Table of Contents

Freelance finance isn’t just about tracking invoices and paying taxes—it’s about learning how to build consistent, high-value income on your own terms.

If you’ve ever wondered how some freelancers scale from unpredictable paychecks to steady, thriving businesses, this guide will show you exactly how to make that shift.

From managing cash flow to setting premium rates and investing strategically, we’ll dive into the systems and habits that turn freelancing into financial freedom.

Understanding The Foundation Of Freelance Finance

Before you can build real wealth as a freelancer, you need to understand how money actually works in a freelance ecosystem.

Freelance finance isn’t just about getting paid—it’s about designing a financial system that supports your growth, flexibility, and peace of mind.

Defining What High-Value Income Really Means

High-value income goes beyond earning more—it’s about earning smarter. It means generating revenue that scales with your expertise, not just your time.

For example, a copywriter who charges $1,500 for a landing page that converts at 10% is earning high-value income compared to one billing $50 per hour.

There are three dimensions to high-value freelance income:

- Scalability: Your income grows without necessarily working longer hours.

- Sustainability: You can maintain your lifestyle without financial burnout.

- Predictability: You can forecast your income months ahead with confidence.

I often advise freelancers to map out their income-to-effort ratio—a simple way to measure if you’re undercharging.

If a project takes you 10 hours but brings long-term client results, your rate should reflect the value delivered, not the time spent.

Shifting From Hourly Work To Outcome-Based Earnings

Hourly work is where most freelancers start—but it’s also where most get stuck. Outcome-based pricing flips the model: instead of selling your time, you sell a result.

Let’s say you’re a designer. Instead of charging $40/hour, charge $1,000 for a complete brand identity package that helps clients achieve a specific goal (like increasing conversions).

The value lies in what you create, not how long it takes you.

Here’s how to transition:

- Track outcomes: Collect client testimonials or performance data to show results.

- Build packages: Bundle services around outcomes (e.g., “Brand Starter Kit”).

- Communicate ROI: Explain how your work drives measurable results—speak in terms of profit, leads, or growth.

Clients are willing to pay more when they clearly understand the transformation you deliver.

Building A Financial Mindset For Long-Term Growth

Money mindset is the difference between surviving and thriving. Freelancers who see themselves as business owners make decisions based on strategy, not survival.

Adopt habits that reinforce financial stability:

- Pay yourself first: Move a percentage of every payment into savings or investments immediately.

- Think like a CFO: Review your income and expenses weekly using tools like QuickBooks Self-Employed or Wave.

- Invest in skills that scale: Courses, tools, and coaching that raise your earning potential are business investments, not expenses.

I believe every freelancer should set quarterly financial goals—not just income targets, but profit and savings milestones too. It builds confidence and a sense of control that many freelancers lack early on.

Creating A Reliable Income Structure As A Freelancer

Freelance income can feel unpredictable at first, but with structure, it becomes manageable—even stable.

Think of your freelance business like a portfolio: diverse, recurring, and strategically balanced.

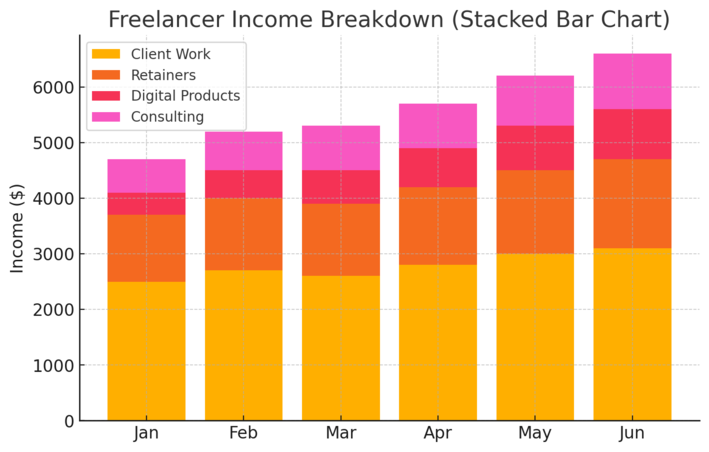

How To Diversify Income Streams For Stability

Relying on one or two clients is risky. If one disappears, so does your income. Diversifying income gives you resilience during slow months.

