Table of Contents

The best way to make your money work for you isn’t just about earning—it’s about letting your money grow while you sleep.

Have you ever wondered why some people seem to build wealth steadily while others struggle no matter how hard they work?

In this guide, we’ll dig into proven strategies, smart habits, and overlooked opportunities that turn your money into an active partner in building financial freedom.

Understand the Power of Compound Growth

If you’re serious about finding the best way to make your money work for you, the magic ingredient you can’t ignore is compound growth. This isn’t just math—it’s the closest thing to financial alchemy we have.

Learn How Compound Interest Multiplies Wealth

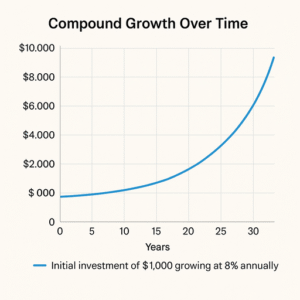

Compound interest means your money earns interest, and then that interest earns interest on itself. It snowballs over time. Here’s a simple example:

- If you invest $1,000 at 8% interest, you’ll have $1,080 after one year.

- In year two, you earn 8% not just on your original $1,000, but also on the $80 in interest. That means your total grows faster, without you lifting a finger.

- Stretch that across 20 or 30 years, and the numbers become staggering. $1,000 invested at 8% grows to nearly $10,000 over 30 years.

I believe most people underestimate compounding because it feels too slow at the start. But once the growth curve kicks in, it accelerates like a rocket launch after liftoff.

Start Investing Early to Maximize Long-Term Returns

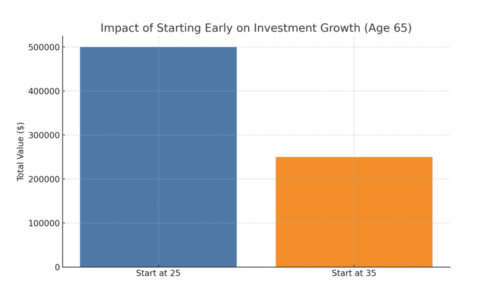

The biggest lever you have in compounding is time. If you start investing in your 20s, even small amounts, you give your money decades to snowball.

For example, investing $200 a month from age 25 to 65 at 7% annual growth leaves you with over $500,000.

If you wait until 35 to start the same $200 per month, you’ll end up with less than half that amount. That’s a $250,000 difference—just because of a ten-year delay.

I suggest thinking of every dollar you invest early as a little worker bee that brings friends along over time.

Reinvest Dividends to Accelerate Portfolio Growth

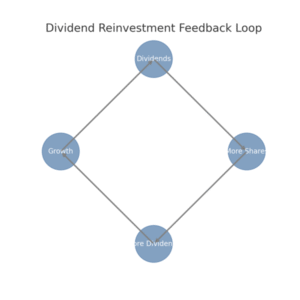

One overlooked hack is reinvesting dividends. Many companies pay a portion of their profits back to shareholders. You can choose to cash out or reinvest them into buying more shares. Reinvesting creates a feedback loop:

- More shares mean more dividends.

- More dividends mean buying even more shares.

- Over time, your snowball grows bigger, faster.

Most brokerages let you check a box to “automatically reinvest dividends.” It’s one of the simplest switches you can flip to make your money compound without extra effort.

Build a Solid Emergency Fund Before Investing

Before diving headfirst into investments, you need to protect yourself from financial shocks.

An emergency fund is your safety net, and without it, one unexpected bill can wipe out years of careful planning.

Decide How Much to Save for Unexpected Expenses

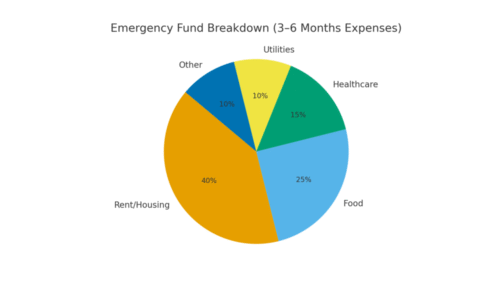

The general rule of thumb is three to six months’ worth of living expenses. If your monthly bills are $3,000, aim for at least $9,000 in your emergency fund.

