Table of Contents

Finding ecommerce accountants who truly understand the unique rhythm of online sales can feel like searching for a needle in a haystack.

I’ve seen many business owners struggle with accountants who don’t “get” things like Shopify payouts, Amazon fees, or the way inventory moves across multiple sales channels.

The truth is, ecommerce finances play by a different set of rules—and you need someone who knows the playbook.

In this guide, I’ll help you pinpoint exactly what to look for when choosing an ecommerce accountant who can keep your books clean, compliant, and ready for growth.

Why Specialized Ecommerce Accountants Matter

When your business sells online, the money doesn’t move in straight lines.

A specialized accountant helps you keep up with the messy, fast-paced flow of digital sales.

Understanding The Complexities Of Online Revenue Streams

Ecommerce revenue rarely appears as a simple deposit. In my experience, this is where most general accountants get lost. Online platforms batch payouts, subtract fees, bundle refunds, and delay deposits by several days.

That means what shows up in your bank account almost never matches what you actually earned.

A specialized ecommerce accountant knows how to decode these patterns. They understand terms like gross marketplace sales, settlement reports, and SKU-level revenue, but they also translate all of that into plain-English financial statements you can actually use.

One practical example: Shopify may show $50,000 in monthly sales, but your bank may only receive $47,800. A specialist knows how to trace the missing amount through fees, refunds, and pending payouts so your books stay accurate.

When I’ve worked with sellers who switched to ecommerce-savvy accountants, the biggest relief they mention is finally understanding their real profit—something that’s nearly impossible without proper revenue tracking.

Managing Platform Fees, Refunds, And Chargebacks Accurately

Fees on Amazon, Shopify, Etsy, and similar platforms are not only complex—they’re also constantly changing. A traditional accountant might record fees as a single lump sum, but that hides crucial metrics you need for pricing, profitability, and forecasting.

An ecommerce accountant breaks down:

- Marketplace commissions

- Payment gateway fees

- Fulfillment costs

- Refund deductions and return fees

- Chargeback penalties

This level of detail helps you spot patterns.

For example, if your Etsy return rate jumps from 2% to 7%, that’s a signal to investigate product quality or customer experience. Without accurate fee and refund tracking, you’d never catch it.

I’ve seen sellers lose thousands simply because returns were recorded incorrectly. A specialist accountant prevents that by reconciling every line item from every platform.

How Ecommerce-Savvy Accountants Prevent Costly Mistakes

From what I’ve seen, most accounting mistakes in ecommerce come from misunderstanding how online platforms move money.

These mistakes often snowball into bigger issues—incorrect tax filings, inventory distortions, or inaccurate profit reporting.

A specialist helps prevent errors like:

- Misstating revenue due to mixed payout batches

- Overlooking cross-border tax obligations

- Recording COGS incorrectly because inventory flows change fast

- Double-counting deposits from payment processors

One seller I worked with accidentally overreported revenue by almost 15% because their accountant counted the same Shopify payout twice.

A knowledgeable ecommerce accountant knows how to catch these errors before they turn into IRS trouble.

The Difference Between General And Ecommerce Accounting Practices

A general accountant focuses on traditional cash flow: invoices, expenses, deposits. Ecommerce accounting operates on platform ecosystems where data must be pulled from dashboards, APIs, and settlement reports.

Here’s the practical difference:

- General accountants rely on bank statements.

- Ecommerce accountants rely on transaction-level platform data, then match it to bank activity.

It’s almost like switching from a bicycle to a motorcycle—you can’t use the same rules and expect to stay safe.

Sellers who work with ecommerce accountants usually get clearer insights, cleaner reporting, and far fewer tax surprises.

