Table of Contents

Financial security is something we all dream of, but what does it actually take to achieve it? The truth is, building financial stability isn’t about quick wins—it’s about creating long-term habits that protect you no matter what life throws your way.

If you’ve ever wondered how to break free from money stress and feel confident about your future, this guide will walk you through 10 proven ways to build financial security for life.

1. Start With A Realistic Budget You Can Stick To

Building financial security starts with one habit: knowing exactly where your money is going. A budget doesn’t need to be restrictive—it should feel like a guide that helps you make better choices and stress less about money.

Break Down Income And Expenses Clearly

Think of your budget like a financial map. The first step is to clearly outline what’s coming in and what’s going out.

Many people underestimate their expenses because they only look at big bills—rent, utilities, car payments—but forget the “invisible leaks” like coffee runs, subscriptions, or random Amazon orders.

Here’s how you can make it simple:

- Write down your monthly income after taxes.

- List fixed expenses: rent, insurance, utilities, debt payments.

- Add variable expenses: groceries, dining out, gas, shopping.

- Don’t forget annual or irregular costs like holiday spending or car maintenance—divide them into monthly amounts so they don’t surprise you.

When you lay it all out, you’ll often find categories that don’t match your priorities. For example, I once realized I was spending more on delivery food than on savings. That was a wake-up call.

Track Spending With Tools And Apps

A budget only works if you know what’s really happening with your money. Tracking every transaction might sound painful, but apps make it almost effortless.

Popular options like YNAB (You Need A Budget), Mint, and EveryDollar let you sync your bank accounts so spending is automatically categorized.

Personally, I recommend YNAB if you want a proactive approach—it makes you assign every dollar a “job” before you spend it. Mint is great if you prefer automatic tracking with less setup.

If apps feel overwhelming, start with something as simple as Google Sheets. The important part is awareness. Once you see the numbers staring back at you—like $180 on takeout last month—you’ll start making changes naturally.

Adjust Categories To Match Your Lifestyle

This is where many budgets fail: they’re too rigid. If you set unrealistic categories, you’ll quit after a few weeks. A good budget reflects your life, not some perfect financial plan.

For example, if you love eating out, don’t eliminate it completely. Instead, create a dining-out category with a realistic limit. If you know you’ll spend $150 a month at restaurants, plan for it. That way you enjoy life without guilt.

Another tip I use: Set “fun money” aside for guilt-free spending. Even $50 a month makes a difference because it keeps the budget sustainable.

The goal isn’t to restrict every dollar—it’s to align your money with your values. That’s how budgeting becomes a tool for financial security, not a punishment.

2. Build A Consistent Emergency Fund

Once your budget is in place, the next step toward financial security is protecting yourself from the unexpected. That’s where an emergency fund comes in.

It’s your financial safety net, giving you peace of mind when life throws curveballs.

Set A Target Amount That Covers Essentials

Most experts recommend saving three to six months’ worth of essential expenses, but don’t let that number intimidate you. If you’re starting from zero, aim for a smaller milestone first—like $500 or $1,000.

That alone can cover things like car repairs or medical bills that might otherwise push you into debt.

Here’s how I suggest calculating your target:

- Add up must-pay expenses like rent, utilities, food, and transportation.

- Multiply that number by the number of months you want covered.

- Start with one month as a goal, then build up gradually.

Think of it as building layers of protection. Even one month of expenses saved can give you breathing room.

Automate Savings To Remove The Guesswork

Saving money is easier when you don’t rely on willpower. Automation takes the decision out of your hands. Most banks let you set up recurring transfers from checking to savings. I advise treating this like any other bill—schedule it right after payday so the money is gone before you even see it.

For example, if you want to save $200 a month, set up an automatic transfer on the same day your paycheck hits. Over time, you’ll barely notice it missing. Some apps like Qapital even let you save automatically by rounding up purchases or analyzing your spending patterns.

This is one of the best habits I’ve ever adopted—automation turns saving into a background process that just works.

Keep Emergency Cash Separate From Daily Funds

Here’s a mistake I’ve made before: keeping my emergency savings in the same account as my everyday checking. Guess what happened? It wasn’t there when I needed it.

