Table of Contents

Some links on The Justifiable are affiliate links, meaning we may earn a small commission at no extra cost to you. Read full disclaimer.

Financial marketing solutions are no longer just about reaching new clients—they’re about earning their trust quickly.

In a world where people are skeptical of financial advice, how can a brand stand out as credible and reliable right from the start?

The answer lies in using the right mix of marketing strategies built on transparency, authority, and personalized engagement.

Let’s break down the most effective ways to build that trust fast and turn prospects into lifelong clients.

Build Credibility Through Transparent Branding

Trust starts with how a financial brand presents itself. In a field where clients are cautious and competitors are plenty, transparency isn’t optional—it’s your currency.

Craft Messaging That Reflects Integrity

People instantly sense when a brand’s tone feels rehearsed or manipulative. I suggest building messaging that focuses on truth over persuasion.

Instead of saying, “We’ll maximize your profits,” say, “We’ll help you make informed investment decisions.” This subtle shift prioritizes honesty and shows confidence without exaggeration.

Use your About page and homepage copy to reflect integrity. Share your origin story, highlight why you started your firm, and outline your guiding principles.

For example, a financial planner could write: “We believe financial confidence starts with education, not sales pressure.” That single line signals trustworthiness far better than industry buzzwords ever could.

Use Clear, Jargon-Free Communication

Clients don’t want to feel like they need a finance degree to understand you. Break down complex concepts into plain language.

For instance, instead of “liquidation of underperforming assets,” say, “selling investments that aren’t meeting your goals.”

A practical way to test this is to read your copy aloud. If it sounds like a conversation rather than a pitch, you’re on the right track.

I’ve seen brands use simple glossary sections or “explain like I’m five” blog posts to make their financial marketing more human—and it works.

Display Credentials, Certifications, and Partnerships

Professional validation builds confidence instantly. Display credentials such as CFP® (Certified Financial Planner), CFA (Chartered Financial Analyst), or partnerships with reputable institutions directly on your website and email signatures.

You can even add verification badges or “as seen in” media logos on your homepage.

According to Edelman’s Trust Barometer, 63% of consumers trust a brand more when it’s endorsed by recognized organizations. It’s not bragging—it’s assurance.

Share Client-Centric Values on All Channels

Every channel should reflect the same values. If you promote transparency on your website but sound overly aggressive in paid ads, the disconnect breaks trust.

Align tone, visuals, and messaging across your emails, social media, and landing pages.

Here’s a practical approach:

- Define your value pillars: e.g., honesty, education, and accessibility.

- Create a voice guide: outline how those values translate into tone and language.

- Audit your content quarterly: ensure it still mirrors your principles.

When every piece of communication reinforces your client-first mission, you create a brand that feels consistent—and consistency breeds trust.

Leverage Content Marketing to Educate, Not Sell

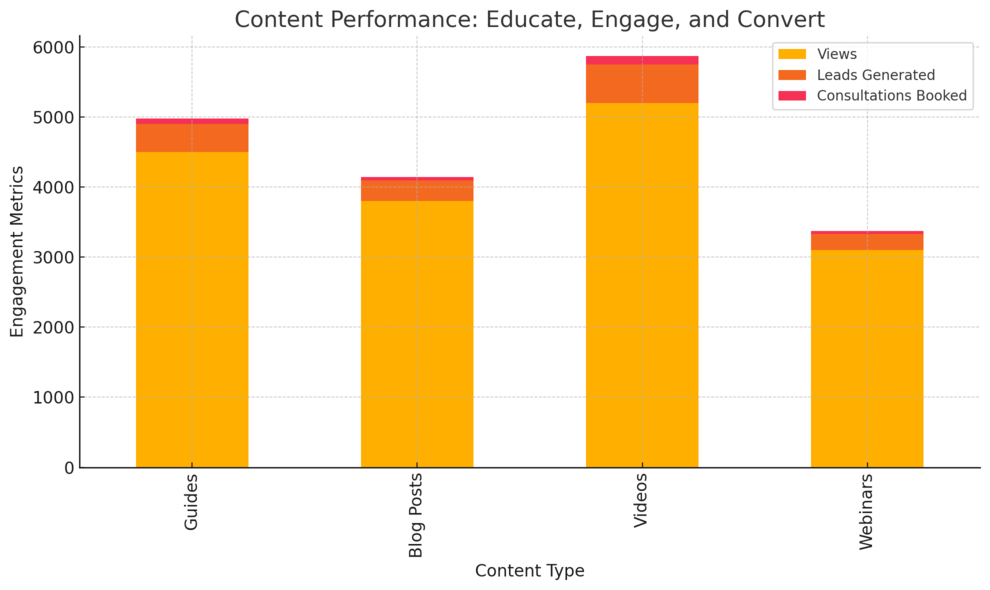

Education is the quiet engine of trust. When you teach instead of pitch, clients perceive your expertise and sincerity at once.

