Table of Contents

Are you wondering if QuickBooks Online pricing in 2025 is worth the investment for your business needs? What new features are included, and are there hidden costs you should be aware of? In this guide, you’ll get a clear breakdown of the updated pricing tiers, what you get for the cost, and whether it’s still a good value.

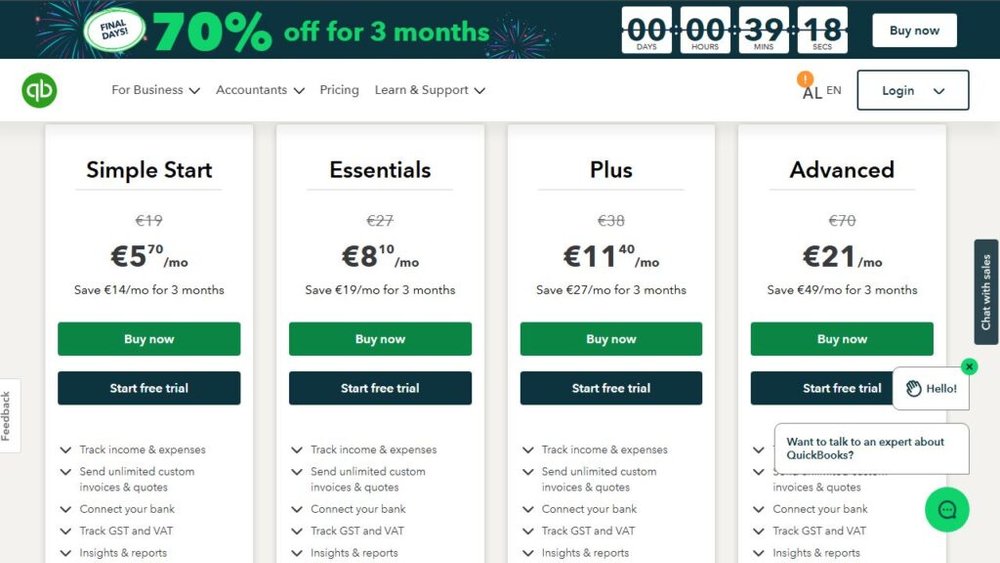

QuickBooks Online Pricing Plans Breakdown

When choosing accounting software, understanding the different pricing plans is crucial. Let’s explore how each plan fits different business needs while considering their costs and features.

Features and Costs of QuickBooks Online Simple Start

Simple Start (€19) is often the entry point for freelancers, solo entrepreneurs, and small businesses. It’s a basic plan, but for many, it’s a cost-effective option to get started with QuickBooks Online.

This plan includes income and expense tracking, invoicing, and receipt capture. For businesses with limited accounting needs, it helps streamline financial tasks while avoiding unnecessary complexities. At its core, Simple Start offers:

- Income and expense tracking to give you a clear snapshot of your financial health.

- Basic reporting tools that help you understand profit and loss.

- The ability to send invoices and accept payments online, making cash flow management simpler.

But let’s be honest—if you plan on scaling soon or need multiple users, this plan might feel limiting. You’ll only have access to a single user, which is fine for individuals, but not for growing teams.

What’s Included in the Essentials Plan

The Essentials plan (€27) builds upon Simple Start with added features that cater to businesses needing more flexibility, especially when collaborating with team members. If you’re hiring or managing multiple projects, this plan might be for you.

Key benefits of the Essentials plan include:

- Access for up to 3 users, making collaboration between you and your accountant easy.

- Bill management to track what’s due, so you never miss payment deadlines.

- Time-tracking tools that help monitor hourly tasks and improve invoicing accuracy.

In my experience, if you’re managing vendor payments or multiple contractors, Essentials delivers excellent value for its cost. The plan bridges the gap between individual operators and small business owners looking for more robust tools.

One thing to note: If you’re dealing with inventory or complex reporting, you may outgrow Essentials fast and need to upgrade.

QuickBooks Online Plus: Key Benefits and Pricing

The Plus plan (€38) is where things get serious. This plan is tailored for small-to-medium-sized businesses with diverse financial tracking needs, including inventory and project profitability.

Here’s what sets it apart:

- Inventory tracking: You’ll have real-time updates on product availability.

- Project tracking: Easily track income and expenses per project, which is essential for service-based businesses.

- Access for up to 5 users, making collaboration across departments seamless.

From what I’ve seen, businesses with multiple revenue streams or those managing physical products benefit the most from Plus. It’s a bit pricier, but the added flexibility and reporting capabilities justify the cost.

