Table of Contents

Invoicing and accounting software is crucial for streamlining financial processes. This article explores top choices like FreshBooks and QuickBooks to help you manage your business finances efficiently.

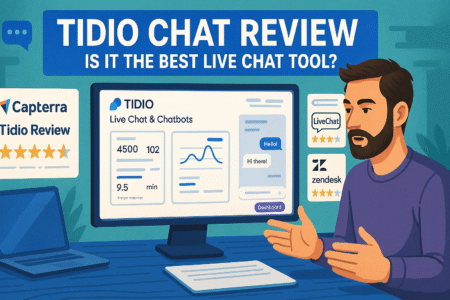

FreshBooks: Streamline Your Invoicing Process

FreshBooks is a leading invoicing and accounting software designed to simplify the financial management of your business. With its intuitive interface and powerful features, FreshBooks enables you to manage invoices, track expenses, and maintain accurate financial records effortlessly. For businesses of all sizes, FreshBooks offers a robust solution that enhances efficiency and productivity in handling accounting tasks.

Using FreshBooks, you can automate many of your invoicing processes, saving valuable time and reducing the likelihood of errors. Whether you’re a freelancer, a small business owner, or managing a larger enterprise, FreshBooks provides tools that cater to your specific needs, making financial management more accessible and efficient.

Key Features for Effective Accounting

FreshBooks offers a range of key features designed to support effective accounting practices. One of the standout features is its invoicing capabilities, which allow you to create professional invoices in minutes. The software also supports automated payment reminders, ensuring that you receive payments on time without the need to manually follow up with clients.

Expense tracking is another essential feature of FreshBooks. The software enables you to easily categorize and record expenses, helping you stay organized and on top of your finances. Additionally, FreshBooks includes time tracking tools, which are particularly beneficial for freelancers and service-based businesses that bill clients based on hours worked.

The reporting features in FreshBooks are comprehensive and user-friendly. You can generate detailed financial reports, such as profit and loss statements, balance sheets, and tax summaries, providing you with a clear overview of your business’s financial health. These reports are crucial for making informed business decisions and ensuring compliance with tax regulations.

User-Friendly Interface and Usability

One of the most compelling aspects of FreshBooks is its user-friendly interface. The software is designed with simplicity in mind, making it accessible even for those with limited accounting knowledge. The dashboard is clean and intuitive, allowing you to quickly navigate through various features and access the information you need.

FreshBooks offers a mobile app that ensures you can manage your finances on the go. Whether you’re traveling for business or simply away from your desk, the mobile app allows you to create invoices, track expenses, and view reports from your smartphone or tablet. This level of convenience ensures that you can stay on top of your accounting tasks no matter where you are.

The software also provides excellent customer support, with resources such as tutorials, webinars, and a comprehensive knowledge base. These resources help users get the most out of FreshBooks and address any questions or issues that may arise.

Pricing Plans and Affordability

FreshBooks offers a variety of pricing plans to accommodate different business needs and budgets. The pricing structure is straightforward, with no hidden fees, making it easy for you to choose the plan that best suits your requirements.

The Lite plan is ideal for freelancers and small businesses with basic invoicing needs. It includes essential features such as invoicing, expense tracking, and time tracking. For businesses that require more advanced features, the Plus plan offers additional capabilities like project management and proposal creation.

The Premium plan is designed for growing businesses with more complex accounting needs. It includes all the features of the Lite and Plus plans, along with advanced reporting tools and the ability to manage more clients. FreshBooks also offers a Select plan for large enterprises, providing customized solutions and dedicated support.

Regardless of the plan you choose, FreshBooks provides excellent value for money, helping you streamline your invoicing and accounting processes without breaking the bank.

Integration with Other Tools

FreshBooks integrates seamlessly with a wide range of other tools, enhancing its functionality and making it an even more powerful solution for your business. Whether you need to connect with your favorite payment gateways, CRM systems, or project management tools, FreshBooks offers integrations that simplify your workflow.

For instance, FreshBooks integrates with popular payment processors like PayPal and Stripe, allowing you to accept payments directly through your invoices. This integration speeds up the payment process and ensures that funds are deposited into your account quickly and securely.

