundreds annually — money that could go straight into savings or debt payoff.

Calculate Your Net Worth Accurately in 2025

Your net worth is your financial health snapshot. It’s simply:

Assets – Liabilities = Net Worth

Assets include cash, investments, retirement accounts, and property. Liabilities are debts like credit cards, student loans, and mortgages.

In 2025, there are excellent tools to simplify this: Apps like Empower (formerly Personal Capital) let you link accounts and auto-calculate net worth. But if you prefer manual tracking, set up a spreadsheet with two columns: one for assets, one for liabilities. Update it quarterly.

The magic of knowing your net worth is that it gives you a baseline. Even if the number is negative, don’t panic — it’s not a judgment, it’s data.

Over time, you’ll see progress. For example, paying down $2,000 of credit card debt while your 401(k) grows $5,000 shifts your net worth by $7,000. That’s real momentum.

Think of net worth as your scorecard — not to compete with anyone else, but to measure your own progress toward financial independence.

Set Short-Term And Long-Term Financial Goals

Once you’ve mapped your current situation, it’s time to decide where you’re headed. Financial goals are the backbone of your plan, and without them, you’ll end up drifting.

Break Goals Into Measurable And Time-Bound Targets

A goal without specifics is just a wish. Saying “I want to save money” isn’t enough. Instead, reframe it: “I want to save $10,000 for an emergency fund in 12 months.”

The formula I use is SMART goals: Specific, Measurable, Achievable, Relevant, Time-bound.

Examples:

- Short-term: Pay off $3,000 in credit card debt within 9 months.

- Medium-term: Save $25,000 for a down payment in 3 years.

- Long-term: Build $1M retirement fund by age 65.

Breaking them down makes them less overwhelming. Saving $25,000 feels massive, but divided into $700/month, it’s actionable.

Prioritize Needs Over Wants Without Losing Balance

Here’s where most people get stuck: choosing between what they “should” do and what they “want” to do. I’ve learned that if you only focus on needs — debt, bills, emergency fund — you’ll burn out.

My approach is the 50/30/20 guideline:

- 50% of income for needs.

- 30% for wants.

- 20% for savings or debt repayment.

That way, you still budget for fun — dinners, hobbies, travel — without sabotaging your bigger goals.

For example, instead of cutting out vacations entirely, maybe you reduce them from two a year to one, redirecting $1,500 into savings while still enjoying life.

It’s about balance, not punishment. Financial planning should support your life, not make you feel deprived.

Align Financial Goals With Lifestyle And Family Plans

Your goals have to match the life you want, not some generic checklist. A newlywed couple planning kids will prioritize differently than a single person focused on early retirement.

Here’s a simple way to test alignment: ask yourself, “Does this goal serve the life I want five years from now?” If not, it’s noise.

For example:

- If you dream of starting a business, then building a large emergency fund and cutting debt fast is crucial.

- If your focus is family, funding a 529 plan or saving for a bigger home might come first.

- If travel is your passion, earmark a “freedom fund” for experiences.

I advise having a “life vision session” once a year — alone or with your partner. Write down what matters most, then make sure your financial goals fuel those dreams instead of fighting them.

Build A Reliable Budget That Works For You

Budgeting isn’t about restricting your life; it’s about giving yourself freedom. When you build a reliable budget, you stop guessing where your money went and start telling it where to go.

Choose The Right Budgeting Method For 2025

There isn’t a one-size-fits-all budget. What works for your best friend may drive you crazy. In 2025, you’ve got more flexible options than ever:

- 50/30/20 Rule: Simple, popular, and easy to track. Half of income covers needs, 30% covers wants, 20% goes to savings or debt.

- Zero-Based Budget: Every single dollar is assigned a purpose. This works great if you like structure and control.

- Envelope System (Digital Version): Originally cash in envelopes, now apps mimic this by setting spending limits for categories like dining, gas, and groceries.

- Reverse Budgeting: Instead of budgeting expenses first, you start with savings goals, lock those in, and then live on what’s left.

I suggest testing one for 90 days. If you feel stressed or constantly moving money around, switch it up. The “best” budget is the one you’ll actually stick with.