Here are the most practical ways:

- Client work: Your primary revenue base—keep this consistent.

- Digital products: Create eBooks, templates, or Notion dashboards.

- Affiliate income: Promote tools you genuinely use (like Kit (formerly ConvertKit), Canva, or Surfer SEO).

- Consulting or coaching: Leverage your expertise one-to-one.

I suggest maintaining at least three income channels—one active, one semi-passive, and one that builds long-term value. This approach smooths cash flow and boosts confidence.

Building Recurring Revenue Through Retainer Clients

Retainers are the freelancer’s version of a paycheck. They ensure consistent income while maintaining flexibility.

To secure retainers:

- Offer monthly deliverables: For example, 4 blog posts or 10 design edits per month.

- Discount slightly for commitment: Offer a small incentive (5–10%) for signing a 3–6 month contract.

- Automate billing: Use tools like FreshBooks or Stripe Billing to schedule invoices.

For example, I once helped a social media freelancer shift three of her clients to $1,200/month retainers. She went from unpredictable weeks to earning $3,600/month consistently—freeing her to focus on growth.

Setting Up A Predictable Payment Schedule

Cash flow chaos often comes from irregular payments. A predictable system reduces stress and improves client relationships.

To establish it:

- Set payment milestones: 50% upfront, 50% on completion (or monthly for ongoing work).

- Use automated invoicing: Platforms like Bonsai and Payoneer handle reminders.

- Charge late fees: Include them in contracts to discourage delays.

I recommend creating a payment calendar to visualize your expected income each month. It helps plan expenses, savings, and investments strategically—like a true business owner.

Pricing Strategies To Maximize Profitability

Freelance pricing isn’t just math—it’s psychology, positioning, and strategy. The goal is to price confidently while delivering undeniable value.

Calculating Your True Hourly Rate For Freelance Finance

Most freelancers underprice because they forget about non-billable hours—admin work, emails, revisions, and marketing. To find your real rate, use this formula:

(Desired Annual Income + Expenses + Taxes) ÷ Billable Hours = True Hourly Rate

For instance, if you aim to earn $80,000, have $15,000 in expenses, and estimate 1,200 billable hours per year: (80,000 + 15,000 + 20% for taxes) ÷ 1,200 = roughly $95/hour.

I often advise rounding up to reflect your value and experience. Remember, the number isn’t just for clients—it’s for you, to anchor your worth.

Using Value-Based Pricing To Charge What You’re Worth

Value-based pricing focuses on client results rather than your time. It’s ideal for skilled freelancers who can deliver measurable impact.

To apply it effectively:

- Understand client goals: What’s the result they care about most—sales, engagement, conversions?

- Estimate financial impact: If your work could bring them $10,000 in revenue, charging $2,000 is completely fair.

- Communicate ROI clearly: Show how your solution pays for itself.

For example, a copywriter who improves a client’s landing page conversion by 5% on $100,000 ad spend adds $5,000 in value. Charging $1,500 is reasonable and still profitable for the client.

When And How To Raise Your Freelance Rates

Raising rates is a key milestone in freelance finance—and it should happen strategically, not emotionally.

Here’s a step-by-step approach:

- Upgrade your positioning: Update your portfolio, testimonials, and service descriptions.

- Communicate confidently: Notify clients ahead of time (e.g., “Starting next quarter, my rates will adjust to reflect the value and results I provide”).

- Add value before increasing price: Deliver above expectations for a few months—make the raise undeniable.

A good benchmark is to increase your rates every 6–12 months or after every major skill upgrade.

I’ve seen freelancers double their income in a year just through steady positioning and pricing adjustments.

