Table of Contents

A freelance CFO can be the secret weapon for businesses that want expert financial strategy—without the full-time price tag.

Many small and mid-sized companies struggle to balance growth with cash flow, but what if you could access CFO-level insight on demand?

In this guide, we’ll explore how hiring a freelance CFO can help you boost profits, streamline operations, and make smarter financial decisions—without the overhead of a permanent executive.

Understanding the Role of a Freelance CFO

A freelance CFO (Chief Financial Officer) offers the financial leadership of a traditional CFO but on a flexible, part-time, or project basis.

This role is designed for businesses that need strategic financial guidance without committing to a full-time executive salary.

Defining What a Freelance CFO Really Does

A freelance CFO manages all the critical financial aspects of a company—from budgeting and forecasting to risk analysis and funding strategy—without being tied to an employee contract.

In practice, this means:

- Creating financial models to forecast revenue and expenses.

- Monitoring cash flow to prevent liquidity issues.

- Advising on cost-saving strategies and investment opportunities.

- Coordinating with accountants and auditors to ensure compliance.

I often describe it this way: a freelance CFO acts as your financial “GPS.” You still drive the car, but they help you avoid detours, forecast roadblocks, and plan your best route toward profitability.

A good freelance CFO doesn’t just crunch numbers; they interpret them. They help business owners see how today’s decisions affect tomorrow’s bottom line.

How Freelance CFOs Differ From In-House Financial Leaders

The main difference between a freelance CFO and a full-time one isn’t capability—it’s flexibility.

A full-time CFO works exclusively for one company, managing every aspect of financial operations daily. By contrast, a freelance CFO typically works with multiple clients, providing expert insight for a fraction of the cost.

Let me break it down clearly:

- Cost efficiency: You pay only for the hours or projects you need.

- Broader expertise: Freelance CFOs often bring cross-industry experience.

- Scalability: As your business grows, you can easily adjust their involvement.

For small to mid-sized businesses, this structure is ideal. You gain senior-level financial strategy without the executive payroll burden. It’s like renting a luxury car when you need it—without paying to park it all year.

When to Consider Hiring a Freelance CFO for Your Business

There’s a sweet spot for bringing in a freelance CFO—it’s when your business outgrows your accountant but isn’t yet ready for a permanent CFO.

Here are common signs it’s time to hire one:

- Your revenue is rising, but profit margins aren’t.

- You’re preparing for funding, expansion, or acquisition.

- Financial reports confuse rather than guide you.

- You need expert budgeting for seasonal or project-based revenue.

I advise entrepreneurs not to wait until finances feel “messy.” A freelance CFO can uncover inefficiencies before they become crises and put systems in place that scale with your company.

Key Financial Areas a Freelance CFO Can Improve

A skilled freelance CFO brings clarity and control to your finances. They don’t just manage numbers—they help you make those numbers work harder for you.

Strengthening Cash Flow and Expense Management

Cash flow is the heartbeat of any business. A freelance CFO monitors inflows and outflows to ensure liquidity—enough cash to keep operations running smoothly.

They often:

- Analyze payment cycles to reduce delays.

- Negotiate vendor terms for better cash positioning.

- Set up forecasting dashboards in tools like QuickBooks Online or Xero.

For example, I’ve seen businesses double their available cash simply by adjusting invoice timing and payment structures—insights that came from CFO-led analysis. Managing cash isn’t about having more money; it’s about making the timing work in your favor.

Identifying Profit Leaks Through Financial Analysis

Profit leaks happen quietly—subscription waste, bloated overheads, unprofitable clients. A freelance CFO hunts them down through meticulous financial reviews.

Using variance reports and cost-benefit analysis, they highlight areas where revenue is slipping through cracks. Imagine a SaaS company paying for 10 marketing tools but effectively using only three—that’s a profit leak.

Once identified, these leaks can be plugged, freeing up cash to reinvest in growth or innovation. It’s one of the fastest ways to improve margins without cutting quality.