Use Digital Tools And Apps To Automate Tracking

Manually tracking every coffee purchase is exhausting, and honestly, most people give up. That’s where budgeting apps shine.

- YNAB (You Need A Budget): Great for zero-based budgeting. The dashboard forces you to give every dollar a job.

- Monarch Money: My pick for families or couples. You can link accounts, set joint goals, and get a bird’s-eye view of progress.

- Empower (formerly Personal Capital): Perfect if you want both budgeting and net worth tracking in one place.

Here’s what I personally do: Link all bank accounts, credit cards, and investment accounts to my app. From the dashboard, I can instantly see how much went to dining, groceries, or subscriptions last month without opening a spreadsheet.

Automation takes the mental load off, and when something spikes (like travel spending), I catch it right away.

Adjust Budgets To Handle Inflation And Price Shifts

This is the part most people overlook: your budget in January rarely looks the same in July. Inflation creeps in quietly. Groceries cost 8% more, utilities climb, and suddenly your budget is off-balance.

I recommend building flex zones into your budget. For example, if you budget $500 for groceries, create a 10% buffer. That way, when eggs suddenly double in price, you’re not scrambling.

Another tip: Review your budget quarterly. Look at categories like fuel, food, and healthcare, which are most sensitive to inflation. If you see consistent increases, shift money from “wants” to cover “needs” without feeling guilty.

A reliable budget isn’t static — it’s a living, breathing system that bends with real life. Treat it that way, and you’ll avoid the frustration of feeling like your budget is “broken.”

Create An Emergency Fund For Stability

Unexpected costs aren’t a matter of if, but when. An emergency fund is the safety net that keeps you from going into debt when life throws you a curveball.

Decide How Much To Save For Unexpected Costs

The golden rule is 3–6 months of essential expenses, but I know that can feel impossible at first. Start small: $1,000 set aside gives you breathing room for minor emergencies like car repairs or medical bills.

Once you’ve got that, calculate your bare-bones monthly costs: rent/mortgage, utilities, groceries, insurance, and minimum debt payments.

Multiply that by 3–6, and you’ll know your ideal target. For example, if essentials cost $2,500/month, your fund should land between $7,500 and $15,000.

I believe the “start small, grow steady” approach works best. Hitting that first $1,000 builds momentum and keeps you motivated to push further.

Place Emergency Funds In Accessible Accounts

The key to an emergency fund is access. If you lock it up in a CD or an investment account, you risk penalties or losses when you need the money fast.

Best options for 2025:

- High-Yield Savings Accounts (HYSAs): Many offer 4–5% APY, letting your emergency fund grow passively.

- Money Market Accounts: Slightly higher yields, with check-writing privileges.

- Separate Checking Account: If you need instant access, though yields will be lower.

Personally, I keep mine in a HYSA that’s linked but not too easy to dip into. It’s one transfer away, which stops impulse spending but still gives me peace of mind in case of a true emergency.

Separate Emergency Savings From Regular Spending

This one’s critical: if your emergency fund sits in the same account as your day-to-day money, it will eventually get spent. The brain sees “extra money” and justifies a new gadget, trip, or fancy dinner.

Here’s how to avoid that:

- Open a separate account only for emergencies.

- Nickname it something motivational in your app, like “Safety Net” or “Peace of Mind.”

- Automate transfers every payday — even $50 adds up fast.

I advise treating your emergency fund like insurance. You don’t think about it daily, but when the unexpected happens — job loss, medical emergency, or even replacing a broken furnace in the middle of winter — you’ll be grateful it’s there.

Building this cushion gives you one of the greatest gifts in personal finance: the ability to breathe when life gets chaotic.

Manage And Reduce Outstanding Debts

Debt isn’t just numbers on a page — it’s stress that lingers in the background of everything you do. Managing and reducing it frees up cash flow and creates space for actual wealth building.

Identify High-Interest Debts That Drain Cash Flow

Not all debt is equal. A mortgage at 4% is very different from a credit card at 22%. The first step is to list every debt you owe with these details:

- Total balance

- Minimum monthly payment

- Interest rate

Once you line these up in a simple spreadsheet or a tool like Empower, the picture becomes clear. I usually highlight anything above 10% interest in red — those are the real drains.