Managing Cash Flow Like A Pro

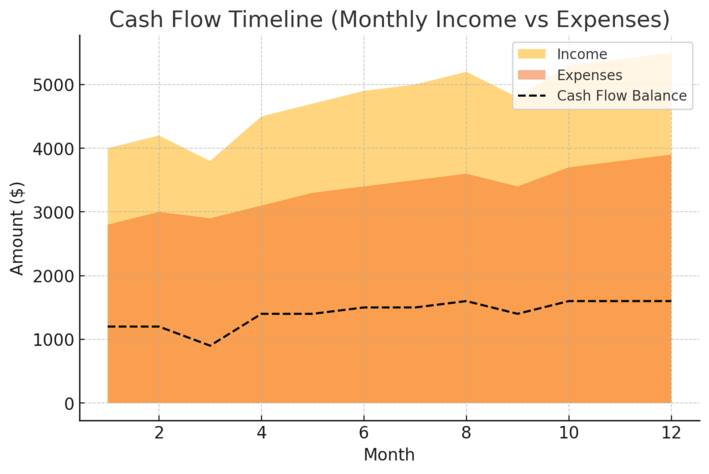

Cash flow is the heartbeat of freelance finance. When it’s steady, you can focus on creative work. When it’s chaotic, even the best projects feel stressful.

Managing cash flow like a pro means setting up systems that make money movement predictable, even when your workload isn’t.

Setting Up A Freelance-Friendly Budget

Budgeting as a freelancer isn’t about restriction—it’s about clarity. You need a system that separates personal and business finances and shows where your money goes each month.

I recommend using the 50/30/20 rule, adapted for freelancers:

- 50% for essentials: rent, bills, taxes, and tools like Canva, Grammarly, or hosting.

- 30% for growth: courses, software upgrades, or marketing.

- 20% for savings and investments: future-proofing your finances.

Use tools like YNAB (You Need a Budget) to categorize spending. You can easily set up categories like “client expenses,” “software,” or “retirement fund.” The UI lets you drag and drop funds between categories, giving real-time visibility into your budget.

I suggest setting up two checking accounts—one for income deposits and one for taxes and savings. This small separation keeps you from accidentally spending money earmarked for the IRS or long-term goals.

Managing Irregular Income With Financial Cushioning

Freelancers often face “feast and famine” cycles. The secret to breaking them isn’t earning more—it’s cushioning your income.

Here’s a structure I’ve seen work consistently:

- Create a buffer account: Aim to save at least 2–3 months of expenses in a high-yield savings account.

- Pay yourself a salary: Transfer a fixed amount monthly from your income account, even when you earn more.

- Save during high months: When you land a big project, set aside 30–40% of that income for lean periods.

For example, if you earn $8,000 in one busy month, pay yourself your usual $4,000 and park the rest in your buffer. Next time work slows, your “salary” continues without stress.

Financial cushioning creates emotional stability too—you stop operating from fear and start planning strategically.

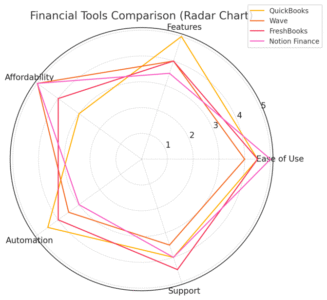

Tools That Simplify Tracking Income And Expenses

Tracking every dollar helps you spot leaks, plan taxes, and stay organized. The right tools make this effortless.

Some I’ve personally used and recommend:

- QuickBooks Self-Employed: Connects directly to your bank and auto-categorizes transactions. The dashboard even estimates quarterly taxes.

- Wave Accounting: Free and ideal for solo freelancers; tracks income, expenses, and invoices in one place.

- Toggl Track + Google Sheets: If you prefer manual tracking, Toggl logs your time and Google Sheets organizes income by project or client.

To make it easier, block 20 minutes each Friday to review finances. It’s short enough to keep up with, yet powerful enough to prevent month-end chaos.

Smart Tax Planning For Freelancers

Taxes can feel overwhelming for freelancers, but they don’t have to. Smart planning turns tax season into a formality instead of a panic-driven scramble.

Setting Aside Taxes Without Stress

One of the biggest mistakes I see is treating tax money as income. I suggest setting aside 25–30% of every payment for taxes immediately after getting paid.

Here’s how to automate it:

- Create a separate tax savings account (most online banks like Ally or Revolut make this easy).

- Use payment rules in QuickBooks or Bonsai to automatically allocate 30% of incoming funds into that account.

- Set reminders for quarterly estimated tax payments (April, June, September, and January in the U.S.).

This small automation keeps you compliant and calm when tax deadlines approach.

Using Accounting Tools To Stay Organized

Accounting tools remove 90% of the stress from tax prep. They keep receipts, expenses, and income records all in one place—so you’re not hunting for PayPal statements in April.