That’s not a random number—it’s enough to handle job loss, medical bills, or a surprise car repair without reaching for credit cards.

I suggest tailoring this to your life. If you have kids, own a home, or work freelance, lean toward the six-month side. If you’re single with a stable job, you might be fine closer to three months.

Keep Funds in High-Yield Savings Accounts

An emergency fund should be safe and liquid. That means no stocks, no crypto, no chasing risky returns. The best spot? A high-yield savings account (HYSA).

With HYSAs, you can currently earn between 4–5% APY depending on the bank. That’s far better than the old-school savings account paying you pennies. Plus, your money is insured and accessible anytime. Look for accounts with:

- No monthly fees.

- Easy online transfers.

- FDIC insurance.

From my own experience, it feels reassuring watching your “just in case” fund quietly earn interest while sitting safe and sound.

Balance Accessibility With Growth Potential

Here’s the trick: accessibility is non-negotiable. You want to reach your funds quickly in an emergency. At the same time, you don’t want that money eroding in value because of inflation.

That’s why I recommend a layered approach:

- Keep one month of expenses in a regular checking account for instant access.

- Park the rest in a high-yield savings account or even a money market account.

- Resist the temptation to invest this money—its job isn’t growth, it’s protection.

Think of your emergency fund as armor. It doesn’t make you money directly, but it keeps your investments safe by ensuring you never have to sell them during a crisis.

Pro tip: If you’re serious about wealth building, set up your emergency fund first, then automate contributions to investments. This way, you’re never forced to choose between financial safety and long-term growth.

Invest in the Stock Market With a Smart Strategy

The stock market is one of the best ways to make your money work for you because it gives you access to the growth of companies around the world.

The trick isn’t just “buying stocks”—it’s investing with a strategy that balances growth, risk, and consistency.

Choose Between Index Funds, ETFs, and Individual Stocks

When you first start, the sheer number of options can feel overwhelming. Here’s a simple breakdown of the three most common ways people invest:

- Index Funds: These are like a basket of hundreds of stocks grouped together. For example, an S&P 500 index fund tracks the 500 biggest U.S. companies. It’s a “set it and forget it” way to grow steadily without needing to pick winners.

- ETFs (Exchange-Traded Funds): Similar to index funds, but they trade like stocks. ETFs give you flexibility and often have lower fees. You can buy them right in your brokerage account by typing the ticker symbol (e.g., VOO for Vanguard’s S&P 500 ETF).

- Individual Stocks: Owning a piece of a single company, like Apple or Tesla. This gives the highest potential upside but also carries the most risk. If that company struggles, your money takes a hit.

If you’re new, I strongly suggest starting with index funds or ETFs. They give you diversification right away, meaning your risk is spread across many companies instead of tied to one. Think of it as planting a whole garden instead of betting everything on a single tree.

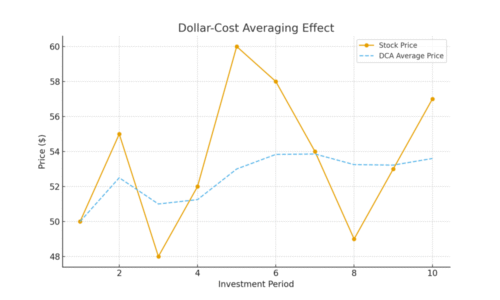

Automate Contributions Through Dollar-Cost Averaging

One of the easiest ways to stay consistent in the market is dollar-cost averaging (DCA). Instead of trying to “time the market” (which even professionals fail at), you invest the same amount of money at regular intervals—say $200 every two weeks.

Here’s how it works:

- When prices are high, your $200 buys fewer shares.

- When prices drop, your $200 scoops up more shares.

- Over time, the average cost of your investments smooths out, reducing the risk of buying at the wrong moment.

From my own setup, I’ve linked my bank account to my brokerage so that every payday, money automatically transfers into my index fund.

I don’t have to think about it, and that automation has quietly built my portfolio in the background. It’s like putting your investments on autopilot.

Diversify Across Sectors to Minimize Risk

Diversification simply means not putting all your eggs in one basket. In practice, this means spreading your money across different industries—tech, healthcare, energy, consumer goods, and so on.