The solution is to park your emergency fund in a separate savings account. A high-yield savings account is ideal because you’ll earn interest while keeping the money accessible. Just don’t tie it to your debit card—you want a little friction so you don’t dip into it for non-emergencies.

Some people even use online banks for this purpose. Out of sight, out of mind, but still there when you need it.

Remember: This account is for true emergencies only—job loss, medical bills, car breakdowns—not vacations or new gadgets.

When you have this cushion, life feels lighter. That’s the power of an emergency fund—it transforms financial stress into financial security.

3. Pay Off High-Interest Debt First

Debt is one of the biggest roadblocks to financial security. The longer you carry it, the more money slips through your fingers in the form of interest.

Tackling high-interest debt early is like giving yourself a raise without changing jobs.

Understand How Interest Eats Into Your Future

Interest works against you the same way compound growth works for you—it multiplies over time. With high-interest debt, such as credit cards charging 20% or more, you’re essentially paying for yesterday’s purchases with tomorrow’s income.

Here’s a quick illustration:

- A $5,000 balance on a card at 22% interest, making only minimum payments, could take over 20 years to pay off and cost you more than double the original balance.

- That’s money that could have been invested, saved, or spent on things you actually value.

I suggest pulling out your latest credit card statement and checking the “minimum payment warning” box. Seeing the total you’ll pay if you stick to minimums is often a jaw-dropping motivator to act fast.

Use The Avalanche Or Snowball Method Strategically

There are two main strategies for paying off debt:

- Avalanche Method: Pay extra on the highest-interest debt first while making minimum payments on others. This saves the most money long-term.

- Snowball Method: Pay off the smallest balance first for a quick win, then roll that payment into the next debt. This builds momentum and motivation.

I believe the best approach depends on your personality. If you’re numbers-driven and motivated by saving the most money, avalanche is your friend. If you thrive on quick wins and need to see progress fast, snowball can keep you from giving up.

Personally, I started with snowball. Knocking out a $600 store card balance felt amazing, and that momentum carried me into tackling larger debts. Over time, I shifted to avalanche once I had confidence and discipline.

Replace Credit Reliance With Smarter Alternatives

Paying off debt is only half the battle—you also have to prevent it from piling up again. That means breaking the habit of relying on credit cards as a fallback.

Here are some alternatives I recommend:

- Build a small emergency fund first: Even $500 can stop you from swiping when unexpected expenses hit.

- Use a debit card for everyday spending: This keeps you grounded in what you actually have.

- Switch to a secured card: If you want to keep building credit, a secured card backed by a deposit prevents overspending.

It’s not about cutting up your cards entirely (unless that works for you). It’s about shifting credit from being a lifeline to being a tool you rarely, if ever, need. That’s how debt stops controlling your future.

4. Invest Early And Let Compounding Work

Once you’ve freed yourself from high-interest debt, the next powerful step toward financial security is investing.

Investing is how you make your money work while you sleep. The earlier you start, the bigger the payoff thanks to compounding.

Start Small With Index Funds Or ETFs

You don’t need thousands to begin investing. Many platforms let you start with as little as $50. The key is choosing investments that spread out your risk.

- Index Funds: These track the performance of a market index, like the S&P 500. They’re low-cost and historically deliver strong returns over time.

- ETFs (Exchange-Traded Funds): Similar to index funds but traded like stocks. They’re flexible, often with low fees, and a great way to start.

From my experience, apps like Vanguard, Fidelity, or Robinhood make it easy for beginners to open accounts and buy fractional shares. I usually recommend Vanguard for its low-cost index funds if you’re playing the long game.

The important part is consistency. Even $100 invested monthly in an index fund compounds dramatically over decades.

Understand Risk Tolerance Before Choosing Investments

Investing isn’t one-size-fits-all. Your risk tolerance—the amount of risk you’re comfortable taking—matters. Stocks tend to give higher returns but with bigger swings, while bonds are more stable but lower growth.

Ask yourself: How would you feel if your investments dropped 20% tomorrow? Panicked? Unbothered because you’re focused on 20 years from now?

I suggest this rule of thumb:

- Younger investors can afford more stock-heavy portfolios (70–90% stocks, 10–30% bonds).