For example, imagine running a growing online store. You’ll appreciate the ability to track inventory and link costs directly to your sales. That’s where Plus becomes an asset.

Advanced Plan Pricing and Its Features

If you’re looking for premium features, the Advanced plan (€70) is the top-tier offering of QuickBooks Online. This plan is designed for larger businesses or those with complex needs, and yes, it does come with a higher price tag—but it could be worth it.

Advanced plan highlights include:

- Customized financial reports tailored to your business.

- Access for up to 25 users, allowing broader collaboration.

- Automated workflows to streamline repetitive tasks.

- Dedicated account manager, giving you personalized support when you need it.

I believe Advanced is ideal for businesses juggling multiple projects, departments, or revenue streams. For instance, if your company is scaling quickly, you’ll benefit from its robust reporting and automation features.

However, keep in mind that unless your business requires extensive reporting or frequent collaboration among large teams, Advanced may feel like overkill. If you’re paying for features you won’t use, consider the Plus plan instead.

Pro Tip: If you’re unsure which plan to choose, start with Simple Start or Essentials. You can always upgrade as your business grows. On the other hand, if you’re already scaling, investing in the Plus plan could save you time and effort down the road.

What’s New With QuickBooks Online Pricing in 2025?

QuickBooks Online pricing has seen some updates this year, making it important to understand what’s changed. From adjusted subscription fees to new features, these updates can impact your decision to invest in a plan that fits your business.

Changes in Pricing Tiers and Subscription Fees

If you’ve been using QuickBooks Online, you’ve probably noticed the price adjustments. But are these changes reasonable or frustrating?

For 2025, QuickBooks Online introduced slight fee increases across most plans. The Simple Start plan saw a modest rise, but larger plans like Plus and Advanced had more significant changes. Why the difference? QuickBooks focuses on enhancing services for mid-sized businesses, especially with new features that improve functionality.

Let’s break down the reason behind this:

- Rising operating costs: QuickBooks claims these adjustments reflect improvements to automation and AI-powered accounting.

- Increased demand for collaboration tools: Plans that support larger teams saw a more substantial jump due to collaboration-friendly upgrades.

- Customization perks: QuickBooks Plus and Advanced now come with better project management and customization options, which factor into pricing.

While the pricing shift isn’t ideal for everyone, businesses that rely on QuickBooks daily may feel the added features offset the cost. However, small business owners on tight budgets could find the changes discouraging.

Are There Any Hidden or Additional Costs?

No one likes surprises, especially when it comes to billing. So, are there hidden costs tied to QuickBooks Online pricing that could catch you off guard?

From my experience, QuickBooks Online has several optional services that can increase your overall expenses, such as:

- Payroll services: Not included in standard pricing, payroll integration can cost extra depending on the level of functionality you need.

- Third-party app integrations: Some add-ons or integrations through the app marketplace come with separate fees.

- Credit card processing fees: If you’re accepting payments through QuickBooks, transaction fees may apply and vary depending on the payment processor.

The good news? These aren’t necessarily hidden—they’re just not always made clear upfront. QuickBooks does provide breakdowns when you’re signing up, but many users miss them while rushing through the setup.

Here’s what I suggest: review your monthly invoices carefully. Some users have reported being charged for extra services they didn’t intend to activate, like advanced payroll features or multi-user upgrades. A quick double-check can save you unnecessary charges.

Updated Features Justifying the Price Increase

So, what’s new this year that justifies paying more for QuickBooks Online? The updates aren’t just about higher prices—they aim to offer better value with advanced tools.

One key addition is enhanced reporting and analytics. If you’ve struggled with generating detailed financial reports in the past, 2025’s improvements are worth noting. Plus and Advanced users can now access deeper insights into profitability, cash flow, and expenses.

Other noteworthy updates:

- AI-powered automation: QuickBooks has invested in automation that reduces repetitive tasks. For example, categorizing expenses and reconciling transactions is now quicker and more accurate.

- Improved mobile experience: The mobile app now allows for more functions, like invoice approvals and payroll processing, making accounting on the go much smoother.

- Advanced multi-currency support: If you’re handling international transactions, you’ll appreciate the refined system that simplifies foreign currency tracking.

These updates aim to reduce manual work and help business owners focus on strategy. While this value proposition appeals to larger businesses, smaller firms might wonder if the features justify the added costs.