The software also connects with various CRM systems, such as HubSpot and Salesforce, enabling you to sync customer data and manage relationships more effectively. Project management integrations, like those with Asana and Trello, help you keep track of project progress and collaborate with your team more efficiently.

Additionally, FreshBooks integrates with numerous accounting and tax tools, such as Gusto and TaxJar, streamlining payroll and tax compliance processes. These integrations save you time and reduce the risk of errors, ensuring that your financial data is accurate and up-to-date.

FreshBooks’ extensive integration capabilities make it a versatile and adaptable solution for businesses of all sizes, helping you create a more connected and efficient workflow.

QuickBooks: Comprehensive Accounting Solution

QuickBooks stands out as a comprehensive accounting solution tailored for businesses of all sizes. With its robust features and user-friendly interface, QuickBooks helps you manage finances more efficiently, from invoicing and expense tracking to payroll and tax preparation. This software is designed to streamline your accounting processes, making it easier for you to focus on growing your business.

One of the most significant advantages of QuickBooks is its versatility. Whether you’re a small business owner, freelancer, or part of a larger enterprise, QuickBooks offers solutions that can be customized to meet your specific needs. By leveraging QuickBooks, you can ensure your financial operations are smooth and accurate, which is essential for maintaining the financial health of your business.

Core Features and Benefits

QuickBooks boasts a range of core features that make it an invaluable tool for managing your business’s finances. One of the key features is its invoicing capabilities. QuickBooks allows you to create and send professional invoices quickly, with options to automate reminders and accept online payments. This feature ensures you get paid faster and improves cash flow management.

Expense tracking in QuickBooks is straightforward and efficient. You can easily categorize and track your expenses, attach receipts, and link your bank accounts for automatic updates. This helps you keep your financial records organized and reduces the risk of errors.

Another powerful feature is payroll management. QuickBooks simplifies payroll processing by automating calculations, tax filings, and direct deposits. This saves you time and ensures compliance with tax regulations, reducing the risk of penalties.

The reporting tools in QuickBooks are comprehensive, providing insights into your business’s financial performance. You can generate detailed reports such as profit and loss statements, balance sheets, and cash flow statements. These reports are crucial for making informed business decisions and planning for the future.

Ease of Use and Navigation

QuickBooks is known for its user-friendly interface and ease of navigation. The software is designed to be intuitive, even for those with limited accounting knowledge. The dashboard provides a clear overview of your financial status, allowing you to access key information quickly.

Setting up QuickBooks is a straightforward process, with guided steps to help you get started. The software offers various customization options, enabling you to tailor it to your business needs. Whether you’re setting up invoicing, expense tracking, or payroll, QuickBooks makes the process simple and hassle-free.

The mobile app extends the usability of QuickBooks, allowing you to manage your finances on the go. You can create and send invoices, track expenses, and view reports from your smartphone or tablet. This level of convenience ensures you stay connected to your business finances, no matter where you are.

QuickBooks also offers excellent customer support, with a range of resources available to help you. From tutorials and webinars to a comprehensive knowledge base, you have access to the information you need to get the most out of QuickBooks.

Flexible Pricing Options

QuickBooks offers flexible pricing options to accommodate different business sizes and needs. The pricing plans are designed to provide value, with features that grow with your business. This flexibility ensures you only pay for what you need, making QuickBooks an affordable choice for many businesses.

The Simple Start plan is perfect for small businesses and freelancers who need basic accounting features. It includes invoicing, expense tracking, and basic reporting tools. This plan provides a solid foundation for managing your finances effectively.

The Essentials plan adds more advanced features, such as bill management and time tracking. This plan is ideal for growing businesses that need more robust accounting capabilities. It also supports multiple users, making it suitable for teams.

For businesses with more complex needs, the Plus plan offers comprehensive features, including project tracking and inventory management. This plan provides all the tools you need to manage your finances in one place, streamlining your accounting processes.