A few great ones for freelance finance:

- FreshBooks: Simplifies invoicing, expense tracking, and tax summaries. It even integrates with Gusto for managing self-employment payroll.

- Xero: Ideal for freelancers scaling to small teams—lets you reconcile accounts and create real-time financial reports.

- Keeper Tax: An app that scans transactions and finds deductible expenses (like domain renewals or coworking fees).

When I first used Keeper Tax, it found over $1,200 in deductions I’d missed manually. That alone covered my accountant’s fee.

Hiring A Tax Professional Vs. Doing It Yourself

This decision depends on your workload and comfort level with numbers.

Hire a professional if:

- You earn over $75,000/year or have multiple income sources.

- You manage overseas clients or pay international taxes.

- You want to optimize deductions for home office, equipment, or retirement contributions.

DIY works fine if:

- Your income is under six figures.

- You use accounting software that generates tax-ready reports.

Personally, I advise hiring a tax professional at least once—to understand your deductions and structure.

After that, you can decide if handling it yourself makes sense. A one-time $400 consultation can save thousands in mistakes.

Building Long-Term Financial Security

Freelance freedom means nothing without long-term security. Building wealth as a freelancer is about protection, investment, and foresight—not just hustle.

Why Freelancers Need Emergency Funds

An emergency fund is your safety net. Unlike traditional employees, freelancers don’t get sick pay or job security, so savings must fill that gap.

I recommend saving at least 3–6 months of living expenses in a separate account you can access instantly.

To build it efficiently:

- Set up automatic transfers from your main account.

- Save a fixed percentage (5–10%) of every payment.

- Use high-yield accounts like Marcus by Goldman Sachs or SoFi Money for interest growth.

I once had a client project delayed three months. My emergency fund covered rent and bills without panic. It wasn’t luxury—it was survival with dignity.

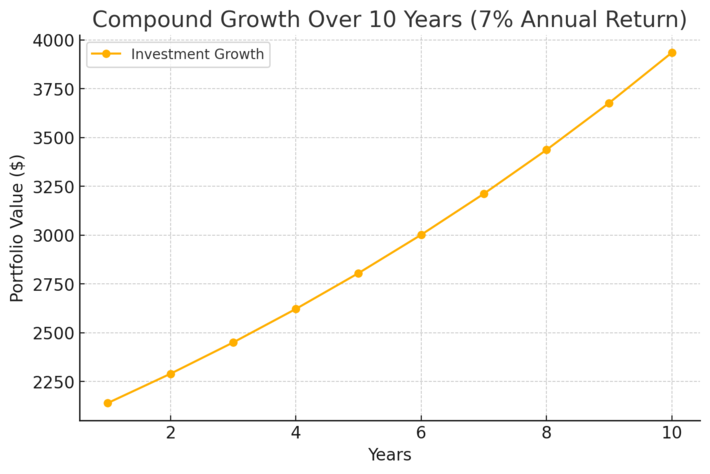

Investing Strategies That Build Wealth Over Time

Freelancers can (and should) invest like any entrepreneur. Start small but consistent.

Some simple strategies:

- Index Funds: Low-risk and beginner-friendly. Use platforms like Vanguard or Fidelity.

- Roth IRA or SEP IRA: Tax-advantaged retirement accounts for self-employed professionals.

- Automated investing apps: Tools like Betterment or Wealthfront manage portfolios for you.

The goal is consistency—automate weekly or monthly deposits. Even $100 a month compounds significantly over time.

A freelancer investing $200/month at 7% annual return could build over $240,000 in 30 years. That’s the quiet power of starting early.

Planning For Retirement Without An Employer

Without employer contributions, you have to create your own retirement safety net. Fortunately, freelancers have options.

- SEP IRA: Lets you contribute up to 25% of income, ideal for high earners.

- Solo 401(k): Offers both employee and employer contributions, doubling your saving potential.

- Traditional IRA: Tax-deductible contributions for moderate earners.

I suggest comparing these plans using calculators on Fidelity or Charles Schwab. For example, if you earn $80,000/year, contributing 15% into a Solo 401(k) could save over $12,000 in taxes annually while building retirement savings.