Optimizing Budget Allocation for Maximum ROI

Budgeting is more than limiting spending—it’s about investing wisely. A freelance CFO allocates funds based on performance data and future projections.

Typical actions include:

- Setting up departmental budgets aligned with company goals.

- Tracking spending efficiency through KPI dashboards.

- Redirecting low-ROI expenditures toward profitable channels.

In my experience, this kind of oversight transforms budgets from static spreadsheets into living strategy documents. It helps business owners feel in control rather than reactive.

Implementing Scalable Financial Systems and Tools

One major advantage of hiring a freelance CFO is their familiarity with cutting-edge financial tech.

They can recommend and implement systems like:

- QuickBooks Online or NetSuite for accounting automation.

- Fathom or LivePlan for financial reporting and scenario modeling.

- Expensify or Bill.com for expense management.

These platforms reduce manual errors, streamline approvals, and provide real-time visibility. When configured properly, they scale seamlessly with your company’s growth, saving both time and money.

How a Freelance CFO Boosts Profitability Strategically

A freelance CFO doesn’t just manage finances—they actively drive profitability by turning data into strategy.

Using Data-Driven Insights to Guide Business Growth

Data doesn’t lie, but it often whispers. A freelance CFO translates financial data into clear, actionable insights.

For example: They might use a Gross Margin Analysis to reveal which products or services deliver the best return. With that data, you can reallocate resources toward your highest-performing segments.

This shift—guided by data, not guesswork—can dramatically increase net profit over time.

Leveraging Forecasting Models to Predict Profit Margins

Forecasting isn’t about crystal balls—it’s about patterns. A freelance CFO uses predictive models to estimate revenue, expenses, and cash flow months in advance.

Using tools like Float or Jirav, they can visualize how small adjustments (like pricing tweaks or hiring plans) impact long-term profitability.

I find this especially powerful for businesses preparing for expansion or investment. Forecasts make future planning less of a gamble and more of a guided experiment.

Streamlining Operations for Cost Efficiency

Operational inefficiency quietly eats into profits. A freelance CFO helps detect redundancies across departments—whether it’s overlapping roles, outdated software, or inefficient vendor contracts.

Common strategies include:

- Automating repetitive financial tasks.

- Outsourcing non-core processes like payroll.

- Benchmarking costs against industry standards.

I’ve seen businesses save 10–20% of operating expenses simply through CFO-led workflow optimization. Efficiency, after all, is a hidden form of profit.

Enhancing Financial Reporting for Better Decision-Making

Accurate reporting turns complexity into clarity. A freelance CFO ensures your reports aren’t just compliant—they’re insightful.

They customize dashboards to show metrics that matter: profit margins, debt ratios, and customer acquisition costs. When you can see real-time financial health at a glance, you make faster, smarter decisions.

I often recommend monthly financial reviews led by your CFO. This rhythm keeps you proactive rather than reactive, guiding your business toward sustained growth and stability.

Expert Tip: The biggest profit gains come from visibility. A freelance CFO doesn’t just organize your numbers—they reveal the story behind them. That story is what allows business owners to make bold, confident moves toward profitability.

Tools and Technology Used by Top Freelance CFOs

A freelance CFO relies on digital tools and automation to manage finances efficiently and deliver real-time insights.

These platforms help streamline accounting, reporting, and collaboration—essential when working remotely with multiple clients.

Cloud Accounting Platforms That Save Time and Money

Cloud-based accounting software allows a freelance CFO to access and manage financial data from anywhere. I’ve seen businesses move from outdated spreadsheets to cloud systems and instantly cut their financial admin time in half.

Common platforms used by top freelance CFOs include:

- QuickBooks Online: Ideal for small businesses. It automates invoices, tracks expenses, and integrates with bank accounts. You can view dashboards under Reports > Profit & Loss to monitor cash flow instantly.