The Advanced plan is designed for larger enterprises with sophisticated accounting requirements. It includes all the features of the lower-tier plans, plus advanced reporting, dedicated support, and enhanced customization options. This plan ensures you have the power and flexibility to manage your business finances effectively.

Compatibility with Various Business Needs

QuickBooks is compatible with a wide range of business needs, making it a versatile solution for many industries. Whether you’re in retail, construction, healthcare, or any other sector, QuickBooks offers features that can be tailored to meet your specific requirements.

One of the key advantages of QuickBooks is its ability to integrate with other business tools. This compatibility enhances its functionality and allows you to create a seamless workflow. For example, you can integrate QuickBooks with your e-commerce platform to sync sales data automatically, or connect it with your CRM system to manage customer relationships more effectively.

QuickBooks also supports industry-specific features, such as job costing for construction businesses or inventory management for retail stores. These specialized features ensure you have the tools you need to manage your business operations efficiently.

Additionally, QuickBooks offers multi-currency support, making it an excellent choice for businesses with international operations. This feature allows you to manage transactions in different currencies, ensuring accurate financial records and simplifying global operations.

With its comprehensive features, user-friendly interface, and flexible pricing options, QuickBooks is a powerful accounting solution that can adapt to the unique needs of your business, helping you achieve greater efficiency and financial success.

Comparing FreshBooks and QuickBooks: Key Differences

When choosing between FreshBooks and QuickBooks for your invoicing and accounting needs, understanding their key differences is essential. Both software solutions offer robust features, but they cater to different types of users and business requirements. This section provides a comprehensive comparison to help you decide which software best suits your business.

FreshBooks is renowned for its intuitive design and simplicity, making it ideal for freelancers and small businesses. QuickBooks, on the other hand, offers a broader range of features and is suited for growing businesses and larger enterprises. By comparing their features, usability, pricing, and integration capabilities, you can make an informed decision about which software aligns with your needs.

Feature Comparison: FreshBooks vs. QuickBooks

When it comes to features, both FreshBooks and QuickBooks excel in different areas. FreshBooks focuses on providing a streamlined invoicing process, with features like automated payment reminders and customizable invoice templates. It also includes expense tracking and time tracking, which are essential for service-based businesses.

QuickBooks, however, offers a more comprehensive set of features. In addition to invoicing and expense tracking, it includes advanced tools for payroll management, inventory tracking, and project management. QuickBooks also provides detailed financial reports, such as profit and loss statements and cash flow statements, giving you a deeper insight into your business’s financial health.

Another key difference is in their reporting capabilities. While FreshBooks offers basic reporting features, QuickBooks provides more advanced options, allowing you to generate custom reports tailored to your specific needs. This makes QuickBooks a better choice for businesses that require detailed financial analysis and forecasting.

Both FreshBooks and QuickBooks integrate with various third-party applications, but QuickBooks has a wider range of integrations, making it more versatile for businesses that use multiple tools. This flexibility can significantly enhance your workflow and improve overall efficiency.

Usability: Which Software Is More User-Friendly?

Usability is a crucial factor when choosing invoicing and accounting software. FreshBooks is known for its user-friendly interface, making it easy for users with little to no accounting experience to navigate. The dashboard is clean and intuitive, allowing you to access key features quickly. FreshBooks also offers excellent customer support, with resources like tutorials and webinars to help you get the most out of the software.

QuickBooks, while slightly more complex due to its extensive features, also provides a user-friendly experience. The software includes step-by-step guides and a comprehensive knowledge base to assist users in setting up and using the software effectively. QuickBooks’ mobile app ensures you can manage your finances on the go, similar to FreshBooks.

For those who prioritize simplicity and ease of use, FreshBooks is the better option. However, if you need more advanced features and are willing to invest a bit more time in learning the software, QuickBooks offers greater flexibility and functionality.

Pricing Analysis: Value for Money

Pricing is another critical factor to consider when comparing FreshBooks and QuickBooks. FreshBooks offers three main pricing plans: Lite, Plus, and Premium. The Lite plan is suitable for freelancers and very small businesses, while the Plus and Premium plans cater to growing businesses with more extensive needs. FreshBooks’ pricing is straightforward, with no hidden fees, making it an affordable choice for many small business owners.