Pro Tip: If you’re debating whether the updates are worth it, consider how often you rely on features like project tracking or custom reporting. If they’re essential, the price hike may be a worthwhile investment. If not, it’s worth exploring whether the Simple Start or Essentials plan can meet your needs without overpaying.

Comparing QuickBooks Online to Competitors

When considering QuickBooks Online pricing, it’s essential to evaluate how it measures up against key competitors. Let’s see how it performs compared to Xero and FreshBooks, and which plan delivers the best value for small businesses.

How QuickBooks Online Pricing Stacks Against Xero

Both QuickBooks Online and Xero are heavyweights in the accounting world. But does QuickBooks’ pricing offer better value, or does Xero win when it comes to affordability and features?

QuickBooks Online generally comes with higher subscription fees, particularly for its Plus and Advanced plans. On the other hand, Xero offers more competitive pricing with tiered plans that include multi-user access at no extra cost. For businesses with multiple users, Xero may initially seem like the more budget-friendly option.

However, QuickBooks compensates with superior features:

- Better reporting capabilities: QuickBooks excels in customizable reporting, while Xero’s reports are often more basic and require third-party apps for advanced options.

- Robust inventory management: QuickBooks offers built-in inventory tracking with the Plus plan, whereas Xero requires integrations to achieve similar functionality.

- More extensive integration options: QuickBooks integrates seamlessly with industry-specific software, making it ideal for businesses needing flexibility.

While Xero’s lower-cost structure appeals to startups, QuickBooks justifies its pricing through its superior automation and scalability. If you plan on expanding your business, QuickBooks could save you from switching platforms in the future.

QuickBooks Online vs FreshBooks: Cost vs Value

FreshBooks is often seen as the go-to accounting software for freelancers and small service-based businesses. But how does QuickBooks Online pricing compare in terms of what you get for your money?

FreshBooks offers cheaper entry-level plans, often costing less than QuickBooks’ Simple Start or Essentials plans. However, the trade-off lies in features and scalability. QuickBooks provides more robust capabilities, such as project tracking, payroll integration, and inventory management, which FreshBooks lacks.

Here’s a breakdown of their key differences:

- Expense management: QuickBooks offers automated categorization and real-time tracking, while FreshBooks requires more manual input, especially for complex finances.

- User access: FreshBooks limits user access based on the plan, making QuickBooks more appealing for businesses with growing teams.

- Reporting depth: QuickBooks delivers advanced financial reports like cash flow analysis and profit/loss summaries, which are limited in FreshBooks.

I believe FreshBooks is an excellent choice for independent contractors who need simple invoicing and expense tracking. But for businesses managing growth, QuickBooks is well worth the higher price due to its long-term functionality.

Which Plan Offers the Best Return for Small Businesses

With multiple competitors and various pricing plans, choosing the right plan is often about balancing cost with features. So, which QuickBooks Online plan offers small businesses the best bang for their buck?

For most small businesses, the Plus plan provides the ideal mix of affordability and functionality. It includes inventory tracking, project profitability tracking, and financial reports that small business owners often need as they scale. The Essentials plan is a good entry point for those with basic needs, but many outgrow it within a year due to its limited functionality.

Here’s how you can decide:

- If you’re a freelancer or sole proprietor, Simple Start is your most affordable option.

- For businesses managing multiple vendors or projects, Essentials works but may feel limited.

- Companies with inventory and project tracking needs will benefit from Plus.

- Large businesses with complex workflows should opt for Advanced.

Ultimately, small businesses seeking long-term value should choose a plan that aligns with their growth projections. While QuickBooks Online pricing may initially seem high, the ability to scale seamlessly and access powerful tools often outweighs the cost.

Pro Tip: If you’re torn between QuickBooks and its competitors, start with a trial period. Both Xero and FreshBooks offer free trials, and testing these platforms alongside QuickBooks will help you identify which features matter most for your specific needs.

Is QuickBooks Online Worth the Cost for Small Businesses?

For many small business owners, the cost of QuickBooks Online can seem high. However, it often offers long-term benefits that outweigh the price. Still, some cases may reveal situations where it’s not the best fit. Let’s explore whether QuickBooks Online is worth the investment.

Key Advantages of Investing in QuickBooks Online

QuickBooks Online has built a reputation as a go-to tool for managing business finances, and for good reason. Small businesses, freelancers, and growing teams benefit from its intuitive interface, detailed reporting, and seamless integrations.

- Scalable plans for growing businesses: As your business grows, QuickBooks can grow with you. Starting with the Simple Start plan, you can upgrade to Essentials or Plus without major disruptions.

