Table of Contents

Some links on The Justifiable are affiliate links, meaning we may earn a small commission at no extra cost to you. Read full disclaimer.

Comprehensive financial planning is more than just tracking your budget or saving for retirement—it’s about creating a roadmap that aligns your money with your life goals.

Have you ever wondered what separates people who feel confident about their future from those who constantly stress over money? The answer often comes down to following a clear, step-by-step process.

In this guide, I’ll break down five critical steps to help you build lasting financial stability and success.

1. Define Clear Financial Goals That Guide Every Decision

Setting goals is the foundation of comprehensive financial planning. Without clear goals, money decisions feel random and disconnected.

With them, every choice — from buying a coffee to investing in stocks — becomes part of a bigger picture.

Translate Aspirations Into Measurable Objectives

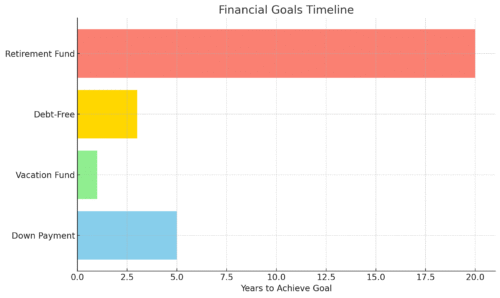

We all have dreams: owning a home, traveling more, sending kids to college, or retiring comfortably. But here’s the catch: dreams don’t drive financial planning unless you pin them down into numbers and timelines.

For example:

- “I want to buy a house” becomes “I want to save $50,000 for a down payment in five years.”

- “I want to travel” becomes “I’ll set aside $300 a month for a Europe trip next summer.”

When you translate vague aspirations into measurable objectives, you give your plan teeth.

Personally, I’ve found writing goals in both words and numbers helps—they hit different parts of the brain and make it harder to ignore.

Prioritize Short-Term Needs Versus Long-Term Dreams

It’s easy to get stuck in one extreme: Either living only for today or obsessing about retirement. The real trick is balance. Think of it as a two-lane road: one lane for immediate needs, the other for long-term dreams.

For example, paying down credit card debt may come before saving for a vacation, because high-interest debt snowballs fast.

But that doesn’t mean ignoring your future. Even $50 a month toward retirement while you’re focused on debt can make a surprising difference over decades.

A helpful exercise: Write down your top three short-term needs (1–3 years) and your top three long-term dreams (5–20 years). Compare them side by side. This forces you to decide what deserves priority now.

Use SMART Goals To Keep Plans Actionable and Realistic

SMART stands for Specific, Measurable, Achievable, Relevant, and Time-bound. It’s not just a buzzword; it’s a practical filter to make sure your goals are realistic and trackable.

- Specific: “Save for a new car” is vague. “Save $15,000 for a Toyota Hybrid” is specific.

- Measurable: Tie it to a number you can track.

- Achievable: If you earn $40,000, aiming to save $100,000 in two years is unrealistic.

- Relevant: Make sure the goal actually supports your life priorities.

- Time-bound: Attach a deadline—without it, goals drift.

I suggest starting with one SMART goal in each area: savings, debt, and lifestyle. This prevents overwhelm and helps you get quick wins.

Adjust Goals As Life Changes To Stay On Track

Life has a habit of throwing curveballs—job changes, kids, health surprises, market crashes. Stubbornly clinging to old goals is a recipe for frustration. Instead, treat your goals like living documents.

I recommend revisiting them at least once a year, ideally around tax season when you’re already reviewing finances.

Ask yourself: Does this goal still matter? Is the timeline still realistic? Do I need to increase or decrease the amount?

For example, if you planned to retire at 60 but a promotion boosts your income, you might adjust the target to 55. Or if medical expenses rise, you may scale back your vacation fund temporarily. Flexibility doesn’t mean failure—it means maturity.

2. Build A Strong Budgeting And Cash Flow Strategy

Budgeting isn’t about punishment or saying no to everything fun. It’s about giving your money a job so it works for you instead of against you.

Strong budgeting paired with smart cash flow management makes sure you’re covering today while building tomorrow.

Track Income and Spending To Reveal Hidden Patterns

Most people think they know where their money goes—until they track it. I’ve sat down with friends who swore they “barely eat out,” then realized they spent $400 a month on DoorDash.

You don’t need fancy tools to start. A simple spreadsheet with two columns—income and expenses—can be an eye-opener. If you want more detail, apps like Mint or YNAB (You Need A Budget) link to your accounts and categorize automatically.

The goal isn’t guilt, it’s awareness. Once you see patterns, you can decide what to keep and what to cut.

Create Spending Categories That Match Your Lifestyle

Generic categories like “entertainment” or “miscellaneous” don’t tell you much. Instead, customize categories that reflect your real life. For example:

- “Fitness” instead of “Health” if you’re a gym-goer.

- “Kids’ Activities” instead of lumping everything into “Family.”