Retirement planning might not feel urgent now—but it’s one of the most powerful ways to secure true freelance freedom.

Scaling Freelance Income Beyond Client Work

Once your freelance income becomes steady, the next step is to scale it. Relying only on client work limits both your income and time.

The real freedom in freelance finance comes from building assets—digital products, systems, and collaborations—that earn money even when you’re not actively working.

Creating Digital Products For Passive Income

Digital products turn your expertise into income that keeps generating long after the work is done. You create once, and it sells repeatedly.

You don’t need to be a tech genius to start.

Some easy entry points:

- Ebooks or guides: Package your knowledge in a 30–50 page PDF. For example, if you’re a social media manager, write a “30-Day Instagram Growth Plan” and sell it on Gumroad or Etsy.

- Templates: Tools like Notion, Canva, or Google Sheets make it easy to design plug-and-play templates clients love.

- Mini-courses: Use platforms like Teachable or Podia to record short, actionable lessons.

I suggest choosing a problem you’ve solved repeatedly for clients. That’s your product seed. If 10 clients paid you for it, there’s likely a wider market waiting.

The secret is automation: use Gumroad or ThriveCart to handle checkout and delivery automatically. Once it’s live, your role shifts from creator to marketer—promoting the product through email lists or your personal brand.

Offering Online Courses Or Consulting Services

Teaching what you know can become one of the most profitable ways to scale. The key difference: products serve many, consulting serves fewer—but at a higher rate.

To launch consulting:

- Identify your transformation—what do clients achieve after working with you?

- Create a 3–5 session package (instead of hourly calls).

- Use tools like Calendly + Stripe to automate bookings and payments.

For courses, start small. Record 3–5 short lessons using Loom or Zoom, upload them to Teachable or Thinkific, and price them between $99–$299. You can upgrade later based on feedback.

I once worked with a freelance designer who created a $129 course on “Brand Identity for Startups.” Within three months, it brought $3,800 in sales—without affecting her client schedule. That’s the beauty of scalable income.

Expanding Into Agency Or Collaborative Projects

If you’ve reached capacity with solo work, collaboration becomes your multiplier.

Start by forming partnerships with other freelancers who complement your skill set—like a writer teaming up with a designer or marketer. You can then pitch larger projects and split revenue fairly.

To scale further, consider building a small agency structure:

- Hire subcontractors for specific roles (e.g., SEO, copywriting, design).

- Use ClickUp or Notion to manage client tasks transparently.

- Automate onboarding using tools like Dubsado or HoneyBook.

I suggest starting small—manage 1–2 projects collaboratively before officially rebranding as an agency. This lets you refine workflows and client experience without overwhelming yourself.

Using Financial Tools To Optimize Growth

Financial tools are like your freelance team—they handle the boring parts so you can focus on creativity and strategy.

From budgeting to investing, the right stack can save hours and boost profitability.

Budgeting And Accounting Tools For Freelance Finance

Freelance finance depends on keeping numbers visible. The best tools automate the process and prevent financial surprises.

Top tools worth trying:

- QuickBooks Self-Employed: Tracks mileage, invoices, and tax estimates automatically. You can connect your bank accounts, and it organizes every transaction for year-end taxes.

- Wave Accounting: Free software that lets you send invoices, track payments, and view cash flow in one dashboard.

- Notion Finance Dashboard: For a custom approach, you can create your own income tracker using tables and formulas.

I use Notion’s “Income Tracker” template, where I log project names, payment dates, and expenses. It’s simple, visual, and flexible—especially if you like having control over your data.

Payment Platforms That Simplify Client Transactions

Getting paid should never be complicated. A smooth payment process keeps clients happy and ensures you’re not chasing invoices.

Reliable platforms include:

- PayPal Business: Fast and global, though fees can be higher. Works well for international clients.

- Wise (formerly TransferWise): Best for freelancers working with overseas clients—it offers real exchange rates and lower fees.

- Stripe: Great for recurring or retainer payments. You can embed payment links directly in proposals or invoices.

To make it seamless, I advise setting payment automation. For example, in Stripe, you can set up recurring billing under “Customers → Subscriptions → Add Plan,” so clients are charged automatically each month.