- Automation that saves time: Tasks like bank reconciliations, expense categorization, and invoicing are automated, helping you cut down on manual errors and time-consuming data entry.

- Comprehensive financial reporting: QuickBooks’ ability to generate profit and loss statements, cash flow reports, and detailed balance sheets ensures you’re always informed about your business’s financial health.

- Mobile accessibility: The mobile app allows you to handle essential tasks on the go, including sending invoices, accepting payments, and tracking expenses.

In my experience, small businesses dealing with complex finances or handling multiple revenue streams benefit most from QuickBooks Online. The flexibility to scale and access advanced reporting as needed means you don’t have to switch to a different accounting platform when you expand.

Scenarios Where It May Be Overpriced

Although QuickBooks Online is a powerful tool, it may not be the right fit for every business—especially those with simple needs or limited budgets. For some, the cost can feel unnecessary, particularly when less expensive options exist.

Consider these situations:

- Freelancers or sole proprietors with minimal transactions: If you only need to track a few expenses or issue occasional invoices, the Simple Start plan might feel like overkill, and alternatives like FreshBooks or Wave could serve you just as well.

- Businesses without inventory or project tracking needs: If you’re not managing inventory or tracking job profitability, paying for features in the Plus or Advanced plans may not be necessary.

- Non-profits or organizations with strict budgets: Budget-conscious organizations often find QuickBooks Online’s monthly fees too high, especially when additional services like payroll or tax filings are factored in.

I suggest evaluating your current and future needs carefully. If you’re not using the bulk of the included features, you might be overpaying. However, businesses that outgrow basic software often find themselves needing QuickBooks later down the road, which makes starting here a proactive choice for some.

User Reviews on Pricing vs Benefits

User feedback plays a crucial role in determining whether QuickBooks Online pricing is justified. Many small business owners praise its ease of use, automation, and reliability, but some are quick to criticize the cost, particularly for premium plans.

- Positive feedback: Users frequently highlight the value of built-in automation and the availability of various tools within a single platform. For instance, business owners using QuickBooks Online Plus often appreciate the ability to track inventory without additional software.

- Concerns about hidden costs: Some users note that QuickBooks’ advertised pricing doesn’t always reflect what they end up paying. Features like payroll, payment processing, and third-party integrations often carry extra charges.

- Mixed reviews on scalability: While many small businesses appreciate QuickBooks’ scalability, others feel the jump in pricing between plans is steep. Those who transition from Essentials to Plus, for example, often mention the added cost as a challenge.

From what I’ve gathered, users with multi-faceted business needs tend to view QuickBooks Online as worth the investment despite its cost. On the flip side, businesses needing only basic bookkeeping functions find its pricing harder to justify.

Pro Tip: If you’re unsure about committing to QuickBooks Online, take advantage of free trials or opt for the lowest-tier plan first. As your business grows, you can upgrade to access more features and avoid paying for functionality you don’t need upfront.

Cost-Saving Tips for Using QuickBooks Online

If you’re concerned about QuickBooks Online pricing but still need its features, there are smart ways to lower your costs without sacrificing functionality. Let’s explore some tips to help you save money and get maximum value from your subscription.

Unlocking Discounts and Promotions

Many users don’t realize that QuickBooks Online frequently offers discounts, promotions, and limited-time deals that can significantly lower your costs—especially during the sign-up phase.

- Seasonal offers: QuickBooks often runs sales around tax season, Black Friday, or major business events. These discounts can range from 30% to 50% off for the first year.

- Bundle deals: If you also need payroll or tax services, bundling them with your QuickBooks Online plan could help you get a discounted rate.

- Partner promotions: QuickBooks partners with banks, accounting firms, and software providers to provide exclusive deals. If you’re working with an accountant, ask whether they can help you access lower pricing.

You might be wondering whether these discounts are worth pursuing. In my experience, they are, especially for new users or those upgrading to a higher-tier plan. For instance, locking in a 12-month discount when you’re just starting out could give you time to build revenue while paying less.

Tip: Keep an eye on QuickBooks’ official website or mailing list for offers, and consider signing up when deals are active.

Choosing the Right Plan to Avoid Overpaying

One of the most effective ways to save money with QuickBooks Online is to pick the right plan. Many small businesses end up paying for features they don’t actually need, which leads to overpaying.