Imagine only investing in tech stocks. In a tech boom, you’d feel like a genius. But when the sector dips, your entire portfolio sinks. By spreading across sectors, you smooth out the bumps.

Here’s a quick example using ETFs:

- VGT (technology ETF) for exposure to tech companies.

- VHT (healthcare ETF) for medical and biotech.

- VYM (high-dividend ETF) for steady income.

Even with just three ETFs, you’re suddenly holding hundreds of companies across different industries. That’s diversification done simply.

Use Real Estate to Generate Passive Income

Real estate can be a powerful tool to grow wealth while also providing ongoing cash flow. It’s tangible—you can see it, touch it—and it often appreciates over time while tenants or trusts provide you income.

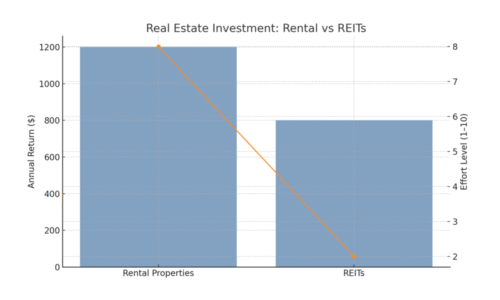

Compare Rental Properties Versus Real Estate Investment Trusts

You don’t have to be a landlord to benefit from real estate. There are two main paths here:

- Rental Properties: Buy a home, condo, or multifamily property and rent it out. The rent covers your mortgage (and ideally more), leaving you with monthly profit. The upside is strong cash flow and property appreciation. The downside? You’re responsible for tenants, repairs, and the occasional midnight plumbing emergency.

- REITs (Real Estate Investment Trusts): These are companies that own income-producing properties, like apartment buildings, malls, or warehouses. You can buy REITs in your brokerage account just like a stock or ETF. They’re much more hands-off and often pay high dividends.

If you don’t like the idea of dealing with tenants, REITs are a great way to get exposure to real estate without the landlord headaches.

Understand How Property Appreciation Builds Wealth

One of the best parts about real estate is appreciation—the property increasing in value over time. Let’s say you buy a house for $200,000. Ten years later, it’s worth $280,000. That $80,000 difference is equity you’ve built just by holding the property.

What makes this more powerful is leverage. You might only put down $40,000 as a down payment, but the appreciation happens on the full $200,000 value. That means your return on investment is much higher than it looks at first glance.

Here’s a simple scenario:

- Down payment: $40,000.

- Property value increases by $80,000 in 10 years.

- That’s effectively doubling your original investment without you adding another dime.

Leverage Financing Without Overextending Yourself

Leverage (using borrowed money to buy real estate) is what makes real estate so powerful, but it’s also where people get burned. Taking on too much debt can wipe you out if the market dips or tenants leave.

Here’s how I suggest approaching it:

- Keep your mortgage payment below 30% of the property’s rental income. That way, even if rents drop, you’re not underwater.

- Set aside at least 5–10% of rental income monthly for repairs and vacancies. Roofs, furnaces, and empty months happen.

- Don’t count on appreciation alone—cash flow should be positive from day one.

If you want a hands-off way to use leverage, some REITs already use financing to buy large properties. You benefit from their scale without having to personally take on the risk.

Pro tip: Whether you choose the stock market or real estate, remember they’re not “either-or.” The most resilient wealth-building strategies use both. Stocks give you liquidity and compounding, while real estate provides tangible assets and cash flow. Combined, they create a financial ecosystem where your money truly works for you.

Maximize Employer Benefits and Retirement Accounts

If you’re looking for the best way to make your money work for you, don’t overlook what’s already within reach—your workplace retirement plans and tax-advantaged accounts.

These are like hidden treasure chests that many people never fully open.

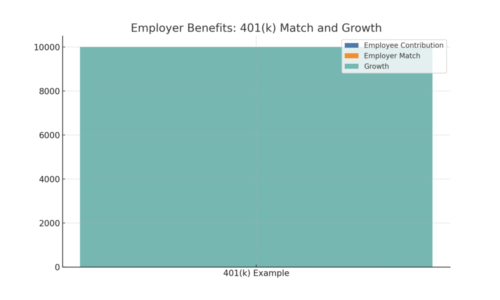

Contribute Enough to Get Your Employer’s 401(k) Match

This is one of those no-brainer moves. Many employers will “match” a percentage of what you put into your 401(k). For example:

- If you earn $60,000 a year and contribute 5% ($3,000), and your employer matches 5%, that’s another $3,000 added for free.