- Xero: Known for its intuitive interface and strong integrations. It syncs with over 1,000 apps, which makes managing multi-channel revenue simple.

- NetSuite: Perfect for larger or fast-scaling companies. It combines accounting, ERP (Enterprise Resource Planning), and CRM in one system.

I recommend starting with QuickBooks or Xero before upgrading to NetSuite as your business grows. These tools not only save money on manual bookkeeping but also ensure your freelance CFO can focus on strategy, not data entry.

Financial Dashboards for Real-Time Performance Tracking

Financial dashboards turn raw data into visual stories. They allow your freelance CFO to spot trends, compare forecasts, and report performance at a glance.

Top tools often used include:

- Fathom: Creates visual reports that compare key metrics like revenue growth, margins, and cash flow.

- LivePlan: Ideal for startups, offering easy forecasting and budget variance tracking.

- Spotlight Reporting: Designed for CFO-level analysis with consolidated multi-entity reporting.

For instance, I once worked with a retail client who couldn’t see which stores were underperforming. Once we integrated Fathom, the data revealed one location consistently lagging. Within two months, operational changes increased profit margins by 15%.

Dashboards turn uncertainty into clarity—something every business owner needs when making financial decisions.

Automation Tools That Reduce Manual Errors

Automation is the secret sauce behind a freelance CFO’s efficiency. Manual processes drain time and increase the risk of mistakes, especially with repetitive tasks like reconciliations or expense tracking.

Common automation tools include:

- Bill.com: Automates payables and receivables, allowing for faster invoice processing.

- Expensify: Simplifies employee reimbursements. Snap a receipt, and it auto-categorizes the expense.

- Zapier: Connects apps like QuickBooks, Gmail, and Google Sheets, automating repetitive workflows.

In one of my projects, setting up automated invoice reminders in Bill.com reduced overdue payments by nearly 40%. That’s a huge cash flow improvement with minimal effort.

Automation doesn’t just make accounting faster—it makes your financial systems smarter.

Secure Collaboration Software for Remote Financial Management

Since freelance CFOs often work remotely, secure communication and document sharing are critical. Modern collaboration tools make this smooth and compliant.

Popular tools for financial collaboration include:

- Google Workspace: Enables real-time spreadsheet collaboration and secure file sharing.

- Slack: Allows direct, organized communication with finance teams. Integrates easily with accounting apps.

- Dropbox Business: Used for encrypted file storage with audit trails.

A freelance CFO might set up a simple workflow like: Google Drive > Shared Folder (Financials) > Subfolders by Month > Access via Slack Link.

This structure keeps your financial data organized and accessible while maintaining security—a vital balance for any growing business.

When to Hire a Freelance CFO Versus a Full-Time CFO

Knowing when to bring in a freelance CFO is just as important as knowing why. It depends on your company’s size, growth stage, and budget.

Comparing Costs and ROI Between Freelance and Full-Time CFOs

Hiring a full-time CFO can cost between $180,000 and $300,000 per year, plus benefits and bonuses. By contrast, a freelance CFO typically charges hourly or project-based rates—often between $100 to $300 per hour.

For many small and mid-sized companies, that cost difference is game-changing. You get the same expertise but pay only for what you use.

Example ROI comparison:

| CFO Type | Annual Cost | Commitment | Best For |

| Full-Time CFO | $200,000+ | 40 hrs/week | Large enterprises |

| Freelance CFO | $60,000–$100,000 | Flexible | Growing SMBs |

If your financial operations are complex but not constant, a freelance CFO gives you access to expert-level strategy without the overhead.

Understanding the Flexibility Advantage of Freelance CFOs

A freelance CFO adapts to your business rhythm. You can engage them during key transitions—fundraising, expansion, restructuring—and scale down when stability returns.

I believe flexibility is the biggest hidden advantage. For example, one of my clients only needed financial leadership during quarterly investor updates and budgeting season. A part-time CFO structure fit perfectly and saved the company $150K a year.