- Closer to retirement, it makes sense to gradually shift toward more bonds and less volatility.

Many robo-advisors like Betterment or Wealthfront automatically adjust your portfolio based on your age and goals. That’s a good starting point if you feel overwhelmed.

Reinvest Dividends To Accelerate Growth

Here’s where compounding truly shines: Reinvesting dividends. When a company or fund pays you a dividend, you can either take the cash or automatically buy more shares.

By reinvesting, you’re letting your investments buy more of themselves, which creates exponential growth.

For example, let’s say you invest $10,000 in an S&P 500 index fund with an average return of 7% per year. If you reinvest dividends, that money could grow to over $76,000 in 30 years. Without reinvesting, you’d lose out on a big portion of that growth.

Most platforms make this easy with a setting called DRIP (Dividend Reinvestment Plan). Turn it on, and every dividend gets reinvested automatically.

I always recommend enabling this because it’s one of the simplest ways to build wealth faster without lifting a finger.

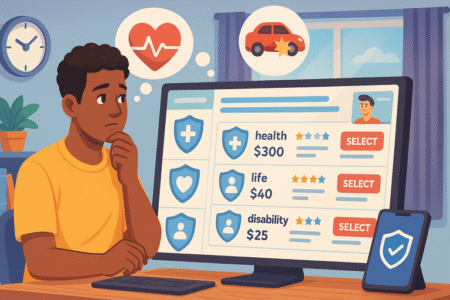

5. Protect Yourself With The Right Insurance

Insurance might not be the most exciting part of financial security, but it’s one of the most important.

Think of it as a safety net that keeps a single unexpected event from wiping out everything you’ve worked so hard to build.

Health Coverage That Shields You From Major Bills

One accident or illness without health insurance can drain savings faster than almost anything else. Even something routine like a broken arm could cost thousands out of pocket.

Here’s what I suggest when looking at health coverage:

- Understand deductibles vs. premiums: A low premium might look appealing, but it usually comes with higher out-of-pocket costs when you actually need care.

- Check in-network providers carefully: If your favorite doctor isn’t included, you might end up paying much more.

- Use preventive care benefits: Many plans cover checkups and screenings at no extra cost—take advantage of those.

When I first picked my own plan, I underestimated how often I’d use it and chose a lower monthly premium. That mistake cost me a lot later in co-pays and prescriptions.

Now, I always balance monthly affordability with the reality of what I might actually need.

Life Insurance To Safeguard Loved Ones

If anyone depends on your income, life insurance isn’t optional—it’s essential. It ensures your family isn’t left struggling financially if the worst happens.

Here are two common types:

- Term life insurance: Affordable and straightforward, it covers you for a set period (like 20 or 30 years). I recommend this for most people.

- Whole life insurance: More expensive, but it lasts your entire life and has a savings component. Better suited for specific estate planning needs.

A simple way to calculate how much coverage you need: multiply your annual income by 10–12. This should provide enough to cover living expenses, debts, and even college costs for kids.

I personally see term life insurance as the most cost-effective option—it gives the protection without overcomplicating things.

Disability Insurance For Income Protection

We often insure our homes, cars, and even phones, but many people forget to insure their income—the very thing that pays for all of it. Disability insurance fills that gap if illness or injury prevents you from working.

There are two main types:

- Short-term disability: Covers a few weeks to months of lost income.

- Long-term disability: Covers years, sometimes until retirement.

Most people underestimate how common disability claims are. Even something like a serious back injury or extended illness could keep you out of work for months. That’s why I believe this coverage is as crucial as health or life insurance.

If your employer offers it, take advantage. If not, individual policies are available, and while they aren’t cheap, the peace of mind is worth it.

6. Diversify Your Income Sources For Stability

Relying on one paycheck feels stable—until it isn’t. Diversifying your income creates resilience. If one stream dries up, the others keep you afloat, making financial security less fragile.

Explore Side Hustles That Align With Your Skills

The best side hustles are the ones you actually enjoy or are already good at. If you’re creative, freelancing in design or writing could be a natural fit. If you’re tech-savvy, tutoring online or offering IT support works.

I once picked up a freelance writing gig that started as just $200 a month but grew into something much bigger. That “extra” money wasn’t just helpful—it was empowering.