- “Side Hustle Costs” if you’re freelancing.

This approach makes it easier to spot leaks and see what truly matters to you.

Personally, when I separated “Books & Learning” from “Entertainment,” I realized I was okay spending more there—it aligned with my values.

Apply the 50/30/20 Rule To Balance Needs and Wants

The 50/30/20 rule is one of my favorite budgeting frameworks because it’s simple and flexible:

- 50% of after-tax income for needs (housing, food, utilities).

- 30% for wants (dining out, hobbies, travel).

- 20% for savings and debt repayment.

If your housing eats up more than 50%, don’t panic—adjust other categories instead. The point isn’t perfection but creating a balance that prevents burnout.

I advise testing this for three months and tweaking based on what feels sustainable.

Monitor and Adjust Cash Flow With Digital Tools

Once you’ve built a budget, the real challenge is sticking to it. This is where digital tools shine. Apps like YNAB, Mint, or EveryDollar let you track spending in real-time. Some banks even offer built-in analytics in their mobile apps.

I suggest setting up alerts: For example, get a text when you hit 80% of your “Dining Out” budget. This small nudge keeps you accountable before it’s too late.

Cash flow isn’t static—bonuses, side hustles, and emergencies all change the picture. A good rule of thumb: Review your cash flow at the end of each month. This way, you’ll spot trends before they become problems and adjust categories proactively.

3. Create An Emergency Fund As Your Safety Net

An emergency fund is the unsung hero of comprehensive financial planning. It’s not flashy like investments or exciting like planning a dream vacation, but it’s the safety net that keeps you from tumbling when life gets messy.

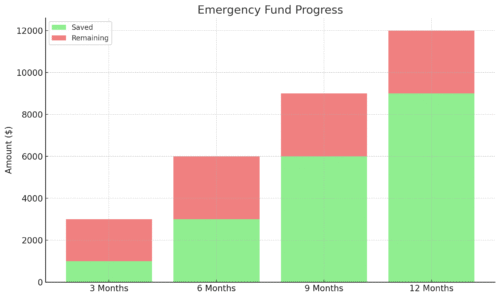

Decide How Much You Truly Need For Unexpected Costs

The classic rule of thumb says three to six months of expenses. But here’s the thing: that number should flex with your life situation.

- Single with no dependents? Three months may be enough.

- Family with kids, mortgage, and one main income? Six months is safer.

- Freelance or self-employed? You may want nine to twelve months.

I like to start with a basic “mini fund” of $1,000 as a quick win—it covers car repairs, vet bills, or an emergency flight. Then I build toward the full target.

To figure out your number, list your monthly essentials—rent or mortgage, utilities, food, insurance—and multiply by your comfort level in months.

Choose The Right Savings Account For Liquidity

The whole point of an emergency fund is easy access, not chasing the highest returns. That means keeping it out of investments where the money could lose value right when you need it.

High-yield savings accounts (HYSAs) are ideal. They’re safe, FDIC-insured, and usually pay better interest than a standard savings account.

From your online banking dashboard, look for an account labeled “high-yield savings” or “money market savings.” Just make sure it has:

- No monthly maintenance fees.

- Easy transfer options to your checking account.

- A mobile app so you can move money quickly.

I suggest avoiding tying it up in CDs (certificates of deposit), because early withdrawals come with penalties.

Automate Contributions To Build Consistency

Saving for emergencies feels less painful when you don’t have to think about it. I recommend setting up an automatic transfer on payday. Even $25 or $50 every two weeks adds up faster than you expect.

Most bank apps let you set this up in minutes: Go to Transfers > Recurring > Choose Amount. If you get side hustle income, set a percentage—say, 10%—that always goes to the fund. Treat it like a bill you can’t skip.

I’ve noticed that once the system runs on autopilot, people rarely miss the money, but the peace of mind grows with every deposit.

Revisit Your Fund Regularly To Match Life Changes

Your emergency needs don’t stay the same forever. Moving to a new city, having a child, or switching to freelance work all increase your financial risk. That’s why I advise checking your fund at least once a year.

For example:

- Got a raise? Bump up your monthly contribution.

- Paid off your car loan? Redirect that payment toward the fund.

- Took on a mortgage? Extend your savings goal to cover the higher expense load.

Think of your emergency fund as a living thing—it should grow and adapt right alongside your life.

4. Develop A Smart Investment And Retirement Plan

Once your safety net is in place, it’s time to grow your money.

Investments and retirement planning are where comprehensive financial planning starts to feel exciting, but only if you do it with a smart, steady approach.

Understand Risk Tolerance Before Choosing Assets

Risk tolerance is your ability (and willingness) to handle ups and downs in the market. I’ve seen people pull their money out in a panic after a 10% dip—usually because they invested in things they didn’t fully understand.

Ask yourself: If my investments dropped 20% tomorrow, would I lose sleep, or could I ride it out? Most brokers, like Vanguard or Fidelity, offer online risk quizzes in their account dashboards. They’ll categorize you from conservative to aggressive.