Create In-Depth Guides That Solve Financial Pain Points

Think of your audience’s real struggles: managing debt, planning retirement, understanding taxes. Build long-form guides around these issues using simple explanations, actionable steps, and real examples.

For instance, a “Retirement Planning for Freelancers” guide could outline how to set up a solo 401(k) in five steps with screenshots of the actual dashboard.

I recommend using Canva Docs or Notion templates to make your guides visually accessible and shareable.

These educational resources not only attract search traffic but also nurture client trust, because they show you care about solving problems, not selling services.

Publish Case-Based Blog Posts to Build Authority

Stories stick better than theories. Write posts showing how clients achieved outcomes using your guidance (without revealing personal data).

For example, “How One Couple Reduced Investment Fees by 30% Without Changing Funds.”

This type of content demonstrates competence in context. Include mini-metrics, such as “This strategy saved them $4,500 in annual fees,” to make it concrete.

I’ve found readers remember results, not abstract advice.

Use Data-Driven Insights to Back Every Claim

Numbers don’t lie—and in finance, they’re your best ally. Support your statements with data from sources like Morningstar, FINRA, or Statista.

If you claim your financial marketing solution improves retention, include a stat like: “Clients who receive monthly education emails are 40% more likely to renew their contracts.”

Data transforms your advice from opinion to evidence. Whenever you make a claim, ask yourself: “Can I prove it?” If yes, show the proof right there.

Offer Free Financial Tools or Calculators

People love interactive tools because they provide immediate value. A retirement savings calculator, budget planner, or investment goal tracker on your site positions you as both educator and enabler.

For example, Wealthfront’s Path tool lets users simulate financial futures based on life goals—it’s educational and persuasive without a single sales line.

I recommend embedding lightweight tools built through Outgrow so users can engage instantly.

Strengthen Trust With Thought Leadership

Being seen as a teacher rather than a seller builds credibility faster than any ad campaign.

Share Expert Insights on LinkedIn and Industry Blogs

LinkedIn remains the best space for financial professionals to establish authority.

Post weekly updates on market trends, personal finance insights, or commentary on recent regulations. Use relatable language—avoid posting whitepaper-style content.

A simple format I often use:

- Start with a client question (“Is the market too volatile to invest right now?”)

- Share your short perspective (2–3 sentences)

- End with a mini-action step or takeaway

This conversational tone sparks engagement while positioning you as a go-to voice.

Host Webinars Featuring Recognized Financial Experts

Live discussions create direct connection and trust. Host free 45-minute webinars with certified experts on topics like “Navigating Tax-Efficient Investments” or “Financial Planning After a Market Downturn.”

Use platforms like Zoom Webinars or Demio to handle registration and replays. Promote the event with teaser posts sharing what participants will learn, not just who’s speaking.

Post-event, upload clips to YouTube and LinkedIn for evergreen reach.

Collaborate With Trusted Financial Publications

Guest posting on established outlets such as Forbes Advisor, Investopedia, or Morningstar Blog amplifies your reputation.

I recommend pitching topics that blend data with opinion—like “How AI Is Reshaping Personal Financial Planning.”

Each published article serves as an external trust badge. Readers see you as credible not because you claim to be—but because authoritative platforms trust your expertise.

Develop Research Reports That Add Real Value

Original research is the pinnacle of thought leadership. Conduct surveys on investor behavior, market sentiment, or fintech adoption trends. Summarize findings into a well-designed report using tools like Google Looker Studio or Infogram.

For instance, releasing a “2025 Financial Confidence Index” not only generates backlinks but also media coverage, positioning your brand as an industry reference.

Include charts, highlight trends, and most importantly—interpret what the data means for your audience.

Expert Tip: In finance, your voice must be as reliable as your numbers. The more you teach, simplify, and share, the more your audience sees you as a trusted ally—someone who helps them make sense of money, not just make it.