Look at your schedule realistically. Even five hours a week can turn into meaningful income if you’re consistent.

Create Passive Income Streams That Scale

Passive income doesn’t mean effortless—it means once you build it, it can run with minimal ongoing effort. Think of it like planting seeds that grow over time.

Examples that work:

- Investing in dividend-paying stocks or ETFs.

- Creating digital products like e-books or courses.

- Renting out property or even a spare room.

One of my friends turned a hobby of photography into a steady stream by selling stock photos online. It took work upfront, but now he earns every month without trading time for money. That’s the beauty of scalable income streams.

Balance Active And Passive Earnings

The smartest income strategy mixes both:

- Active income gives you cash flow right now.

- Passive income builds long-term wealth and stability.

Think of active income as the engine and passive income as the fuel that keeps you moving without burning out.

I believe having at least one reliable active side hustle and one passive stream is the sweet spot. This way, you’re not depending too heavily on one source, and your overall financial security becomes far more resilient.

7. Plan For Retirement Without Delay

Retirement might feel far away, but the earlier you start planning, the easier and less stressful it becomes. Thanks to compounding, every year you wait costs you big in the future.

Contribute To Employer-Sponsored Plans First

If your employer offers a retirement plan like a 401(k), start there. Especially if they offer matching contributions—it’s literally free money.

For example, if your company matches 50% up to 6% of your salary, and you earn $60,000 a year, contributing that full 6% means you get an extra $1,800 in your account each year. Skipping that is like walking past free cash on the sidewalk.

I advise at least contributing enough to get the full match, even if you can’t max out your account yet.

Use Roth Or Traditional IRAs Wisely

If you don’t have access to an employer plan—or you want to save more—IRAs are a fantastic option.

- Traditional IRA: Contributions may be tax-deductible, but you’ll pay taxes when you withdraw in retirement.

- Roth IRA: Contributions are taxed now, but withdrawals are tax-free later.

I personally love Roth IRAs because of the tax-free growth. Imagine investing $6,000 a year, and decades later withdrawing tens of thousands without paying a penny in taxes. That’s powerful.

Increase Contributions As Income Grows

One of the smartest habits I’ve adopted is increasing retirement contributions whenever I get a raise. If you bump your savings rate by even 1% each year, you barely notice the difference in your paycheck, but your retirement account will thank you.

Here’s a quick visual example:

| Annual Contribution | Years | Growth At 7% Return |

| $3,000 | 30 | $283,000 |

| $5,000 | 30 | $472,000 |

| $8,000 | 30 | $755,000 |

That’s the magic of starting early and consistently increasing your contributions. It’s not about huge leaps—it’s about steady progress.

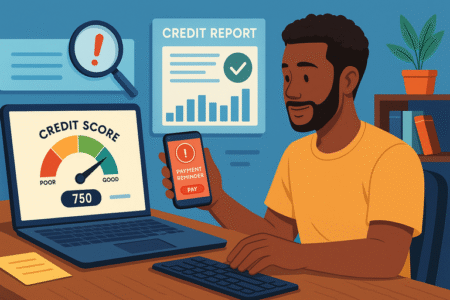

8. Build Strong Credit And Maintain It

A strong credit score isn’t just about borrowing—it impacts everything from renting an apartment to getting good insurance rates. Building and maintaining healthy credit is one of the quiet foundations of financial security.

Pay Bills On Time Every Single Month

Payment history makes up the largest portion of your credit score. Even a single missed payment can stay on your record for years.

What’s worked best for me is automating as many payments as possible. Most banks let you set up autopay directly from your online dashboard—just link your checking account and schedule recurring payments for the due date. If autopay makes you nervous, at least set reminders on your phone or calendar a few days before each bill.

It may feel small, but these habits compound into reliability that lenders notice. Think of it as showing consistency to the “credit world.”

Keep Credit Utilization Low For A Healthy Score

Credit utilization is the percentage of your available credit you’re using. A good rule of thumb is to keep it under 30%, but I suggest aiming even lower if you can—around 10–15%.

Example: If you have a $10,000 total credit limit, try to keep your balance below $3,000 at all times. Even better, pay it off before your statement closes so the reported balance is lower.