QuickBooks, on the other hand, provides four pricing plans: Simple Start, Essentials, Plus, and Advanced. The Simple Start plan is ideal for sole proprietors, while the higher-tier plans offer more advanced features for larger businesses. QuickBooks’ pricing is competitive, but it can be higher than FreshBooks, especially for the Plus and Advanced plans. However, the extensive features and capabilities provided by QuickBooks justify the cost for many businesses.

When evaluating value for money, consider the specific features you need and the size of your business. FreshBooks may be more cost-effective for smaller businesses with simpler needs, while QuickBooks offers better value for larger businesses requiring advanced accounting features.

Integration Capabilities: FreshBooks vs. QuickBooks

Integration capabilities are vital for businesses that rely on multiple software tools. FreshBooks integrates with a variety of popular applications, including PayPal, Stripe, and G Suite. These integrations enhance the functionality of FreshBooks, allowing you to streamline your invoicing and accounting processes.

QuickBooks offers a broader range of integrations, connecting with over 650 business apps, including Shopify, Square, and Salesforce. This extensive compatibility makes QuickBooks a more versatile solution for businesses that need to integrate their accounting software with other tools and platforms.

Both FreshBooks and QuickBooks support integrations with major payment processors, making it easy to accept online payments. However, QuickBooks’ wider range of integrations provides more flexibility for businesses with complex needs. This capability can significantly enhance your workflow, reducing manual data entry and improving overall efficiency.

Why Choose FreshBooks for Your Small Business

Invoicing and accounting software like FreshBooks is essential for small businesses aiming to streamline their financial management. FreshBooks stands out due to its user-friendly interface and robust features that simplify accounting tasks. For small businesses, FreshBooks offers an efficient way to manage invoices, track expenses, and maintain accurate financial records, making it an invaluable tool for enhancing productivity and ensuring financial accuracy.

Small business owners often face the challenge of managing multiple tasks simultaneously. FreshBooks alleviates this burden by automating invoicing and expense tracking, allowing you to focus more on growing your business. With FreshBooks, you can ensure timely payments and keep your financial data organized, which is crucial for maintaining a healthy cash flow and making informed business decisions.

Advantages of FreshBooks for Startups

FreshBooks provides several advantages for startups looking to establish a solid financial foundation. One of the primary benefits is its simplicity. Startups often have limited resources and cannot afford to spend excessive time on complex accounting processes. FreshBooks’ intuitive design allows you to quickly set up your account and start managing finances without a steep learning curve.

Another advantage is the ability to create professional invoices in minutes. FreshBooks offers customizable templates that reflect your brand, ensuring you make a great impression on clients. Automated payment reminders help you get paid faster, which is crucial for startups needing consistent cash flow.

Expense tracking is seamless with FreshBooks. You can categorize expenses, attach receipts, and sync with your bank accounts for real-time updates. This feature helps startups stay organized and prepares them for tax season by keeping all expense records in one place. The time tracking feature is particularly useful for startups that bill clients by the hour, ensuring accurate invoicing and payment for work done.

FreshBooks: Ideal for Freelancers and Contractors

FreshBooks is an ideal solution for freelancers and contractors who need a reliable way to manage their finances. The software simplifies invoicing, making it easy to bill clients for services rendered. Freelancers and contractors can create detailed invoices, set up recurring billing, and accept online payments, all of which contribute to faster payment cycles.

Time tracking is another valuable feature for freelancers and contractors. FreshBooks allows you to track your time for different projects and clients, ensuring accurate billing and transparency. This feature helps you provide detailed timesheets to clients, enhancing trust and professionalism.

Expense tracking in FreshBooks is straightforward, allowing freelancers and contractors to keep personal and business expenses separate. By categorizing expenses and attaching receipts, you can easily manage your finances and prepare for tax filings. The ability to generate financial reports, such as profit and loss statements, provides insights into your earnings and helps you make informed business decisions.

FreshBooks also offers project management tools that enable freelancers and contractors to collaborate with clients and team members effectively. You can track project progress, manage deadlines, and communicate within the platform, ensuring projects are completed on time and within budget.