- That’s a 100% return on your money instantly, before the investments even start compounding.

I suggest checking your HR portal today. You’ll usually find a “Retirement” or “Benefits” tab where you can set your contribution percentage. If you’re not contributing at least enough to grab the full match, you’re leaving free money on the table.

Explore Roth IRA and Traditional IRA Advantages

Beyond a 401(k), IRAs (Individual Retirement Accounts) are another powerful way to build wealth. Here’s the difference in plain English:

- Roth IRA: You pay taxes now, but your money grows tax-free. When you retire, withdrawals aren’t taxed. Perfect if you expect to be in a higher tax bracket later.

- Traditional IRA: You contribute pre-tax dollars, lowering your taxable income today. You’ll pay taxes when you withdraw in retirement. Great if you want immediate tax breaks.

From what I’ve seen, younger investors often lean toward Roth IRAs for tax-free growth, while higher earners may prefer Traditional IRAs for the deduction.

You can even open one online through Vanguard, Fidelity, or Schwab in under 15 minutes—it’s just like setting up a bank account.

Avoid Early Withdrawals That Hurt Long-Term Growth

It can be tempting to dip into retirement savings for emergencies or big expenses, but early withdrawals often come with a 10% penalty plus taxes. Even worse, you lose decades of compounding.

Here’s a quick example: pulling out $10,000 at age 30 could cost you more than $70,000 in lost growth by age 65. That’s a huge tradeoff for short-term relief.

I advise keeping your retirement accounts strictly off-limits. Build an emergency fund for short-term needs so your long-term money stays untouched.

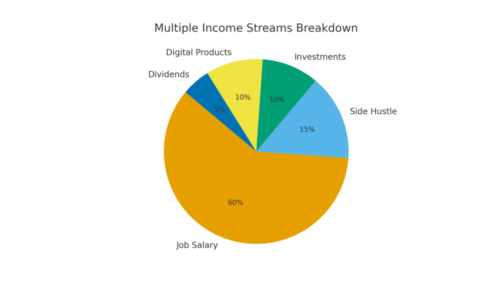

Create Multiple Income Streams Beyond Your Job

Relying on a single paycheck is risky. Creating extra income streams gives you stability and speeds up wealth building.

Think of it as planting different trees—some grow fast, some grow slow, but together they form a forest of financial security.

Start a Side Hustle That Scales With Minimal Effort

The best side hustles are ones you can scale without constantly trading hours for dollars. A few examples:

- Freelancing on platforms like Upwork or Fiverr.

- Turning a hobby (photography, writing, design) into paid projects.

- Offering a local service—dog walking, tutoring, or lawn care—that can expand with help.

I suggest picking something you’d do even if it didn’t pay much. That way, it won’t feel like a grind while you’re getting traction. Once you’ve got demand, look for ways to outsource tasks or raise prices to scale.

Use Digital Products or Online Services for Passive Earnings

Digital products are powerful because you build once and sell infinitely. Some ideas include:

- An eBook or guide (think “How I Saved $10,000 in a Year”).

- An online course hosted on sites like Teachable or Udemy.

- Print-on-demand designs on platforms like Redbubble or Merch by Amazon.

The upfront effort is heavy, but after that, income trickles in without constant work. I personally love this model because your time investment keeps paying you long after the initial effort.

Invest in Dividend-Paying Assets for Recurring Income

Dividends are like your portfolio paying you rent every quarter. Dividend stocks or ETFs give you cash just for holding them. For example:

- If you own $20,000 of a stock with a 4% dividend yield, you’ll earn $800 a year in passive income.

- Reinvest those dividends, and the compounding kicks in even faster.

I recommend starting with a Dividend ETF (like VYM or SCHD) to spread risk across multiple companies. This way, even if one company cuts dividends, others can balance it out.

Pay Off High-Interest Debt Quickly

Before you pour too much into investments, clear high-interest debt. Credit cards charging 20% interest are wealth killers.

Paying them off is often the fastest, most guaranteed return you can get.