Here’s why: A $5,000 balance on a card at 20% APR, with only minimum payments, could take over a decade to pay off and cost more than $6,000 in interest. Once you see numbers like that, you know where your focus has to go.

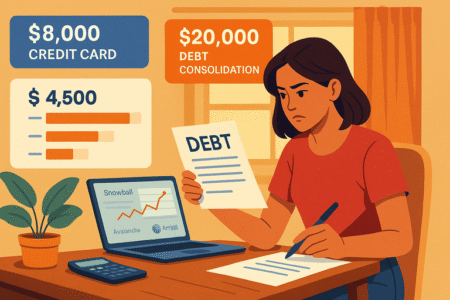

Apply Proven Repayment Strategies Like Snowball Or Avalanche

Two repayment methods work best, depending on your personality:

- Debt Snowball: Pay off the smallest balance first, regardless of interest rate. The quick win gives you motivation. Once one debt is gone, you roll that payment into the next.

- Debt Avalanche: Pay down the highest interest rate first, while making minimums on the rest. It’s mathematically faster and saves the most money long-term.

Here’s an example:

- Card A: $500 at 18%

- Card B: $1,200 at 22%

- Loan: $4,000 at 6%

With snowball, you’d crush Card A first. With avalanche, you’d attack Card B. Personally, I recommend avalanche if you’re disciplined, snowball if you need early wins to stay motivated.

The trick is to automate payments. Set them up in your bank’s dashboard so they happen without you thinking about it. Momentum builds consistency.

Consolidate Debts With Modern Financial Services

If juggling multiple balances and due dates stresses you out, consolidation can simplify things. In 2025, options are smarter and more accessible than ever:

- Balance transfer credit cards: Many offer 0% APR for 12–18 months. If you can pay down your balance within that window, it’s like borrowing money for free.

- Debt consolidation loans: Roll high-interest debts into one loan with a lower fixed rate. Services like SoFi and Marcus offer easy applications online.

- Credit counseling agencies: Nonprofits can negotiate lower interest rates with creditors, bundling your payments into one.

I suggest only consolidating if it lowers your interest rate and you commit to not racking up new debt. Otherwise, it’s just shuffling the problem.

Develop An Investment Plan That Fits Your Goals

Once debt is under control, the next step is putting your money to work. Investments grow wealth faster than savings ever can, but the right plan has to fit your goals and tolerance for risk.

Decide On Risk Tolerance And Asset Allocation

Risk tolerance is simply how much fluctuation you can stomach without panicking. If seeing your portfolio drop 15% makes you want to cash out, you’re more conservative.

Asset allocation means spreading your money across different investment types — stocks, bonds, real estate — to balance risk and reward. A common starting point is:

- Younger investors: 80% stocks, 20% bonds

- Mid-career: 60% stocks, 40% bonds

- Near retirement: 40% stocks, 60% bonds

I believe the key is adjusting allocation to match your timeline. Money you’ll need in 3 years shouldn’t be in volatile assets. Retirement money you won’t touch for 30 years can afford market swings.

Explore Stocks, Bonds, ETFs, And Real Estate Options

Here’s a quick breakdown of core investment vehicles:

- Stocks: Ownership in companies, high growth potential but volatile.

- Bonds: Loans to governments or corporations, safer but lower returns.

- ETFs (Exchange-Traded Funds): Bundles of stocks or bonds, great for diversification with one purchase.

- Real estate: Physical property or REITs (real estate investment trusts). Steadier cash flow, but less liquid.

If you’re new, ETFs are the easiest entry point. For example, buying an S&P 500 ETF like VOO or SPY instantly spreads your money across 500 companies.

I suggest avoiding stock picking unless you have time to research thoroughly. Broad funds usually outperform most DIY portfolios long-term.

Use Robo-Advisors And Digital Platforms For 2025 Investing

Technology makes investing ridiculously easy today. Robo-advisors like Betterment or Wealthfront build a portfolio for you based on your goals and risk tolerance. You just answer a few questions, and the algorithm does the heavy lifting.