Customer Support and Resources in FreshBooks

FreshBooks excels in customer support and offers a variety of resources to help users get the most out of the software. The support team is known for being responsive and knowledgeable, providing assistance through email, phone, and live chat. This ensures that any issues or questions you have are addressed promptly, minimizing disruptions to your workflow.

The FreshBooks website features a comprehensive knowledge base with articles, tutorials, and FAQs that cover all aspects of using the software. These resources are invaluable for new users learning the system and for experienced users seeking to maximize their efficiency. Additionally, FreshBooks offers webinars and video tutorials that provide step-by-step guidance on various features and functionalities.

Another valuable resource is the FreshBooks blog, which offers tips, insights, and best practices for managing your business finances. The blog covers a wide range of topics, from accounting and invoicing to productivity and business growth, providing you with useful information to enhance your business operations.

The community aspect of FreshBooks is also noteworthy. Users can join forums and online communities to share experiences, ask questions, and learn from other business owners. This sense of community fosters collaboration and provides additional support, making FreshBooks not just a software tool but a valuable resource for small businesses, freelancers, and contractors.

Why QuickBooks Is Preferred by Larger Enterprises

QuickBooks is a popular choice among larger enterprises due to its extensive features and scalability. The software provides comprehensive tools for managing complex financial operations, making it suitable for businesses with more advanced accounting needs. QuickBooks’ ability to handle large volumes of transactions and its robust reporting capabilities make it an ideal solution for larger enterprises looking to optimize their financial management processes.

For large enterprises, managing finances involves dealing with numerous transactions, multiple accounts, and various financial reports. QuickBooks offers the necessary tools to streamline these processes, ensuring accuracy and efficiency. The software’s advanced features and customization options allow enterprises to tailor it to their specific needs, providing a powerful solution for managing business finances at scale.

Tailored Solutions for Large Businesses

QuickBooks offers tailored solutions that cater to the unique needs of large businesses. One of the key features is its ability to manage multiple users with varying levels of access. This ensures that different departments can use the software effectively while maintaining data security and integrity. For example, finance teams can handle accounting tasks, while sales teams can generate invoices and track payments.

The software also supports advanced inventory management, making it suitable for businesses with extensive product catalogs. QuickBooks allows you to track inventory levels, manage orders, and generate reports on stock status. This feature helps businesses maintain optimal inventory levels and avoid stockouts or overstocking.

QuickBooks’ advanced reporting capabilities are another significant advantage for large businesses. The software offers customizable reports that provide detailed insights into financial performance. These reports can be tailored to meet the specific needs of different departments, providing valuable information for decision-making and strategic planning.

Additionally, QuickBooks supports multi-currency transactions, making it ideal for businesses with international operations. This feature allows you to manage transactions in different currencies, ensuring accurate financial records and simplifying global business operations.

Scalability and Advanced Features

Scalability is a critical factor for large enterprises, and QuickBooks excels in this area. The software is designed to grow with your business, offering features that can handle increasing volumes of transactions and more complex accounting needs. As your business expands, QuickBooks provides the tools necessary to manage your finances efficiently.

One of the advanced features that make QuickBooks suitable for large enterprises is its project management capabilities. The software allows you to track project expenses, manage budgets, and generate project-specific financial reports. This feature is particularly useful for businesses that handle multiple projects simultaneously, ensuring accurate financial tracking and reporting.

QuickBooks also offers robust payroll management, automating payroll calculations, tax filings, and direct deposits. This feature saves time and ensures compliance with tax regulations, reducing the risk of errors and penalties. For large enterprises with numerous employees, efficient payroll management is crucial for maintaining smooth operations.

The integration capabilities of QuickBooks further enhance its scalability. The software integrates with a wide range of business applications, including CRM systems, e-commerce platforms, and payment processors. These integrations create a seamless workflow, improving efficiency and reducing manual data entry.

Enterprise-Level Support and Training in QuickBooks

QuickBooks provides enterprise-level support and training to help large businesses maximize the benefits of the software. The support team is available to assist with any issues or questions, ensuring that your financial operations run smoothly. QuickBooks offers various support channels, including phone, email, and live chat, providing prompt and effective assistance.