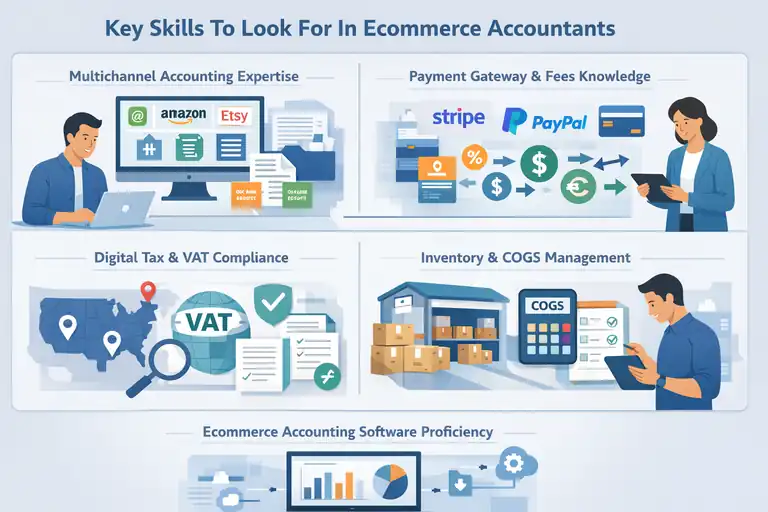

Key Skills To Look For In Ecommerce Accountants

If you want an accountant who truly understands how you operate, certain skills are non-negotiable. These skills make the difference between accurate books and financial chaos.

Expertise In Multichannel Accounting (Shopify, Amazon, Etsy)

Selling on multiple platforms means your accountant must understand each ecosystem’s quirks. Shopify uses payout batches; Amazon deducts fees before deposit; Etsy bundles transactions differently altogether.

An accountant with multichannel experience knows how to:

- Track SKUs across different platforms

- Match settlement reports to bank activity

- Consolidate revenue into a single, accurate financial statement

If you ever plan to expand your store to new marketplaces, this expertise becomes invaluable. In my experience, multichannel sellers without specialized accountants often struggle with mismatched numbers and inventory discrepancies.

Familiarity With Payment Gateways And Merchant Fees

Stripe, PayPal, Shop Pay, and similar processors all have unique fee structures. These fees affect your margins more than most sellers realize.

A skilled ecommerce accountant knows how to break down:

- Percentage-based fees

- Transaction fees

- Cross-border charges

- Currency conversion losses

This isn’t just bookkeeping—it’s strategy. When you understand your true processing costs, you can negotiate better terms or shift your checkout mix to improve profit margins.

Knowledge Of Digital Tax Rules And International VAT

Online sales come with tricky tax obligations: nexus rules, marketplace facilitator laws, and cross-border VAT requirements.

I’ve seen sellers unintentionally violate tax laws simply because standard accountants didn’t understand how ecommerce tax works.

A well-trained ecommerce accountant helps you:

- Track state-by-state tax thresholds

- Identify where you owe VAT or GST

- Stay compliant with marketplace tax rules

- Avoid audit-triggering errors

According to Avalara, 52% of ecommerce sellers face tax compliance challenges each year—usually because they outgrow the tax knowledge of a traditional accountant.

Ability To Reconcile Inventory Costs With Real-Time Sales

Inventory is often the biggest area where general accountants fall short. In ecommerce, inventory updates constantly due to returns, restocks, cost changes, and new SKUs.

A specialist accountant knows how to:

- Track COGS accurately as items sell

- Account for landed costs and freight

- Reconcile inventory across warehouses and 3PLs

- Handle bundled and multipack products

This level of care prevents misleading profit reports. In my experience, incorrect COGS is one of the top reasons ecommerce owners misjudge their profitability.

Proficiency In Ecommerce-Focused Accounting Software

Modern ecommerce accounting relies heavily on automation. Tools like A2X, Link My Books, and connector apps make data accurate, consistent, and clean.

A specialist accountant knows how to set up:

- Automated settlement imports

- SKU-level revenue mapping

- Accurate COGS calculations

- Multi-currency financial workflows

If your accountant still enters Shopify data manually, that’s a sign they’re not the right fit for ecommerce.

Essential Tools And Software Ecommerce Accountants Should Use

Tools aren’t optional in ecommerce accounting—they’re the backbone of clean, reliable books. The right accountant will already be fluent in these platforms.

Using Xero And QuickBooks For Ecommerce Accounting

Xero and QuickBooks remain the two most reliable accounting platforms for ecommerce sellers. A knowledgeable accountant can optimize either system to match your sales channels and reporting needs.

Here’s what a specialist typically sets up:

- Custom chart of accounts for ecommerce

- Automated bank feed rules

- Sales tax tracking tied to platform data

- Inventory and COGS workflows

Each system also integrates nicely with marketplace automation tools, which saves hours of reconciliation time each month. I’ve found that sellers who fully automate their settlement imports often cut bookkeeping time by 70–80%.

Leveraging A2X And Link My Books For Platform Integrations

These tools act as translators between platforms (like Shopify or Amazon) and your accounting software. Without them, your accountant may be forced to manually reconcile hundreds—or thousands—of transactions.