The key is matching your portfolio to both your timeline and your nerves. Saving for retirement in 30 years? You can afford more risk. Saving for a house in three years? Stick to safer assets.

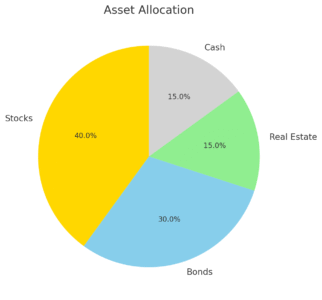

Diversify Investments To Protect Against Market Shifts

Diversification means not putting all your eggs in one basket. A well-diversified portfolio might include:

- U.S. and international stocks.

- Bonds for stability.

- Real estate or REITs (real estate investment trusts).

- Cash or cash equivalents.

Many people use index funds or ETFs (exchange-traded funds) because they give instant diversification at low cost. For example, a single S&P 500 index fund gives you exposure to 500 companies.

I believe the easiest way to check your mix is to log into your brokerage account and look at the “Allocation” chart—it usually shows your balance between stocks, bonds, and cash. If one slice looks way too big, it’s time to rebalance.

Maximize Retirement Accounts Like 401(k)s and IRAs

Retirement accounts aren’t just about saving; they’re about saving smarter through tax advantages. If your employer offers a 401(k) match, grab it—it’s free money.

Say your employer matches 50% up to 6% of your salary: if you earn $60,000 and contribute 6% ($3,600), they’ll add another $1,800.

If you don’t have a 401(k), or you want to invest more, open an IRA (Individual Retirement Account). Roth IRAs grow tax-free, which can be a huge advantage later. From most brokerage dashboards, you can open one in under 15 minutes by selecting “Open New Account > IRA.”

I suggest starting with auto-contributions, even small ones. Consistency beats lump sums you can’t sustain.

Review Portfolio Performance On A Regular Schedule

Markets are noisy—checking your account daily will drive you crazy. Instead, I recommend setting a review schedule, maybe quarterly or twice a year. During that time:

- Compare your portfolio’s performance to a benchmark, like the S&P 500.

- Rebalance if one asset class has drifted too far from your target.

- Ask yourself if your goals or risk tolerance have changed.

One practical tip: Create a recurring calendar reminder (say, April and October) so reviews become a habit, not a reaction to headlines.

5. Protect Wealth With Insurance And Estate Planning

Protecting your wealth is just as important as building it. Without insurance and estate planning, years of effort can be wiped away by one accident, illness, or family dispute.

This step ensures your money actually serves the people and purposes you care about.

Identify Essential Insurance Coverage For Your Stage Of Life

Insurance needs change as life changes. In your 20s, health insurance might be the only must-have. In your 40s, with kids and a mortgage, life and disability insurance become crucial. By retirement, long-term care insurance might move higher on the list.

A quick checklist to consider:

- Health insurance to protect against medical debt.

- Auto insurance if you drive.

- Renters or homeowners insurance to cover property.

- Life insurance if someone depends on your income.

I suggest reviewing policies once a year. Even a small adjustment in coverage can save thousands down the road.

Integrate Disability And Life Insurance Into Your Plan

Many people overlook disability insurance, but the truth is you’re more likely to face a disabling injury or illness than death during your working years. If your employer offers a plan, check the details in your HR portal—it’s often cheaper to buy through work.

For life insurance, term policies are usually the best value. They cover you for a set number of years (say, 20 or 30) and are much more affordable than permanent policies. The general guideline is coverage equal to 10–12 times your annual income.

I believe these aren’t just “extras”—they’re core parts of comprehensive financial planning because they protect your family’s stability.

Create Or Update A Will To Safeguard Assets

Without a will, state laws decide who gets your property—and it may not match your wishes. Drafting a simple will ensures your assets, even modest ones, go where you want.

Online services like LegalZoom or Trust & Will make it affordable if you don’t want to hire an attorney.

If you already have a will, dust it off and check if it still reflects your current life. Marriage, kids, divorce, or major asset changes all mean it’s time for an update.

Consider Trusts And Tax Strategies For Long-Term Security

If you have significant assets, a trust can give you more control than a will. For example, you can specify that your children only receive money once they reach a certain age. Trusts also help reduce estate taxes in some cases.

On the tax side, consider strategies like gifting (up to the annual exclusion limit) or charitable donations to reduce taxable estate value. These are best discussed with a financial planner or estate attorney, but even a basic awareness can save your heirs a lot of headaches.

I’d frame this part like seatbelts—you hope never to need them, but you’ll be grateful they’re there if life takes a sharp turn.

I’m Juxhin, the voice behind The Justifiable.

I’ve spent 6+ years building blogs, managing affiliate campaigns, and testing the messy world of online business. Here, I cut the fluff and share the strategies that actually move the needle — so you can build income that’s sustainable, not speculative.