Personalize Client Communication at Scale

Personalized communication builds the strongest trust in financial marketing solutions.

When clients feel you understand their goals, they’re far more likely to stay loyal, refer others, and invest in your services.

Segment Audiences Based on Financial Goals

Not every client wants the same outcome. Some are saving for retirement; others want to optimize short-term investments.

I suggest segmenting your audience by goals and life stages using CRM data or survey responses.

Here’s a simple segmentation setup you can use:

- Retirement-focused clients: Send guides on pension optimization or tax-efficient savings.

- Wealth builders: Share market insights, diversification tips, and compounding calculators.

- Business owners: Offer advice on cash flow management and business exit strategies.

If you’re using Freshsales or Monday, you can tag clients by goal type right in the contact profile. This allows you to send tailored content at scale without losing that personal touch.

Use CRM Platforms to Deliver Personalized Content

CRM (Customer Relationship Management) tools like Salesforce Financial Services Cloud or Zoho CRM Plus help automate personalization intelligently. These tools track client interactions—such as which pages they visit, what emails they open, and what services they’ve inquired about.

Example: If a user downloads your “Wealth Management Guide,” your CRM can automatically schedule an email offering a free consultation on investment planning. This feels helpful rather than pushy.

I recommend setting up content workflows where each email or follow-up provides a relevant next step. Clients feel guided, not marketed to.

Implement Behavior-Based Email Automation

Behavior-based automation means your marketing adapts to what clients do, not what you hope they’ll do.

Tools like Mailerlite or Omnisend can trigger specific messages based on behavior—like visiting your “Tax Optimization” page or abandoning a financial assessment form.

For example:

- A visitor who downloads a budgeting template might receive a follow-up email: “Here’s how to make your new budget work for long-term savings.”

- Someone who views pricing pages twice gets a friendly check-in: “Want to discuss which package fits your financial goals best?”

These subtle nudges feel like natural conversations, not sequences.

Highlight Client Success Stories Authentically

Nothing builds trust faster than seeing real results. Share client success stories that feel human and relatable.

Instead of saying, “We helped John grow his portfolio by 20%,” say, “John wanted to retire early. We worked together to restructure his investments—and now he’s closer to that dream than ever.”

Authenticity matters more than numbers alone. Use short video testimonials or mini-interviews where clients explain the problem, process, and payoff in their own words.

I’ve seen even simple smartphone-recorded stories outperform polished ads when they’re honest.

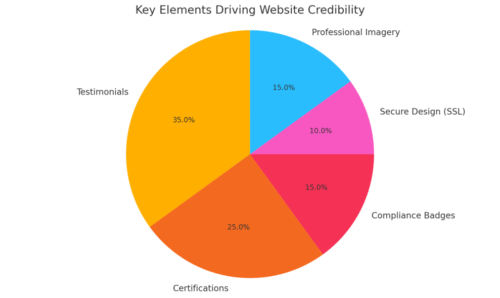

Optimize Your Website for Credibility and Conversion

Your website is often a client’s first impression of your financial brand. It should instantly feel professional, secure, and human.

Include Real Testimonials and Case Studies

Visitors trust peer validation more than marketing claims. Display genuine testimonials—complete with names, photos, and business types.

If compliance rules restrict details, you can summarize results like: “Client reduced advisory fees by 15% through our rebalancing strategy.”

Create a dedicated Success Stories section with sortable categories (e.g., “Retirement,” “Wealth Management,” “Small Business Finance”). Use visual proof like before-and-after charts to make impact tangible.

A study by BrightLocal found that 77% of consumers trust online reviews as much as personal recommendations. In finance, that figure climbs even higher when transparency is evident.

Add Secure, Professional Design Elements (SSL, Trust Badges)

Security is credibility. Ensure your site runs on HTTPS (SSL certificate) and displays trust signals such as Norton Secured, McAfee Trusted, or Better Business Bureau Accredited.

You can also include a footer statement like: “We adhere to FINRA and SEC compliance standards.” That one line alone reassures cautious visitors.

Design-wise, keep colors consistent, avoid flashing graphics, and use professional imagery—real photos of your team perform better than stock images.

Simplify Navigation for Clarity and Trust

Clients shouldn’t have to hunt for information. I suggest limiting your top navigation to five or six main pages (Home, About, Services, Insights, Resources, Contact).

Use clear CTAs (calls-to-action) like Schedule a Consultation or Download the Free Guide. Avoid vague terms like “Learn More.”