These integrators help with:

- Automated settlement imports

- Accurate fee categorization

- COGS syncing

- Multi-channel revenue tracking

What I like most about these tools is how they eliminate human error. A2X, for example, matches payouts precisely to accounting entries so numbers line up perfectly with bank statements.

Managing Inventory With Cin7 Or DEAR Systems

Once your business grows past a certain point, spreadsheet inventory becomes a disaster waiting to happen. That’s where dedicated inventory management systems come in.

Cin7 help sellers:

- Track stock across warehouses

- Manage purchase orders

- Optimize reorder points

- Sync inventory with online storefronts

When paired with an accountant who understands these systems, you get far more accurate inventory reporting—and far fewer profit surprises.

Simplifying Tax And VAT Compliance With Avalara Or TaxJar

Sales tax is one of the biggest pain points for ecommerce sellers. With ever-changing state regulations and international VAT thresholds, compliance gets complicated fast.

Avalara and TaxJar help automate:

- State nexus monitoring

- Marketplace tax calculations

- International VAT requirements

- Filing and remittance processes

A good accountant sets these tools up so you always know where you owe taxes and why. I’ve seen sellers save thousands simply by catching a tax nexus they didn’t realize they triggered.

How To Evaluate Ecommerce Accountants Before Hiring

Choosing the right accountant can feel overwhelming, especially when online sales add layers of complexity. I’ve found that a structured evaluation makes the decision much clearer.

Questions To Ask During The First Consultation

Asking the right questions early on saves you from surprises later. I always treat the consultation as a two-way interview. You’re not just trying to impress them—they need to impress you too.

Key areas to cover:

- Experience with your exact sales channels: Ask who they already work with on Shopify, Amazon, Etsy, or marketplaces you use.

- Workflow clarity: Have them walk you through how they handle payouts, reconciliations, and monthly closes.

- Tool proficiency: Ask how they use A2X, Link My Books, Cin7, or other ecommerce tools in real workflows.

- Tax strategy: Don’t just ask if they “do taxes.” Ask how they approach nexus, VAT, and marketplace facilitator rules.

I like to ask for a real example: “Could you walk me through how you would reconcile a Shopify payout that’s missing inventory data?” Their answer tells you immediately whether they understand digital sales or not.

How To Assess Their Experience With Your Ecommerce Platform

Every platform behaves differently. Shopify has payout delays, Amazon takes fees upfront, and Etsy often bundles transactions. Someone who claims to be an ecommerce accountant should know these differences like second nature.

A simple test is to ask them to explain:

- How your platform handles refunds

- Which reports they review monthly

- How they approach SKU-level profit tracking

- How they deal with inventory discrepancies

If they respond vaguely or rely only on bank statements, that’s a red flag. I always prefer accountants who can show screenshots or sample workflows (with client info removed, of course). It proves they’ve lived in the systems, not just read about them.

Checking Certifications, Client Portfolios, And Reviews

Certifications help, but real experience matters even more. An accountant might be certified in Xero or QuickBooks, but that doesn’t guarantee ecommerce expertise.

Here’s what usually gives me confidence:

- A client list of active ecommerce stores across different sizes

- Platform-specific case examples showing how they solved real problems

- Reviews mentioning ecommerce terminology, not generic comments about “good service”

If their portfolio includes Shopify brands, Amazon FBA sellers, subscription-box companies, or multichannel retailers, that’s usually a great sign. You want someone who has actually worked through messy settlement data before—not someone learning on your dime.

Understanding Pricing Models And Value-Based Fees

Ecommerce accounting rarely fits into a simple hourly or monthly fee because complexity varies by platform, order volume, and integrations. I personally prefer value-based pricing because you know exactly what you’re paying for and why.

When comparing quotes, ask:

- What’s included monthly?

- What happens if order volume spikes?

- Are integrations included or billed separately?

- Are tax filings part of the package or standalone services?

A good ecommerce accountant will explain how your volume and channels affect workload. If someone offers a “one price fits all” quote, it usually means they haven’t dealt with enough sellers to understand how different one store can be from another.

Common Mistakes When Hiring An Ecommerce Accountant

I’ve watched many sellers learn these lessons the hard way. Avoiding these mistakes saves money, stress, and messy cleanups down the line.

Choosing A Traditional Accountant Without Ecommerce Knowledge

This is by far the most common mistake. Traditional accountants are excellent at what they do, but ecommerce accounting is a different world. Digital payouts, multi-platform fees, chargebacks, and automated systems require a different skill set entirely.