In addition to support, QuickBooks offers extensive training resources to help users get the most out of the software. These resources include webinars, video tutorials, and training courses that cover different aspects of using QuickBooks. Whether you’re new to the software or looking to deepen your knowledge, these training resources provide valuable insights and guidance.

QuickBooks also offers a dedicated account manager for enterprise clients. This account manager works closely with your business to ensure that you are leveraging the software effectively and addressing any specific needs or challenges. This personalized support enhances the overall user experience and helps large businesses optimize their financial management processes.

The QuickBooks community is another valuable resource for large enterprises. By joining forums and online communities, users can connect with other businesses, share experiences, and learn best practices. This collaborative environment provides additional support and fosters a sense of community among QuickBooks users.

Best Practices for Using Invoicing and Accounting Software

Invoicing and accounting software is an essential tool for businesses aiming to streamline their financial processes. By implementing best practices, you can maximize the benefits of these tools, ensuring efficient and accurate financial management. This section provides actionable tips to help you get the most out of your invoicing and accounting software.

Adopting best practices involves optimizing your workflow, maintaining data accuracy, and leveraging integrations to enhance efficiency. By following these guidelines, you can improve your financial management processes, reduce errors, and save valuable time, allowing you to focus on growing your business.

Optimizing Your Workflow with Invoicing Tools

To optimize your workflow with invoicing tools, start by setting up automated invoicing. This feature allows you to schedule recurring invoices, send payment reminders, and automate follow-ups. By automating these tasks, you can ensure timely payments and reduce the administrative burden on your team.

Another effective strategy is to customize your invoice templates. Personalizing your invoices with your branding, payment terms, and detailed descriptions can make a professional impression on clients and enhance clarity. Clear and detailed invoices reduce the likelihood of disputes and facilitate quicker payments.

Utilizing real-time tracking features in your invoicing software can also boost efficiency. These features allow you to monitor the status of invoices, track payments, and identify overdue accounts. By keeping a close eye on your receivables, you can take proactive steps to follow up on late payments and maintain healthy cash flow.

Integrating your invoicing tools with your accounting software is crucial for seamless data management. This integration ensures that all your financial data is synchronized, reducing the risk of errors and saving time on manual data entry. It also provides a comprehensive view of your financial health, enabling better decision-making.

Ensuring Data Accuracy and Compliance

Maintaining data accuracy and compliance is vital for effective financial management. Start by regularly reconciling your accounts. This practice involves comparing your financial records with bank statements to ensure that all transactions are accurately recorded. Regular reconciliation helps identify and correct discrepancies promptly, ensuring the integrity of your financial data.

Implementing access controls is another important step. Restrict access to sensitive financial data to authorized personnel only. This not only protects your data but also ensures that those handling the information are adequately trained and knowledgeable about accounting practices.

Staying updated with tax regulations and compliance requirements is essential for avoiding penalties. Use your accounting software to keep track of tax deadlines, generate necessary reports, and ensure accurate tax filings. Many accounting tools offer features that automate tax calculations and generate compliance reports, simplifying the process and reducing the risk of errors.

Regularly backing up your financial data is crucial for data security. Ensure that your accounting software provides automatic backups and consider using cloud-based solutions for added security and accessibility. Regular backups protect your data from loss due to technical failures or cyber threats.

Maximizing the Benefits of Software Integrations

Maximizing the benefits of software integrations can significantly enhance your business operations. Start by integrating your accounting software with your CRM system. This integration allows you to sync customer data, track sales, and manage customer relationships more effectively. Having all customer information in one place improves communication and enhances customer service.

Integrating with payment processors like PayPal or Stripe streamlines the payment process. It enables you to accept online payments directly through your invoices, speeding up the payment cycle and improving cash flow. This integration also reduces the risk of payment errors and simplifies the reconciliation process.

Using project management tools in conjunction with your accounting software can improve project tracking and budgeting. Integrations with tools like Asana or Trello allow you to monitor project expenses, track time spent on tasks, and ensure projects stay within budget. This holistic view of project finances helps in better planning and execution.