Test your website on mobile—most financial clients start research on smartphones. Platforms like Hotjar or Crazy Egg help visualize user paths and reveal where people drop off.

Ensure Compliance With Financial Marketing Regulations

Financial services are heavily regulated, so every claim should be factual, fair, and verifiable. Review materials regularly to stay aligned with SEC, FINRA, and CFPB rules.

Simple steps to stay compliant:

- Add a Disclosure Page explaining disclaimers.

- Keep Record Archives of all client communications.

- Review ad copy for exaggerated claims.

Tools like Smarsh or Proofpoint can automate content archiving and compliance checks across emails and social posts. Transparency here protects your reputation and your license.

Use Social Proof to Reinforce Brand Authority

Social proof is powerful because it shifts trust from “you say so” to “others say so.” It’s the fastest way to validate your financial marketing solutions.

Showcase Media Mentions and Awards

If you’ve been featured in Forbes, Bloomberg, or Financial Times, highlight it proudly. Use a simple “As Seen In” bar on your homepage.

Industry awards—like Best Independent Advisory Firm 2024 or Top Wealth Manager—signal professionalism. Just ensure any accolade displayed is verifiable; fake or obscure badges can do more harm than good.

A clean press section or dedicated Media Page with links to published articles builds long-term credibility.

Highlight Positive Client Reviews Across Platforms

Encourage satisfied clients to leave reviews on Google Business Profile, Trustpilot, or Yelp for Financial Services. Then embed those reviews directly on your site using widgets.

I suggest responding publicly to every review—positive or negative. A calm, professional reply to criticism often impresses future clients more than glowing praise does.

Encourage User-Generated Content and Community Engagement

Invite clients to share their experiences, financial tips, or event photos using a branded hashtag like #MyMoneyJourney. These small, community-driven posts build emotional connection while expanding organic reach.

For example, a wealth advisor might host a Financial Freedom Friday campaign where clients share their savings milestones. The authenticity of real voices adds warmth no paid ad can replicate.

Partner With Reputable Influencers in Finance

Influencer partnerships can extend credibility beyond your network—but choose carefully. Focus on finance educators or niche creators known for transparency, like YouTube financial planners or LinkedIn educators.

Before collaborating, vet influencers for:

- Verified credentials or proven expertise.

- Consistent, transparent messaging.

- Authentic audience engagement (not inflated followers).

Co-create content such as Ask Me Anything sessions or live portfolio Q&As. When done right, it feels less like sponsorship and more like peer endorsement.

Pro Tip: In finance, credibility isn’t claimed—it’s earned. Every touchpoint, from your first email to your last review response, either builds or breaks trust.

Keep your communication authentic, your data transparent, and your brand consistent—and clients won’t just believe in your expertise, they’ll advocate for it.

Maintain Transparency in Advertising and Offers

Transparency in financial marketing solutions isn’t just ethical—it’s essential for compliance and credibility.

Clients are quick to spot exaggerated claims, so every ad, offer, or ROI promise must stand on truth and clarity.

Avoid Misleading Promises in Campaigns

Financial ads should inspire confidence, not skepticism. Avoid buzzwords like “guaranteed returns” or “zero-risk investments.” Instead, frame offers realistically: “Our advisors help you minimize risk while targeting steady growth.”

A good rule of thumb is to ask, Would this claim hold up if reviewed by FINRA or the SEC? If the answer isn’t an immediate yes, it’s time to rewrite.

I suggest including disclaimers on every campaign landing page—short, clear statements like: “Past performance is not indicative of future results.” It shows you respect the client’s intelligence and legal transparency.

Use Realistic ROI Examples and Disclosures

Clients trust numbers, but only if they make sense. Instead of promising “up to 30% annual returns,” show a realistic range with context: “Clients with diversified portfolios typically achieve 6–10% annual returns, depending on market conditions.”

Add ROI disclaimers near charts or performance visuals. If you use software like Google Ads or Meta Ads Manager, place disclosures directly within ad copy or on the landing page to comply with advertising standards.

When in doubt, under-promise and over-deliver—it’s better to surprise clients with better outcomes than lose trust over unmet expectations.

Clearly Explain Fees, Rates, and Service Terms

Hidden fees destroy trust faster than poor results. Always publish your fee structures, rates, and payment terms upfront. Even a short pricing transparency statement can work wonders:

Example: “We charge a flat 1% advisory fee annually, with no hidden commissions or transaction charges.”