- Assess your current needs: If you’re a sole proprietor or freelancer, the Simple Start plan is often sufficient. It covers basic needs like invoicing and expense tracking without the extra cost of project tracking or multi-user access.

- Avoid jumping to higher plans prematurely: While it may be tempting to go for the Plus or Advanced plan due to their additional features, take a step back and evaluate whether you’ll actually use those options right away.

- Review your usage annually: As your business grows, your accounting needs may change, but that doesn’t always mean you need to upgrade. Regularly reviewing what you use ensures you’re not overpaying for unused features.

I suggest creating a list of your must-have features before deciding on a plan. In many cases, starting with Essentials or Simple Start can help you save significantly, especially in the early stages of your business.

Integrations That Help You Get More for Your Money

QuickBooks Online integrates with a wide range of third-party apps, many of which can save you time and reduce the need for additional software expenses. Instead of paying for multiple platforms, using integrations allows you to consolidate functions under one system.

- Payment processing apps: Tools like PayPal, Stripe, and Square integrate directly with QuickBooks, saving you the cost of hiring additional help to reconcile payments.

- Time-tracking software: Instead of paying for separate time-management systems, apps like TSheets (now QuickBooks Time) connect seamlessly with QuickBooks for more accurate payroll and billing.

- Expense management: Apps like Expensify and Hubdoc allow you to scan receipts and manage expenses effortlessly, reducing the time you spend on manual data entry.

By using these integrations, you’ll avoid paying for standalone services while still accessing the tools you need. In my opinion, this is one of the smartest ways to maximize value and ensure your QuickBooks Online subscription is worth the cost.

Pro Tip: If you’re already using third-party apps, check their integration compatibility with QuickBooks Online. This can help you streamline operations and prevent unnecessary software subscriptions.

Exploring Free and Low-Cost Alternatives

For businesses looking to save money, free and low-cost accounting software can be tempting alternatives to QuickBooks Online. But are they capable of meeting your needs, or does sticking with QuickBooks provide long-term advantages? Let’s explore the options and when it makes sense to switch or stay.

Free Accounting Software Options to Consider

Many free accounting software options are available for small businesses with basic needs, such as freelancers, startups, or nonprofits. These tools offer core functions like invoicing and expense tracking without the hefty monthly fees.

Wave Accounting is one of the most popular free solutions. It’s ideal for businesses with simple financial processes. It includes features like invoice generation, payment tracking, and basic reporting, making it a common choice for freelancers and independent contractors.

Another option is Zoho Books (free version), which provides core features for businesses with minimal transactions. You can manage bank reconciliations, invoices, and expenses without paying extra. For businesses already using Zoho’s other products (like CRM or email management), the integration is seamless.

However, free software does have its limitations:

- Limited scalability: Free options usually lack multi-user access, inventory management, and detailed reporting.

- Minimal support: You may need to rely on community forums instead of dedicated customer support.

- Fewer integrations: Many free platforms don’t integrate well with other software, which can be frustrating as your business grows.

While free solutions can help you cut costs, they’re best suited for businesses with straightforward accounting needs.

When to Stick With QuickBooks Despite the Higher Cost

It’s understandable to consider alternatives when QuickBooks Online pricing feels expensive. However, some scenarios make sticking with QuickBooks a smarter long-term decision.

- Growing businesses: If you anticipate growth, QuickBooks Online’s scalability ensures that you won’t need to switch to a different platform when your needs evolve. Moving from Simple Start to Plus or Advanced is much easier than migrating to a new accounting system entirely.

- Businesses needing advanced reporting: QuickBooks offers robust reports, including cash flow statements, tax summaries, and profitability tracking. These are often missing in free alternatives, making QuickBooks indispensable for strategic financial planning.

- Multi-user access: For businesses that require collaboration between team members, accountants, and financial advisors, QuickBooks provides role-based permissions, something free platforms typically don’t offer.

From what I’ve seen, businesses with more complex workflows or long-term growth plans often find QuickBooks worth the investment. Skipping it initially may save money, but it could lead to costly migrations or feature gaps later on.

Evaluating Usability, Scalability, and Long-Term Value

Cost savings are important, but they aren’t the only factor to consider when choosing between QuickBooks and free alternatives. Usability and long-term value play a crucial role in ensuring your accounting software grows with your business.

- Usability: QuickBooks’ intuitive design and automation features reduce the learning curve for small business owners. Free options, while straightforward, may lack automation, requiring more manual entry and oversight.