When sellers choose someone without ecommerce experience, the issues often include:

- Revenue being recorded incorrectly

- Fees missing or lumped into random categories

- Poor inventory tracking

- Major tax miscalculations

A traditional accountant may be brilliant, but if they don’t understand marketplace behavior, your books will always be a step behind reality.

Overlooking Integration Capabilities With Your Sales Channels

If your accountant doesn’t know how to use tools like A2X or Link My Books, you’re at risk for messy reconciliations and inaccurate financials.

These integrations automate:

- Shopify payouts

- Amazon fees

- Etsy refunds

- Multi-currency transactions

I’ve seen businesses spend 20–30 hours a month manually entering platform transactions simply because their accountant wasn’t familiar with the software. The right accountant saves you that time instantly.

Ignoring Communication And Reporting Style

The accountant you choose will become one of your closest partners. That means you need someone who communicates clearly and regularly. If they take days to reply during the sales process, imagine what tax season will be like.

Here’s what I look for personally:

- Plain-language explanations

- Scheduled monthly check-ins

- Clear monthly reports

- A collaborative mindset

A great ecommerce accountant helps you understand your numbers—not just file them away.

Focusing Only On Price Instead Of Value

I get it—accounting fees can feel expensive. But choosing the cheapest option almost always costs more in the long run.

If an accountant charges less because they don’t understand ecommerce, you’ll pay for it later through cleanup work, tax penalties, or poor decision-making.

It often helps to ask: “How will your work help me increase profit or reduce risk?” Someone who specializes in ecommerce will have a clear, confident answer.

Benefits Of Hiring Ecommerce Accountants For Online Growth

The right accountant doesn’t just record your numbers—they help you grow with clarity and confidence. I’ve watched this shift happen again and again with online sellers.

Accurate Profit Tracking Across Multiple Channels

Multichannel selling is amazing for growth but a nightmare without proper accounting. A specialized ecommerce accountant connects all your data points so you finally see true profitability.

That means:

- SKU-level profit insights

- Channel-by-channel margin analysis

- Accurate tracking of returns and refunds

- Clean reconciliation between systems

When you understand where profit actually comes from, scaling becomes much easier.

Better Cash Flow Management For Online Sellers

Cash flow is often one of the trickiest parts of ecommerce because payout timing, inventory purchases, and seasonal swings all hit you at once.

I’ve found that accountants who specialize in ecommerce have a better grasp of predicting cash gaps before they happen.

They help you forecast:

- Inventory restock cycles

- Sales spikes and dips

- Advertising pushes

- Seasonal trends

Small improvements here make a huge difference. Even a 10% improvement in cash flow timing can reduce stress dramatically.

Improved Tax Planning And Compliance For Global Sales

Once you start selling internationally, tax requirements can get overwhelming. An ecommerce accountant understands VAT thresholds, marketplace facilitator laws, and state-by-state nexus rules.

With their help, you can:

- Avoid penalties by filing correctly

- Understand where you owe taxes and why

- Plan future expansion with confidence

- Keep accurate historical records for audits

According to Avalara’s industry data, more than half of online sellers struggle with tax compliance. A specialist accountant takes this burden off your shoulders.

Data-Driven Financial Insights To Scale Your Store

One of my favorite parts about working with ecommerce accountants is how much data they uncover. When your financials are clean, you can make smarter decisions about pricing, inventory, marketing, and growth.

Some insights you might gain include:

- Which products drive the most profit

- Where your margins are slipping

- How returns affect your bottom line

- Where overspending happens in your operations

Better data leads to better decisions, and better decisions create growth. It really is that simple.

Where To Find Reliable Ecommerce Accountants

If you’re trying to find ecommerce accountants who actually understand online sales, the search gets much easier when you know where to look.

Let me walk you through the places where I’ve consistently seen sellers connect with the right professionals.

Exploring Specialized Accounting Firms For Online Sellers

Specialized firms are often the safest starting point because they already understand the moving parts of ecommerce. These firms typically work with Shopify, Amazon FBA, Etsy, Walmart Marketplace, and multichannel sellers every day, so the learning curve is almost zero.

What makes specialized firms helpful:

- They already use ecommerce tools like A2X, Link My Books, or Cin7 Core.

- They understand marketplace statements and how to cleanly reconcile payouts.