Investment Apps That Help Freelancers Build Wealth

Once your freelance income stabilizes, let your money start working for you. Investment apps simplify wealth building without needing financial expertise.

Consider these options:

- Betterment or Wealthfront: Automated investing platforms that build diversified portfolios for you.

- Robinhood or Fidelity: Good for freelancers who prefer hands-on investing in stocks or ETFs.

- Acorns: Rounds up spare change from purchases into investment accounts—a simple way to grow savings passively.

I believe investing early, even small amounts, builds discipline. You can start with as little as $50 per month and scale as your income grows.

Protecting And Growing Your Freelance Business

Protecting your freelance business is part of protecting your future. Legal, structural, and financial safeguards ensure your hard work doesn’t unravel because of one unexpected event.

Why You Need Business Insurance And Legal Protection

Freelancers often skip insurance until they need it—which is usually too late. A single lawsuit or lost file can cost thousands.

At minimum, consider:

- Professional liability insurance: Covers you if a client claims your work caused financial loss.

- General liability insurance: Protects against property damage or personal injury claims.

- Business equipment insurance: Useful if you rely on expensive tech or tools.

You can get affordable coverage through providers like Next Insurance or Hiscox. Setting up coverage usually takes under 20 minutes online.

Also, use simple legal protections: contracts and NDAs. Tools like HelloSign or Bonsai offer templates and e-signature workflows. Never start a project without one—it sets expectations and prevents disputes.

Setting Up A Business Structure For Tax Efficiency

As income grows, the right structure can save you significant tax money.

If you’re in the U.S., these are your main options:

- Sole Proprietor: Easiest to start but offers no legal protection.

- LLC (Limited Liability Company): Separates personal and business assets, often ideal for full-time freelancers.

- S-Corp: Lets you pay yourself a salary and dividends, reducing self-employment taxes.

I recommend using LegalZoom or Stripe Atlas to register your LLC—they guide you through the setup and even help with EIN applications.

When I switched to an LLC, my accountant estimated I saved roughly $3,000 in taxes annually. It’s a practical step once your yearly revenue passes $60,000.

Creating A Financial Backup Plan For Downturns

Freelancing isn’t immune to slow seasons or global downturns. Having a backup plan gives peace of mind when projects dry up.

You can build one in three steps:

- Create a six-month emergency reserve: Keep it liquid in a high-yield account.

- Develop backup offers: Maintain smaller, fast-turnaround services you can sell quickly when needed.

- Diversify client geography: Work with clients from different regions to protect against local recessions.

I suggest reviewing your backup plan twice a year. It’s like insurance for your income stability.

Developing Financial Habits That Drive Success

The final piece of freelance finance is habit-building. Consistency—not luck—is what keeps your finances strong year after year.

Tracking KPIs That Reflect True Financial Health

Freelancers often track revenue but overlook profit, expenses, or client dependency. I recommend setting up three simple KPIs (Key Performance Indicators):

- Profit margin: Net income ÷ total revenue. Aim for 60% or higher.

- Client concentration: No single client should represent more than 30% of income.

- Monthly cash flow: The difference between total income and total expenses.

You can visualize these KPIs in Google Sheets or Notion. Just create three columns—“Revenue,” “Expenses,” and “Profit Margin %”—and update them monthly. It takes 10 minutes and provides clarity most freelancers lack.

Automating Savings And Investments For Consistency

Automation removes the emotional friction from managing money.

You can set up:

- Automatic transfers to savings each time a payment arrives.

- Recurring investments through your brokerage or app.

- Scheduled invoices to ensure payments flow predictably.

For example, I use Wise to receive client payments, and once funds hit, I’ve automated 25% to go into my savings and 10% into my investment account. It’s the easiest discipline-builder I know.

Building A Money Management Routine That Sticks

The secret isn’t complexity—it’s consistency. A weekly money routine keeps your freelance finances under control.

Here’s what I recommend:

- Every Friday: Review income and expenses.

- Monthly: Reconcile your budget and update KPIs.

- Quarterly: Revisit pricing and business goals.

Over time, this simple rhythm transforms money management from a chore into second nature.

I believe mastering freelance finance isn’t just about income—it’s about freedom. When your systems, habits, and mindset align, you stop working for money and start letting money work for you.