This elasticity is ideal for startups or seasonal businesses that experience revenue swings.

Determining the Right Stage of Business Growth to Outsource CFO Services

Generally, you should hire a freelance CFO when your revenue passes the $1–2 million mark or when you start dealing with investors, debt, or multi-entity reporting.

Key signs you’re ready include:

- You’re struggling to understand your profit margins.

- Your accountant provides reports, but not strategy.

- You’re planning to scale, merge, or raise capital.

I suggest viewing a freelance CFO as a bridge between your accountant and a future full-time CFO. They prepare your financial foundation so you can scale sustainably and confidently.

How to Find and Hire the Right Freelance CFO

Hiring the right person can make or break your financial strategy. The best freelance CFOs combine analytical skill with business intuition.

Where to Look for Qualified Freelance CFO Professionals

You can find credible freelance CFOs through specialized platforms that vet professionals.

Top places to search include:

- Toptal Finance: Offers pre-screened CFOs with experience in startups and corporations.

- Upwork: More flexible—ideal for project-based or interim roles.

- Paro.io: Focuses on U.S.-based freelance finance experts.

I recommend reading reviews and looking for industry-specific experience. A CFO who understands e-commerce, for example, will know how to optimize for cash flow cycles and inventory turnover.

Key Skills and Certifications to Evaluate Before Hiring

When evaluating candidates, look beyond titles. Certifications like CPA (Certified Public Accountant), CMA (Certified Management Accountant), or CFA (Chartered Financial Analyst) signal strong technical foundations.

Also, check for:

- Experience with tools like QuickBooks, NetSuite, or Xero.

- A track record of improving profitability.

- Communication skills that simplify complex data.

Ask them to explain a past financial turnaround. How they describe it will tell you if they think strategically—or just crunch numbers.

Questions to Ask in a Freelance CFO Interview

To find the right fit, focus your interview on both skill and mindset.

Try questions like:

- How do you approach creating a financial forecast for a growing business?

- Which KPIs do you prioritize for profitability tracking?

- Can you share a time when your analysis directly increased a company’s revenue or reduced costs?

- How do you communicate financial results to non-financial stakeholders?

I suggest listening for clarity and curiosity. Great CFOs simplify complexity—they don’t hide behind jargon.

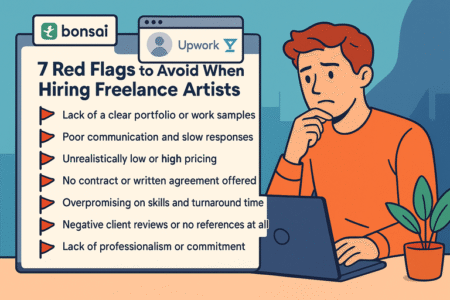

Red Flags That Signal the Wrong Fit for Your Business

Even experienced CFOs can be a poor match if their style clashes with your company’s needs.

Watch for these warning signs:

- They talk more about compliance than strategy.

- They avoid using or recommending financial software.

- They lack experience in your industry or revenue range.

- They overpromise unrealistic results.

I once worked with a company that hired a CFO who refused to use cloud-based tools. The result? Disconnected reports, missed deadlines, and frustrated staff. Always look for someone who embraces modern systems and transparency.

Expert Tip: Think of your freelance CFO as a financial co-pilot. They don’t replace your vision—they refine it with data, discipline, and strategy. The right one won’t just balance your books; they’ll help you build a more profitable future.

Setting Expectations and Deliverables for a Freelance CFO

A freelance CFO relationship works best when expectations are clear and measurable. This means setting specific goals, defining reporting routines, and creating a workflow that balances flexibility with accountability.

How to Define Clear Financial Goals and KPIs

Your first step is to align on what success actually looks like. I suggest starting with a short financial strategy session where you and your freelance CFO agree on clear, measurable targets.

Examples of CFO-driven KPIs (Key Performance Indicators):

- Gross Profit Margin: Tracks efficiency after direct costs.