For hands-on investors, platforms like Fidelity, Schwab, or Vanguard offer user-friendly dashboards. In fact, on Fidelity’s app, you can go to “Accounts > Open New Account > Brokerage” and set up an account in minutes.

One feature I love: Automatic rebalancing. Robo-advisors shift your portfolio back to your target allocation without you needing to log in. For example, if stocks grow and tilt your mix from 70/30 to 80/20, it sells a little stock and buys bonds to keep balance.

That’s the beauty of investing in 2025 — with the right tools, even beginners can build a professional-grade portfolio.

Protect Your Wealth With Insurance And Safeguards

Wealth building is exciting, but it only takes one disaster to wipe it out. Insurance is the guardrail that protects the financial plan you’ve worked hard to build.

Review Health, Life, And Property Coverage Needs

Start with the basics:

- Health insurance: A must, no matter what. Without it, one hospital visit could ruin your finances.

- Life insurance: If anyone depends on your income, term life coverage is crucial. Skip the fancy products — simple term coverage usually does the job.

- Property insurance: Homeowners or renters insurance covers not just property damage but also liability if someone gets hurt on your property.

I suggest doing a coverage check once a year. Call your provider and ask directly: “If something happens tomorrow, what does this policy actually cover?” You’d be surprised how often people assume protections they don’t have.

Understand The Role Of Disability And Income Insurance

Most people overlook this, but your biggest asset isn’t your house or your car — it’s your ability to earn an income. Disability insurance protects that.

There are two types:

- Short-term disability: Covers a portion of your income for a few months.

- Long-term disability: Kicks in after a waiting period and can last years, sometimes until retirement.

Employer plans often provide some coverage, but it’s worth checking gaps. I advise reviewing your benefits portal. If coverage only pays 40% of your salary, you might need supplemental insurance.

It sounds boring, but losing income is one of the fastest ways financial plans collapse. Disability coverage is peace of mind.

Update Insurance Policies To Match Current Circumstances

Life changes fast, and insurance that fit three years ago may not be enough today. Marriage, kids, a new home, or even just rising property values all change your needs.

Set a reminder to review every policy annually. Ask:

- Has my income increased?

- Do I have new dependents?

- Has my property appreciated in value?

I once helped a friend realize her home insurance was underinsured by nearly $100,000 after renovations. Had disaster struck, she would’ve been financially crushed.

Insurance doesn’t make you money, but it saves you from losing everything. It’s the quiet bodyguard for your financial plan.

Plan For Retirement Strategically

Retirement may feel far off, but the sooner you plan, the easier it becomes. Think of it as planting a tree: the earlier you start, the more time it has to grow.

Estimate Retirement Income Needs Accurately

A lot of people guess at this number and either overshoot or undershoot. The simplest way to estimate is to aim for 70–80% of your pre-retirement income each year.

For example, if you live comfortably on $70,000 today, you’ll likely need about $50,000–55,000 annually in retirement.

Here’s how I suggest tackling it:

- List your expected retirement expenses — housing, healthcare, food, travel.

- Factor in inflation. A $3,000 monthly expense today could easily be $5,000 in 25 years.

- Subtract guaranteed income sources like Social Security or pensions to see how much your investments need to cover.

I believe the act of writing this out makes the future less intimidating. Suddenly, retirement isn’t a vague dream — it’s a math problem you can solve.

Maximize Employer-Sponsored Plans And IRAs

If your employer offers a 401(k), 403(b), or similar plan with a match, that’s free money — don’t leave it on the table.

For instance, if they match 4% and you earn $60,000, contributing 4% ($2,400/year) gets you another $2,400 automatically.

Beyond that, open an IRA (Individual Retirement Account). You can choose between:

- Traditional IRA: Contribute pre-tax, pay taxes when you withdraw.

- Roth IRA: Contribute after-tax, but withdrawals are tax-free in retirement.

In 2025, contribution limits are higher than ever, giving you more room to grow. I advise setting up automatic contributions through your payroll or bank dashboard so investing happens without effort.

Think of retirement accounts as a conveyor belt moving money into your future — the less you have to think about it, the better.