- They’re familiar with ecommerce workflows, like returns, chargebacks, and SKU-level profitability.

I personally like these firms because you spend less time explaining how your business works and more time actually improving your numbers. It’s a much smoother onboarding experience.

Using Directories Like A2X Partner Network Or Xero Advisors

Directories are underrated, but they’re one of the most reliable ways to vet accountants without guessing. The A2X Partner Directory, for example, lists professionals who already know how to integrate marketplace data into accounting platforms like Xero and QuickBooks.

Why directories work well:

- Listings often include ecommerce specialties so you can filter by Amazon, Shopify, Etsy, or multichannel.

- You can check certifications easily, especially for cloud accounting platforms.

- You can compare firms side by side before reaching out.

The Xero Advisor Directory is also helpful because many ecommerce accountants prefer Xero for its clean automation and reporting workflows.

Networking In Ecommerce Communities And Facebook Groups

I’ve seen some of the best accountant recommendations come from ecommerce communities. Groups like Shopify forums, Amazon seller groups, and Reddit threads are full of sellers sharing real experiences—not marketing pitches.

How to make this useful:

- Ask for referrals from sellers with similar revenue levels.

- Look for repeat mentions of the same firms or accountants.

- Pay attention to comments about communication style, not just technical skills.

Real seller feedback often reveals things you wouldn’t notice during a consultation, like how accessible an accountant is during tax season.

Asking Referrals From Other Online Business Owners

Referrals from fellow sellers are gold. Someone who understands your world can point you toward accountants who already know how to handle the same challenges you face.

Here’s a quick script I often suggest:

“Hey, who handles your ecommerce accounting? And what specifically do they do that you find most helpful?”

People tend to be honest when sharing referrals, and those honest answers can save you months of trial and error.

How To Build A Long-Term Partnership With Your Accountant

A great accountant becomes part of your growth team. If you want the relationship to last and produce real financial clarity, there are a few habits that really help.

Setting Clear Expectations And Financial KPIs

I’ve noticed that the healthiest accountant relationships begin with clarity. You both need to know what success looks like and how it’ll be measured.

You can align on:

- Monthly close deadlines

- KPI dashboards you want (profit by SKU, channel margins, inventory turns)

- Communication timelines for questions and updates

- Responsibilities for collecting and sharing data

This creates a steady rhythm. When both sides know what they’re accountable for, everything runs more smoothly.

Scheduling Regular Reviews And Forecasting Meetings

Monthly or quarterly check-ins might sound boring, but they’re where some of the best insights come from. These meetings help you catch trends before they turn into problems.

For example, I’ve watched sellers discover that a product line was slowly losing margin because of small changes in shipping costs. Without a review meeting, that insight might have gone unnoticed for months.

Helpful meeting topics:

- Cash flow forecasts

- Tax planning

- Inventory trends

- Profitability by channel or SKU

These sessions turn your accountant into a real partner, not just someone who inputs numbers.

Encouraging Open Communication About Growth Goals

The more your accountant knows about where you want your business to go, the better they can guide your finances.

I always suggest sharing expansion ideas early—whether it’s moving into wholesale, adding new sales channels, or outsourcing fulfillment.

When accountants understand your goals, they can help you:

- Plan cash flow for expansions

- Anticipate tax implications

- Build better forecasts

- Identify financial bottlenecks before they slow you down

It feels more collaborative, almost like having a co-pilot for your financial decisions.

Evolving Accounting Strategies As Your Store Expands

Ecommerce businesses rarely stay still. As order volume grows, you might expand into new platforms, upgrade inventory systems, or manage multiple warehouses. Your accounting workflows need to adapt along the way.

A good partner will:

- Suggest new tools as you scale

- Help refine COGS tracking when complexity increases

- Update reports as your business model evolves

- Monitor cash flow changes as your store grows

I’ve seen many sellers outgrow their initial accounting setup without realizing it. Regular adjustments keep your financial system healthy and ready for growth.

Red Flags To Watch Out For When Choosing Ecommerce Accountants

If something feels off early in the process, it usually is. Here are the warning signs I encourage people to pay attention to.

Lack Of Transparency In Reporting Or Pricing

If an accountant avoids giving clear pricing or won’t explain what’s included in their service, that’s an immediate sign to pause. You shouldn’t have to guess what you’re paying for.

Transparency matters because ecommerce accounting can involve:

- Multiple integrations

- Tax filings

- Cleanup work

- Ongoing reconciliations

You deserve a breakdown that makes sense without digging for answers.