- Operating Cash Flow: Measures liquidity from core operations.

- Customer Acquisition Cost (CAC): Essential for understanding marketing ROI.

- Debt-to-Equity Ratio: Monitors financial leverage and risk.

It’s helpful to keep these KPIs visible—most CFOs use dashboards in Fathom or LivePlan so you can monitor results together. I recommend reviewing them monthly or quarterly to ensure your goals evolve with the business.

Remember, KPIs aren’t just numbers; they’re signals. They show where to double down, where to adjust, and when to celebrate.

Structuring Performance Reviews and Reporting Cadence

The best freelance CFOs operate on rhythm. They’ll create a reporting schedule that keeps you informed without overwhelming you.

A typical review cadence might look like this:

- Weekly: Cash flow and accounts receivable updates.

- Monthly: Profit and loss, variance analysis, and budget tracking.

- Quarterly: Strategic review—forecasts, market trends, and investment opportunities.

I’ve found that a monthly financial snapshot meeting (around 30–45 minutes) is ideal. It keeps everyone aligned while leaving time for strategic discussion rather than reactive firefighting.

This consistent cadence builds trust and helps your CFO demonstrate measurable impact over time.

Managing Communication and Workflow Effectively

Communication is the backbone of any successful CFO relationship. I recommend establishing your main communication channels early—such as Slack for quick updates and Google Drive for shared financial files.

A simple workflow might include:

- Submitting key financial documents by the 5th of each month.

- CFO delivers updated reports by the 10th.

- Review meeting scheduled between the 12th–15th.

In my experience, using tools like Notion or Asana to track financial tasks keeps both parties accountable and prevents things from falling through the cracks. A freelance CFO is not just a vendor—they’re an extension of your leadership team.

Creating Scalable Contracts and Engagement Terms

Freelance CFO agreements should adapt as your business evolves. Start with a three- to six-month engagement, allowing flexibility to expand as needs change.

Include these essentials in your contract:

- Scope of work (e.g., forecasting, reporting, fundraising support).

- KPIs and deliverable timelines.

- Confidentiality and data protection terms.

- Clear renewal or exit clauses.

I advise using tools like PandaDoc or DocuSign for contract management—they make adjustments fast and transparent. This approach keeps the partnership flexible while maintaining professionalism and trust.

Common Mistakes to Avoid When Working With a Freelance CFO

Even with the best intentions, businesses sometimes limit the value of their freelance CFO due to avoidable mistakes. Being proactive about these pitfalls can make your collaboration far more productive.

Failing to Share Transparent Financial Data Early On

One of the biggest barriers to CFO success is incomplete data. A CFO can only strategize effectively if they have full visibility into your accounts, cash flow, and liabilities.

I once worked with a client who withheld vendor invoices until mid-quarter. When the expenses finally surfaced, it completely skewed the profit forecast. Early transparency prevents these surprises and allows accurate decision-making from day one.

Quick tip: Give your CFO secure read-only access to platforms like QuickBooks Online or Xero. This builds confidence and speeds up analysis.

Overlooking the Importance of Long-Term Strategic Planning

It’s easy to get stuck in short-term financial firefighting, but a freelance CFO’s true value lies in long-term strategy.

They can model “what-if” scenarios—like price increases, hiring plans, or funding rounds—to forecast future growth. When you only use them for bookkeeping oversight, you’re missing 70% of their potential.

Make space for forward-looking conversations at least once per quarter. It’s not just about survival—it’s about scaling intelligently.

Ignoring Regular Performance Reviews and Metrics

Without regular performance checks, even the best CFO relationships drift off course. Schedule periodic reviews to evaluate whether targets are being met.

Ask: Are we seeing improved margins? Faster collections? Fewer cost overruns?

Tracking measurable outcomes maintains accountability and demonstrates ROI. It also helps you determine when it’s time to expand their role or shift priorities.