Adapt Retirement Planning To Account For Longevity Trends

Here’s the twist: people are living longer. It’s not uncommon now for retirement to stretch 25–30 years. That means your plan has to last longer too.

This is where diversification matters. You can’t rely solely on safe bonds because inflation will eat away at returns. At the same time, you can’t put everything in high-risk stocks as you age. I recommend a “glide path” strategy: gradually shift from growth-oriented assets to more stable ones over time.

Also, don’t underestimate healthcare costs. Medicare doesn’t cover everything, so planning for supplemental insurance or a Health Savings Account (HSA) now can save stress later.

The goal isn’t just to retire, but to retire with enough flexibility to enjoy life without constant financial worry.

Optimize Taxes With Smart Planning

Taxes can quietly drain your wealth if you ignore them. A smart financial plan uses the rules in your favor, letting you keep more of what you earn.

Track Deductions And Credits Available In 2025

Tax codes change, and so do the opportunities to save. For 2025, you’ll want to keep an eye on:

- Standard vs. itemized deductions — which gives you the bigger benefit.

- Child tax credits and education credits if you have kids in school.

- Energy efficiency credits for home upgrades like solar or insulation.

Here’s my personal tip: Use a digital tax organizer like the one built into TurboTax. From the dashboard, you can upload receipts and forms throughout the year instead of scrambling in April.

This makes filing less stressful and ensures you don’t miss money-saving opportunities.

Use Retirement Contributions For Tax Advantages

Retirement accounts aren’t just for the future — they lower your tax bill today.

- Contributions to a 401(k) or Traditional IRA reduce taxable income. If you make $70,000 and contribute $7,000, the IRS only taxes $63,000.

- With a Roth IRA, contributions don’t reduce today’s taxes, but the long-term benefit of tax-free withdrawals often outweighs that.

I believe the smartest move is a mix — contribute enough to pre-tax accounts to lower today’s bill, and also build up Roth savings for future flexibility.

The more you use these tax-advantaged accounts, the less you give away to Uncle Sam each year.

Consider Professional Help For Complex Tax Situations

If you’re self-employed, have multiple income streams, or own real estate, taxes get complicated fast. A good CPA or enrolled agent can save you thousands — often far more than their fee.

Here’s what I suggest: book a mid-year check-in, not just year-end filing. That way, you can adjust withholding, make estimated payments, or take advantage of new credits before it’s too late.

Think of a tax pro as part of your financial team. Just like you wouldn’t try to fix your car’s transmission without a mechanic, sometimes it’s smarter to bring in an expert.

Review And Update Your Financial Plan Regularly

A financial plan isn’t something you create once and forget. Life changes — and your plan should too. Regular reviews keep everything aligned with your goals.

Schedule Annual And Mid-Year Plan Reviews

I advise two check-ins each year: one in January and one mid-year (June or July). Use these sessions to review:

- Income and expenses

- Debt balances

- Savings progress

- Investment performance

Put it on your calendar like a doctor’s appointment. Consistency is what keeps small issues from turning into big problems.

Adjust Goals And Budgets When Life Circumstances Change

Major life events — marriage, kids, job change, moving — all affect your financial plan. Even smaller shifts, like inflation nudging up grocery bills, deserve an adjustment.

Here’s a scenario: If your income jumps 15% with a new job, don’t let lifestyle creep swallow it all. Instead, allocate part of that raise to savings or debt payoff before expanding your budget.

I believe flexibility is what makes financial plans sustainable. Sticking to rigid numbers when life evolves only leads to frustration.

Track Progress Using Digital Dashboards And Reports

One of the best motivators is seeing progress visually. Tools like Monarch Money, Empower, or YNAB generate charts that show debt shrinking, net worth climbing, or savings goals filling up.

From the dashboard, you can usually click “Reports” to see month-over-month changes. Watching your emergency fund bar grow from 40% to 80% funded feels amazing — it’s proof your efforts are working.

I advise checking these reports monthly. Not to obsess, but to celebrate wins and spot red flags early.

When you track, adjust, and review regularly, your financial plan becomes a living system — one that grows with you instead of getting left behind.