Prioritize Credit Card and Personal Loan Repayments

Focus first on debts with interest rates above 7–8%, because they grow faster than most investments. For example:

- A $5,000 balance at 20% interest costs you $1,000 a year just to stand still.

- Paying it off is like earning a 20% return risk-free.

I suggest listing all debts with their balances and interest rates, then tackling the highest interest ones first. It’s like plugging the biggest leaks in your financial bucket.

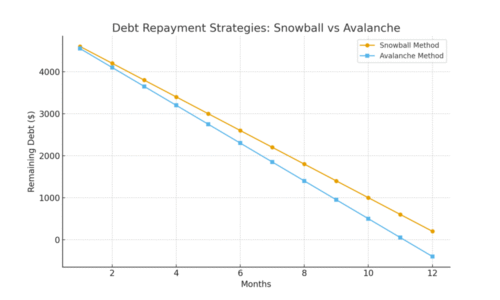

Use the Avalanche or Snowball Method Effectively

Two popular strategies work here:

- Avalanche Method: Pay off the highest-interest debt first. This saves the most money long term.

- Snowball Method: Pay off the smallest balance first, then roll that payment into the next debt. This builds momentum and confidence.

From what I’ve seen, the method you stick with matters more than which one you pick. If you need quick wins, go Snowball. If you’re disciplined and math-driven, go Avalanche.

Refinance Loans to Lower Interest Burdens

If you’ve got student loans, car loans, or even a mortgage at a high rate, refinancing can save thousands.

For example, lowering a $20,000 loan from 12% to 7% could cut your monthly payment significantly and reduce the total interest you pay over time.

I recommend comparing refinance offers online. Most lenders let you check your rate without a hard credit pull.

Just make sure any refinancing keeps your overall repayment timeline manageable—you don’t want to drag debt out so long that it negates the savings.

Pro tip: Think of debt payoff and investing as teammates, not enemies. Pay down high-interest balances aggressively, but keep contributing at least enough to retirement accounts to capture employer matches. That way, you’re crushing debt while still letting your money grow for the future.

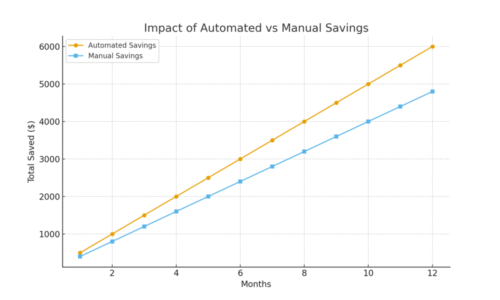

Automate Your Savings and Investments

One of the best ways to make your money work for you is to remove willpower from the equation. Automation ensures you save and invest consistently, even when life gets hectic or motivation dips.

Set Up Direct Transfers to Investment Accounts

Think of automation as paying yourself first. Instead of waiting to see what’s left at the end of the month, set up automatic transfers that move money straight into savings or investments right after payday.

Here’s how you can set it up in minutes:

- Log in to your bank’s online dashboard.

- Find the “Transfers” or “Recurring Transfers” section.

- Choose the account where your paycheck lands.

- Schedule a recurring transfer to your brokerage or savings account for the day after payday.

This way, you never feel like you’re “losing” money—because you never see it sitting in your spending account.

I suggest starting small, even $100 a month, and increasing as you adjust. Over time, this habit snowballs into serious wealth.

Use Robo-Advisors for Stress-Free Portfolio Management

If choosing funds or rebalancing investments feels overwhelming, robo-advisors are your best friend. These are automated platforms (like Betterment or Wealthfront) that:

- Ask a few questions about your goals and risk tolerance.

- Build a portfolio of index funds tailored to you.

- Automatically rebalance and reinvest dividends.

From my own experience, setting this up feels like hiring a personal financial assistant for a fraction of the cost.

You log in, answer a short questionnaire, and the system handles the rest. No spreadsheets, no stress—just steady progress.

Track Progress With Budgeting and Investment Apps

Automation doesn’t mean ignoring your money. You still want to track progress so you stay motivated. Apps like Mint, YNAB (You Need a Budget), or Personal Capital connect to your accounts and show you a dashboard of your finances.