Outdated Knowledge Of Ecommerce Tax Regulations

Tax rules for ecommerce shift often. Marketplace facilitator laws, VAT thresholds, and state-level nexus changes can catch you off guard.

If an accountant:

- Downplays tax complexity

- Doesn’t mention tax automation or monitoring

- Can’t describe how nexus is triggered

…then they’re probably not keeping up. This is one of those areas where “close enough” can get really expensive really fast.

Minimal Experience With Automated Tools Or Integrations

If a potential accountant still talks about manual entry for Shopify or Amazon, that’s a big red flag. Automation tools aren’t optional in ecommerce—they’re essential for accurate books.

You want someone who can confidently implement:

- A2X

- Link My Books

- Cin7 Core

- Payment gateway integrations

Without automation, reconciliation becomes messy and error-prone.

Poor Understanding Of Online Business Models

A general accountant might not understand your margins, customer acquisition costs, refund cycles, or inventory turnover. If they struggle to speak your language, you’ll spend your time teaching instead of growing.

Some quick tests:

- Ask them to explain how a Shopify payout works.

- Ask how Amazon fees are deducted.

- Ask what impacts SKU profitability the most.

Their answers will tell you everything.

Expert Tips For Getting The Most From Your Ecommerce Accountant

Once you’ve found someone great, there are a few habits that can help you get even more value from the partnership.

Share Real-Time Data To Improve Forecast Accuracy

Your accountant can only work with the information you give them. When data flows freely, their insights become sharper and more actionable.

I’ve seen sellers unlock much better forecasting simply by sharing:

- Live sales dashboards

- Inventory levels

- Ad spend metrics

- Restock timelines

Even small updates can help your accountant spot patterns or risks early.

Align Accounting Reports With Marketing And Sales Insights

One of the most powerful things you can do is bring your accountant into the marketing conversation. When they understand campaign performance, they can help you see the real financial impact.

For example:

- How discount campaigns affect profit

- Whether ROAS aligns with margin

- Which channels drain cash flow

- Where customer lifetime value is rising or falling

This cross-functional alignment creates smarter decisions across the board.

Use Their Expertise To Plan For Expansion And New Market Entry

Your accountant has a front-row seat to your business’s financial health. They can help you decide when you’re ready to expand into new channels, launch new SKUs, or enter new markets.

They can support you with:

- Cash flow projections

- Market-specific tax considerations

- Inventory planning

- Pricing strategy adjustments

I always recommend looping your accountant into expansion plans early—they’ll often catch things you haven’t thought about.

Treat Them As A Strategic Partner, Not Just A Bookkeeper

When you view your accountant as a partner, the quality of the relationship changes. You start sharing more, asking better questions, and getting more valuable insights.

A great accountant can help you:

- Understand what’s driving profit

- Spot operational inefficiencies

- Build long-term financial stability

- Make confident decisions during growth

The more open the partnership, the stronger your business becomes.

Final Thoughts: Choosing The Right Accountant Changes Everything

Finding ecommerce accountants who genuinely understand online sales is one of those decisions that quietly shapes everything else in your business. When your numbers are clear, timely, and accurate, you make better choices. You sleep better. And growth stops feeling like a guessing game.

From what I’ve seen, the biggest shift happens when sellers stop treating accounting as a chore and start treating it as a strategic advantage. The right accountant doesn’t just keep you compliant—they help you see what’s actually working, what’s quietly draining profit, and where your next smart move should be.

If there’s one takeaway I’d leave you with, it’s this: don’t rush the decision. Ask real questions. Look for hands-on ecommerce experience, not just credentials. And choose someone who can explain complex financial details in a way that actually makes sense to you.

When you find that person, the relationship pays off far beyond clean books. It gives you clarity, confidence, and the freedom to focus on building a stronger, more profitable online business—without constantly second-guessing the numbers behind it.

Frequently Asked Questions

What Are Ecommerce Accountants?

Ecommerce accountants specialize in accounting for online sales, including platform fees, payouts, inventory, refunds, and ecommerce tax compliance.

How Are Ecommerce Accountants Different From Regular Accountants?

Ecommerce accountants work with sales platforms, integrations, and settlement reports to track true profit, not just bank deposits.

When Should I Hire An Ecommerce Accountant?

You should hire an ecommerce accountant as soon as you start selling online or managing multiple platforms to avoid accounting and tax mistakes.