Connecting your accounting software with inventory management systems can optimize inventory tracking and order management. This integration provides real-time updates on stock levels, sales, and orders, ensuring you maintain optimal inventory levels. It also helps in generating accurate financial reports that reflect your inventory status, aiding in better decision-making.

Future Trends in Invoicing and Accounting Software

The future of invoicing and accounting software is shaped by emerging technologies and innovations. Staying informed about these trends can help businesses stay ahead of the curve and leverage new tools for enhanced financial management. This section explores some of the key trends transforming the landscape of invoicing and accounting software.

Advancements in technology are driving significant changes in how businesses manage their finances. From AI-driven predictive analytics to mobile financial management, these trends offer exciting possibilities for improving efficiency, accuracy, and decision-making in accounting processes.

Emerging Technologies and Innovations

Emerging technologies are revolutionizing invoicing and accounting software. One notable trend is the integration of blockchain technology. Blockchain offers a secure and transparent way to record transactions, reducing the risk of fraud and ensuring the integrity of financial data. This technology can also streamline audit processes and enhance data security.

Artificial Intelligence (AI) and machine learning are making significant impacts on accounting practices. AI-driven tools can automate routine tasks such as data entry, invoice processing, and reconciliation. These tools can also analyze large volumes of data to provide insights into spending patterns, financial health, and potential areas for cost savings.

Another innovation is the use of cloud-based accounting solutions. Cloud accounting offers flexibility, allowing businesses to access financial data from anywhere, at any time. This accessibility is particularly beneficial for remote work and multi-location businesses. Cloud solutions also offer scalability, making it easy to adapt to the changing needs of your business.

Robotic Process Automation (RPA) is another technology transforming accounting processes. RPA uses software robots to automate repetitive tasks, reducing manual effort and minimizing errors. This technology can be applied to tasks such as invoice processing, data entry, and compliance reporting, freeing up valuable time for your finance team to focus on strategic activities.

Predictive Analytics and AI in Accounting

Predictive analytics and AI are reshaping the way businesses approach financial management. Predictive analytics uses historical data to forecast future financial trends, helping businesses make informed decisions. By analyzing patterns in spending, revenue, and cash flow, predictive analytics can provide valuable insights into future financial performance.

AI-driven accounting tools can identify anomalies and potential fraud in real-time. These tools analyze transaction patterns and flag unusual activities, enabling businesses to take immediate action. This proactive approach to fraud detection enhances financial security and protects against potential losses.

Another benefit of AI in accounting is the automation of complex financial analysis. AI algorithms can process large datasets quickly and accurately, providing detailed insights into financial performance. These insights can help businesses identify opportunities for growth, optimize resource allocation, and improve overall financial health.

AI-powered virtual assistants are also becoming more common in accounting software. These assistants can handle tasks such as scheduling payments, generating reports, and answering user queries. By automating these routine tasks, AI virtual assistants free up time for finance professionals to focus on higher-value activities.

The Role of Mobile Apps in Financial Management

Mobile apps are playing an increasingly important role in financial management. With the rise of remote work and the need for on-the-go access to financial data, mobile accounting apps offer a convenient solution. These apps allow users to manage invoices, track expenses, and view financial reports from their smartphones or tablets.

One of the key benefits of mobile accounting apps is real-time access to financial information. This accessibility ensures that business owners and finance professionals can make informed decisions, even when they are away from the office. Mobile apps also facilitate collaboration, allowing team members to access and update financial data from anywhere.

Mobile apps often come with features such as receipt capture, which allows users to take photos of receipts and upload them directly to their accounting software. This feature simplifies expense tracking and ensures that all expenses are accurately recorded. Mobile apps also support mobile payments, enabling businesses to accept payments on the go and improve cash flow.

Security is a critical consideration for mobile accounting apps. Leading accounting software providers implement robust security measures, such as encryption and multi-factor authentication, to protect financial data. These security features ensure that sensitive information is safeguarded, giving users peace of mind when managing their finances on mobile devices.