- Scalability: QuickBooks’ tiered pricing structure allows you to add features like payroll, project tracking, and advanced reports as needed. Free software often caps usage or lacks advanced functionality, making scaling difficult.

- Long-term value: While free tools offer immediate cost savings, the efficiency gained from QuickBooks’ automation, integrations, and reporting can deliver long-term ROI. For example, automating tax filings and expense categorization can save hours of work, which may offset the higher monthly cost.

Imagine running an online retail store that starts with minimal inventory. A free option might work initially, but as sales increase and you require real-time inventory tracking and profit margin analysis, you’ll need more comprehensive tools. Upgrading to QuickBooks Online Plus at that point may feel like a natural progression, rather than a disruption.

Pro Tip: If you’re unsure about switching or committing, test both options. Many paid and free software providers offer trial periods, allowing you to evaluate their usability and fit before making a long-term decision.

Final Verdict on QuickBooks Online Pricing in 2025

QuickBooks Online pricing in 2025 has sparked mixed opinions among business owners, but understanding its value depends on your unique needs. Let’s review whether it’s still the right choice, how its long-term benefits stack up, and what factors to consider before subscribing.

Is It Still the Best Choice for Your Accounting Needs?

With its robust tools, seamless integrations, and reputation as a reliable accounting solution, QuickBooks Online remains a leading option for businesses of various sizes. However, the decision to stick with it or explore alternatives depends on your requirements.

Many businesses continue to invest in QuickBooks due to its powerful reporting features, including profit/loss analysis and real-time cash flow updates. These reports allow small business owners to make informed decisions, track progress, and plan for growth. For businesses that rely heavily on accurate financial insights, this alone makes QuickBooks invaluable.

However, QuickBooks Online may not be ideal for businesses with minimal financial needs. Freelancers and sole proprietors who only need simple income and expense tracking might find cheaper options like Wave or FreshBooks better suited. If you’re only sending a few invoices monthly, the advanced functionality of QuickBooks could feel excessive.

On the flip side, if your business involves project tracking, inventory management, or collaboration across teams, QuickBooks Online easily outperforms competitors. The scalability of its features ensures that you won’t outgrow the software as you expand.

Consider this: If you’re unsure whether QuickBooks is overkill or essential, assess your financial processes. Businesses with frequent transactions, payroll needs, or tax filing responsibilities often find it indispensable.

Weighing Costs, Features, and Long-Term ROI

The rising cost of QuickBooks Online can deter many small businesses. However, looking at the bigger picture helps put this investment into perspective. The time saved through automation, the reduction in manual errors, and the convenience of having everything centralized contribute to its overall return on investment.

Let’s break it down:

- Time-saving automation: Features like automatic bank reconciliations, expense categorization, and recurring invoices save hours of manual work each month.

- Scalable pricing tiers: While the monthly cost may seem steep, the flexibility to upgrade plans means you’re paying only for what you need as your business evolves.

- Fewer financial errors: By automating data entry and tax calculations, QuickBooks minimizes costly mistakes that can arise from manual processes.

Some users find that QuickBooks pays for itself through efficiency and accuracy. If you’re managing high transaction volumes or multiple revenue streams, its automated features can free you from repetitive tasks and allow you to focus on strategic growth. However, for businesses that won’t benefit from these time-saving tools, the cost may outweigh the convenience.

In my experience, weighing the initial investment against potential savings in time and resources is key. If QuickBooks can eliminate hours of bookkeeping work, it’s likely worth the price.

Key Takeaways to Decide Whether to Subscribe

If you’re on the fence about subscribing to QuickBooks Online, there are a few important factors to keep in mind:

- Assess your current needs: Evaluate whether you require advanced features like project tracking, payroll, or custom reporting. If your accounting needs are basic, consider starting with free or low-cost alternatives.

- Plan for future growth: Businesses expecting to scale should prioritize a platform that offers scalability without major disruptions. QuickBooks Online fits this role well, with options to upgrade plans as your needs grow.

- Calculate potential savings: Think beyond the monthly fee and consider the long-term value in terms of time saved, fewer errors, and streamlined financial processes.

- Try the free trial: Before making a commitment, test QuickBooks using the free trial. This allows you to explore its features and see how they fit into your daily operations.

Whether QuickBooks Online pricing feels justified ultimately comes down to how much you value its features and whether they directly impact your business efficiency.

Pro Tip: If your business is growing rapidly or you’re managing complex finances, investing in QuickBooks Online could prevent future headaches. But if your current processes are simple, testing free alternatives can help you avoid unnecessary costs.