If your pricing depends on portfolio size, show a sliding scale or use an interactive calculator. Tools like Outgrow or Typeform make it easy for visitors to estimate costs based on inputs like investment amount or service type.

Audit All Ad Copy for Compliance and Accuracy

Every ad or content piece must pass two filters: accuracy and compliance. I recommend conducting quarterly audits using a simple checklist that covers:

- Fact Verification: Are stats and figures backed by credible sources?

- Disclosure Placement: Are disclaimers visible and compliant?

- Ad Alignment: Does the ad copy match the landing page offer?

You can automate parts of this process using compliance review tools like Smarsh or Proofpoint. These tools scan your ad text and flag potential compliance violations—saving you from hefty fines or reputation hits.

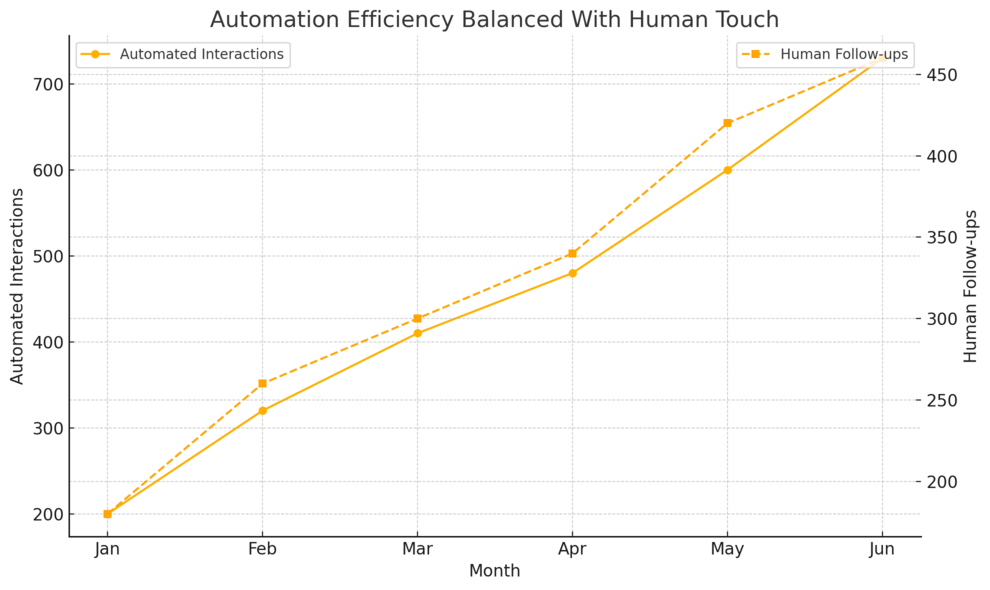

Combine Automation With a Human Touch

Automation can scale efficiency, but empathy scales trust. The best financial marketing solutions merge both seamlessly—using AI to support clients while keeping real advisors within reach.

Use Chatbots for Quick, Transparent Assistance

Chatbots handle repetitive queries instantly, freeing human advisors for deeper interactions. Tools like Drift or Intercom let you build financial-specific chat flows that answer FAQs, provide rate info, or guide users to calculators.

For example, a chatbot could say: “I can help you compare retirement plans. Do you want a quick estimate or a detailed breakdown?” This kind of guided choice feels personal and empowering.

Just ensure bots clearly identify themselves. Transparency—even in automation—matters.

Follow Up With Real Advisors for Complex Queries

When questions go beyond automation’s reach, switch to a real human seamlessly. I recommend using HubSpot Workflows or Zapier automations to assign these leads to advisors.

Example path: A chatbot detects phrases like “investment advice” or “retirement planning,” then routes the conversation to a certified planner via live chat or email.

Clients appreciate this transition because it shows you value their needs enough to give them expert attention.

Automate Follow-Ups While Preserving Personal Tone

You can automate follow-up sequences without sounding robotic. Use dynamic tags like [First Name] and conversational openings such as:

“Hi Sarah, I noticed you downloaded our retirement guide. Would you like to explore a few strategies to stretch your savings further?”

Platforms like ActiveCampaign or MailerLite allow you to personalize based on actions (downloads, clicks, etc.). Write your emails like real conversations—not campaigns.