Not Aligning CFO Insights With Business Vision

A CFO can create brilliant reports, but if those insights don’t match your company’s mission, they’ll fall flat.

I’ve seen this happen when financial strategies focus solely on cutting costs without supporting brand growth or innovation. Alignment starts with context—share your long-term goals and company culture with your CFO early.

This ensures their recommendations strengthen—not sideline—your broader vision.

Measuring Success and ROI From a Freelance CFO

To know if your freelance CFO is worth the investment, you need a clear framework for measuring ROI. It’s about tracking progress, profitability, and long-term stability.

Key Metrics to Track for Financial Performance Improvement

A few core metrics show whether your freelance CFO is driving results:

- Net Profit Margin: Indicates how effectively your business turns revenue into profit.

- Cash Conversion Cycle: Tracks how quickly cash moves from sales to operations.

- Operating Expenses as % of Revenue: Reveals cost efficiency.

- Revenue Growth Rate: Measures overall business expansion.

If these metrics trend positively over 3–6 months, your CFO’s strategies are working. I recommend keeping them visible on a shared dashboard for easy progress tracking.

How to Evaluate Profit Growth Over Time

Profit growth should be viewed as a marathon, not a sprint. Short-term wins are good—but consistent, steady improvement is better.

Example: If your gross profit margin improves from 40% to 48% within two quarters due to better vendor terms and pricing strategy, that’s a direct ROI on CFO input.

Compare new financial results with pre-engagement performance to see clear cause and effect.

Using CFO Reports to Inform Future Business Investments

Your freelance CFO’s reports aren’t just for record-keeping—they’re blueprints for smarter investments.

For instance, a well-structured Variance Analysis Report might reveal that marketing delivers a 3:1 ROI while operations lag behind. With this insight, you can redirect funds to accelerate growth where it matters most.

I advise reviewing these reports before any major financial decision—whether that’s hiring, expansion, or product development.

Turning Short-Term Insights Into Long-Term Strategy

A great freelance CFO doesn’t stop at problem-solving—they anticipate the next opportunity.

Turn recurring financial patterns into playbooks. For example, if you notice recurring Q1 revenue dips, your CFO can help design cash flow buffers or off-season promotions to balance the year.

Short-term financial wins become long-term advantages when you analyze and systematize them.

Expert Tips to Maximize Value From a Freelance CFO

Working with a freelance CFO should feel like a partnership, not a transaction. When managed well, this collaboration can deliver transformative financial outcomes.

Building a Collaborative Relationship for Lasting Results

Treat your freelance CFO like part of your leadership team. Share context, challenges, and plans openly.

In my experience, when founders involve their CFOs in strategic meetings—not just financial reviews—decisions improve across the board. The more context your CFO has, the sharper their insights become.

Encouraging Proactive Strategy and Innovation

Invite your CFO to brainstorm ways to improve profitability or efficiency beyond their traditional scope.

They might spot opportunities to automate workflows, restructure debt, or optimize pricing models. I recommend setting aside “strategy hours” once a month to explore these ideas together—it keeps innovation alive.

Integrating CFO Recommendations Into Daily Operations

A CFO’s reports only matter if they drive action. Build systems where their insights translate into tasks for your operations, marketing, or sales teams.

Example workflow: CFO identifies rising customer acquisition costs → Marketing adjusts campaign targeting → CFO measures ROI impact next quarter.

This loop turns analysis into measurable growth.

Leveraging Fractional Expertise for Sustainable Profit Growth

A freelance CFO brings the perfect balance of strategy and flexibility. You get high-level insight without the full-time cost burden.

Think of it as financial leadership on demand—scalable, data-driven, and deeply aligned with your goals.

In my experience, the businesses that grow fastest are those that use their CFO as a long-term strategic partner, not just a number cruncher.

Pro Tip: The best freelance CFOs don’t just manage your money—they teach you how to think like a financially confident leader. Treat the partnership as a mentorship, and you’ll gain not just profits, but wisdom for the long haul.