I personally love seeing my “net worth” graph inch upward month by month. It’s like watching the gym scale go down—proof that your quiet habits are paying off.

The key is to check in regularly, not obsessively. Once a month is enough to make sure you’re on track without overthinking daily market swings.

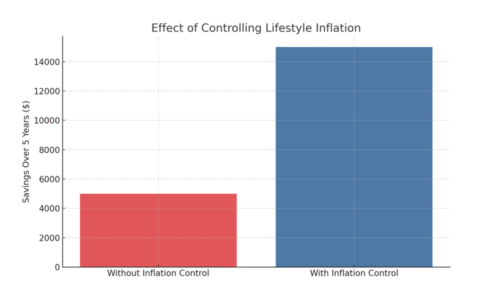

Reduce Lifestyle Inflation to Save and Invest More

Lifestyle inflation is sneaky. Every time your income goes up, expenses somehow rise to match it.

The secret to financial freedom isn’t just making more money—it’s keeping your spending in check so you can invest the difference.

Identify Wants Versus Needs in Spending Habits

The line between “want” and “need” gets blurry when you’re used to convenience. Do you really need that $6 latte every morning, or is it a habit?

I suggest tracking your spending for a month, then highlighting what’s truly essential (housing, food, utilities) versus optional (subscriptions, dining out, gadgets).

One trick I use: If cutting something feels like a downgrade in quality of life, it’s probably a need. If cutting it feels inconvenient but survivable, it’s a want. This little mindset shift can free up hundreds each month.

Redirect Salary Increases Into Investments

When you get a raise or bonus, the temptation is to upgrade—new car, nicer apartment, more takeout. Instead, lock in your old lifestyle and redirect the extra money into investments.

For example:

- If your paycheck increases by $500 a month, increase your 401(k) contribution by $300.

- Use the other $200 for guilt-free fun, so you don’t feel deprived.

I’ve done this personally, and it works beautifully. Over time, your investments grow while you still enjoy some perks of the raise. It’s a balanced approach that feels sustainable.

Live Below Your Means Without Feeling Restricted

Living below your means doesn’t mean living miserably. It’s about choosing what you value most and cutting ruthlessly on what you don’t.

For instance, maybe you cook at home 80% of the time but splurge on weekend getaways. Or you drive a reliable used car but never skimp on health and fitness.

The secret is intentionality. By aligning spending with values, you avoid that hollow feeling of sacrificing too much. And every dollar saved becomes another worker bee in your investment hive, compounding quietly in the background.

Continuously Educate Yourself on Money Management

Money isn’t a “set it and forget it” subject. The best way to make your money work for you is to keep learning, adapting, and sharpening your skills.

The financial world evolves, and staying curious keeps you ahead.

Read Trusted Financial Books and Resources

Books are timeless teachers. A few that have shaped my own thinking include:

- “The Millionaire Next Door” for understanding simple wealth habits.

- “I Will Teach You to Be Rich” for practical, modern money management.

- “The Psychology of Money” for mindset shifts around wealth.

Set a goal to read one finance book a year. That’s a small time investment for knowledge that could save or make you thousands.

Follow Market Trends Without Reacting Emotionally

It’s important to know what’s happening in the market, but reacting emotionally—selling in a panic or chasing hype—is dangerous. Instead, follow trends like you’d check the weather. Informative, but not dictating your every move.

Here’s what works for me: I skim financial news headlines weekly but rarely act on them. My long-term investments stay on course, regardless of short-term noise. This keeps me from turning into a day-trader glued to my phone.

Learn From Experts While Building Your Own Strategy

Podcasts, blogs, and YouTube channels can give you fresh insights, but don’t just copy blindly. Everyone’s situation is different. Use experts for guidance, then adapt their advice to your income, goals, and risk tolerance.

For example, you might hear an investor swear by real estate, but if you hate dealing with tenants, a REIT might be your better fit. I believe the ultimate financial strategy is the one you’ll actually stick with. Learning from others while crafting your own playbook ensures it’s both effective and sustainable.

Pro tip: Think of financial education like going to the gym. The first few workouts feel heavy and awkward, but with consistency, it becomes second nature. And just like fitness, money mastery compounds—small lessons today build into lifelong confidence and wealth.