A practical hack I’ve used: making two smaller payments each month instead of one. It keeps my utilization consistently low and helps me avoid any big spikes.

Review Reports Regularly To Fix Errors

Credit report mistakes are surprisingly common. A wrong balance, a closed account still showing as open, or even someone else’s debt attached to your name—all of these can hurt your score.

You can check your credit reports for free once a year from each major bureau (Experian, Equifax). I recommend staggering them—pull one every four months. That way, you’re monitoring all year long without paying extra.

If you spot an error, dispute it right away through the bureau’s online portal. It usually takes 30 days to resolve, but fixing even one mistake could raise your score and save you money on interest rates later.

9. Spend Mindfully And Align With Your Values

True financial security isn’t just about saving—it’s also about how you spend. Mindful spending helps you enjoy your money today while still protecting your future.

Differentiate Between Needs And Wants

This sounds obvious, but it’s where most budgets fall apart. Needs are things you can’t live without—rent, groceries, transportation. Wants are the extras—streaming services, dining out, weekend shopping sprees.

Here’s a quick trick I use: before buying something, ask, “Will this matter to me in three months?” If the answer is no, it’s probably a want, not a need.

This doesn’t mean cutting out every want. It means recognizing them and making intentional choices.

Practice Conscious Consumption Daily

Conscious consumption is about pausing before you swipe. Do you really value what you’re about to buy? Or is it just impulse or habit?

One method that’s helped me: the 24-hour rule. If I see something I want (outside of essentials), I wait a full day before deciding. Most of the time, the urge fades. When it doesn’t, I know it’s something I truly value.

Apps like YNAB even have categories where you can name your savings goal—like “Weekend Trip” or “New Laptop.” It turns spending into something deliberate instead of reactive.

Avoid Lifestyle Inflation As Income Rises

The sneakiest threat to financial security is lifestyle inflation—spending more just because you’re earning more. I’ve been guilty of this myself. The moment I got my first raise, I upgraded my apartment, bought new furniture, and suddenly that extra income was gone.

The key is to freeze your lifestyle for a little while after each raise. Direct the extra money into savings, investments, or debt payoff before it disappears into “upgrades.”

A practical system I suggest:

- 50% of any raise goes to savings or retirement.

- 30% can go toward lifestyle improvements.

- 20% can be for fun or personal goals.

This way, you reward yourself but still build lasting security.

10. Keep Learning And Adjusting Financial Habits

Financial security isn’t a “set it and forget it” achievement. It’s an ongoing process that changes as your life changes. The more you learn and adapt, the stronger your foundation becomes.

Stay Updated On Financial Trends And Tools

The world of money is always shifting—new savings apps, investment platforms, and even laws that impact taxes or retirement. Staying informed doesn’t mean obsessing over every headline, but keeping your knowledge fresh pays off.

For example, I once switched banks after learning about high-yield online savings accounts. That one decision increased my interest earnings without any extra work.

I suggest subscribing to one or two trustworthy financial newsletters or podcasts. Just a few minutes a week can keep you ahead of the curve.

Review And Rebalance Investments Periodically

As your goals shift, so should your portfolio. Maybe you were all-in on stocks in your 20s, but now in your 40s you want more balance with bonds. Rebalancing ensures you’re not taking on more risk than you’re comfortable with.

Most investment platforms make this easy. For example, from the Vanguard dashboard, you can view your current allocation and adjust percentages with just a few clicks. Many robo-advisors even do this automatically for you.

I advise checking at least once a year—mark it on your calendar like a yearly checkup.

Seek Expert Advice When Needed

You don’t have to do everything alone. A certified financial planner (CFP) or even a tax advisor can save you from costly mistakes and point out strategies you might overlook.

Think of it this way: if spending a few hundred dollars on expert advice helps you save thousands in taxes or avoid poor investment choices, it’s worth every penny.

Even if you don’t hire someone full-time, having one or two consultations during major life changes—like buying a house or planning retirement—can give you clarity and confidence.

Pro tip: Financial security is less about perfection and more about consistency. Small, steady actions—like paying bills on time, saving a bit more each year, and staying curious—add up to a life where money supports your goals instead of controlling them.