Balance Efficiency With Empathy in Every Interaction

Efficiency should never come at the expense of warmth. Whether it’s an automated reminder or a follow-up email, I suggest reviewing every message with a simple question: Would I send this to a friend?

Empathy shows through tone, pacing, and attentiveness. Use language that reassures rather than pressures.

Even an automated “I’m checking in to see if you’re okay understanding your plan” builds more trust than “Your subscription expires in 24 hours.”

Measure Trust-Building Metrics Effectively

You can’t manage what you don’t measure. Tracking the right metrics shows whether your financial marketing efforts truly build trust—or just look good on paper.

Track Brand Sentiment Through Client Feedback

Client sentiment is your trust thermometer. Use surveys, NPS (Net Promoter Score), and post-service feedback forms to gauge confidence.

Example: After a client meeting or webinar, send a one-question survey like, “On a scale of 1–10, how confident do you feel about your financial strategy now?”

Tools like SurveyMonkey and Typeform integrate with CRMs to collect and analyze these insights automatically. I suggest reviewing feedback monthly to catch trust issues early.

Monitor Engagement and Retention Rates

Engagement reveals trust in action. If clients read your newsletters, open your emails, or renew services, they’re signaling confidence.

Track these key metrics:

- Email Open Rate: Healthy range = 35–45% for financial content.

- Click-Through Rate (CTR): Indicates how valuable your content feels.

- Client Retention Rate: Anything above 85% signals strong satisfaction.

Platforms like Klaviyo Analytics or HubSpot Reports can visualize these numbers for you.

Analyze Transparency and Compliance KPIs

Transparency isn’t emotional—it’s measurable. Track how often disclaimers are viewed, compliance reports are clean, and content passes audits.

KPIs to include:

- Percentage of approved campaigns without revisions.

- Number of compliance violations (target: 0).

- Client complaints related to unclear terms.

The cleaner these numbers, the stronger your brand’s trust footprint.

Refine Strategies Based on Data-Driven Insights

Data should always lead to decisions, not decoration. If engagement drops, adjust tone or timing. If compliance issues rise, retrain your copywriters.

I suggest quarterly reviews combining analytics with real feedback. You’ll start spotting patterns—like which content themes consistently boost engagement—and that’s where your trust engine truly refines itself.

Reinforce Client Loyalty With Ongoing Education

Trust grows with knowledge. Educating your clients continuously positions you as a guide, not a seller—and that’s the ultimate trust builder in financial marketing solutions.

Launch Financial Wellness Email Series

Create an automated education sequence that teaches, not sells. Example topics could include “Understanding Compound Interest,” “How to Read a Market Chart,” or “Planning for Tax Season.”

You can use tools like ConvertKit to drip content weekly and personalize based on interests. Each email should include one small, actionable takeaway—something clients can apply immediately.

Offer Exclusive Webinars for Clients Only

Hosting private webinars builds exclusivity and value. Clients feel appreciated when they’re part of an “inner circle.”

Example: A monthly webinar titled “Smart Moves Before Year-End Tax Filing” can deepen relationships and encourage long-term engagement. Use Zoom or Demio to make participation simple.

Encourage live Q&A to make sessions interactive. Clients who can directly ask advisors questions feel more connected and valued.

Keep Clients Updated on Market Trends and Insights

Market news can feel overwhelming. Your role is to translate it into clarity. Send short updates summarizing key events—like interest rate changes or policy updates—and explain how they affect your clients’ portfolios.

This shows you’re proactive and dependable, even during uncertainty. A consistent, calm voice in volatile times builds immense trust.

Build a Community That Encourages Continuous Learning

Create a digital space where clients can learn and share experiences. This could be a private Facebook group, Slack channel, or client-only portal.

I’ve seen firms thrive when clients discuss wins, ask questions, and exchange insights under the brand’s guidance. It builds peer credibility and long-term loyalty.

Encourage members to contribute—invite guest speakers, celebrate financial milestones, or post discussion prompts. When clients see you as part of their journey, not just their advisor, trust becomes lasting.

Expert Tip: Education and empathy are the twin engines of financial trust. Keep your communication clear, your data honest, and your tone human—and your brand won’t just grow clients; it’ll grow believers.

I’m Juxhin, the voice behind The Justifiable.

I’ve spent 6+ years building blogs, managing affiliate campaigns, and testing the messy world of online business. Here, I cut the fluff and share the strategies that actually move the needle — so you can build income that’s sustainable, not speculative.